AUTHOR : BABLI

DATE : 21/12/23

Introduction

In the ever-evolving landscape of digital transactions, the role of payment gateways has become increasingly pivotal. As businesses in India harness the power of online commerce, establishing and nurturing robust vendor relationships within the payment gateway sector is crucial for seamless financial transactions. This article delves into the dynamics of payment gateway vendor relationships in India, exploring their evolution, key players, challenges, strategies, and future trends.

Brief Overview of Payment Gateways

Payment gateways are one of the most important technologies that were created. Earlier, there was no reliable and secure way to transfer payments or to make online payments. serve as the virtual bridge between online businesses and financial institutions, ensuring secure and swift transactions. In India, the proliferation of e-commerce has heightened the significance of these gateways.

Significance of Vendor Relationships in the Indian Market

The Indian market, Payment Gateway in India characterized by its diversity and complexity, necessitates strong vendor relationships for effective payment processing. Building and maintaining these relationships is a cornerstone for successful digital transactions.

Evolution of Payment Gateways in India

Early Days and Challenges

In the nascent stages, payment gateways faced challenges related to trust and technological limitations. However, Online Payment Service Providers[1] persistent efforts and advancements have paved the way for a more sophisticated and reliable infrastructure.

Technological Advancements Driving Change

The integration of cutting-edge technologies like artificial intelligence and blockchain has transformed payment gateways, Online Payment Companies[2] enhancing efficiency and security. These advancements have also attracted a diverse range of players in the Indian market.

Key Players in the Indian Payment Gateway Industry

Established Giants

Well-established payment gateway providers[3] have played a pivotal role in shaping the industry. Their experience and infrastructure contribute to the reliability of digital transactions. But with the advent of payment gateways, online financial transactions are fast and secure. According to the Economic Times, Indian customer’s

Emerging Players

A new wave of innovative startups is disrupting the payment gateway landscape. These players bring agility and novel solutions, challenging the status quo and fostering healthy competition his is why we have reviewed the top online payment gateways in India 2024 for accepting payments on the web..

Importance of Strong Vendor Relationships

Trust and Security

In an era where data security is paramount, establishing trust between vendors and payment gateways is non-negotiable. Gateway to Seamless Payments[4] Robust relationships contribute to a secure and transparent transaction environment.

Customization and Flexibility

Different businesses have unique requirements. A strong vendor relationship allows for customization and flexibility in payment solutions, Payment Gateway Vendor Relationships aligning with the specific needs of individual businesses.

Challenges in Vendor Relationships

Regulatory Compliance

Navigating the complex regulatory landscape poses challenges for payment gateway vendors. Adhering to guidelines while maintaining operational efficiency requires a delicate balance you’re a small operation or a large enterprise.

Technical Integration Issues

Smooth technical integration is crucial for seamless transactions. Vendors often face challenges in integrating their systems with diverse e-commerce platforms[5], leading to disruptions. a wide range of payment options such as Visa, Mastercard, Maestro, Rupay, Amex), 75+ net banking options, and popular mobile wallets.

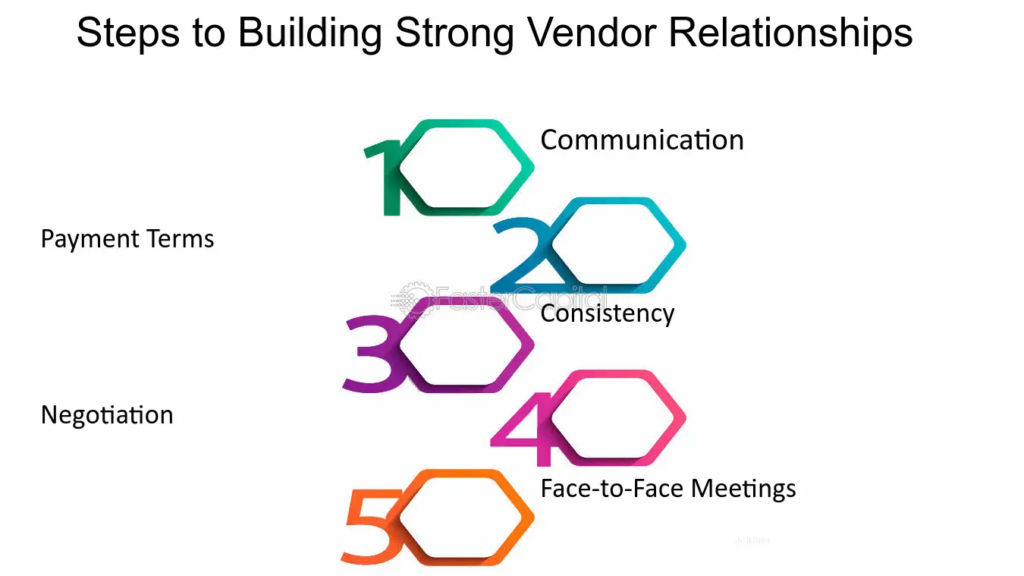

Strategies for Building Strong Vendor Relationships

Clear Communication

Open and honest communication forms the bedrock of every robust and enduring relationship.. Vendors and payment gateways must maintain open lines of communication to address issues promptly and foster understanding.

Collaboration and Feedback

As India continues its digital transformation, the future of payment gateway vendor relationships holds immense potential. Nurturing these relationships will be instrumental in shaping a robust and inclusive digital financial landscape. Collaborative efforts and feedback mechanisms enhance the relationship. Regularly seeking input from vendors and incorporating feedback contributes to the evolution of more efficient processes.

Case Studies

Success Stories

Examining success stories highlights effective strategies in building and maintaining strong vendor relationships. Nurturing these relationships will be instrumental in shaping a robust and inclusive digital financial landscape.

Lessons Learned

Analyzing challenges and failures is equally important. Nurturing these relationships will be instrumental in shaping a robust and inclusive digital financial landscape. The platform is also India’s leading API provider and allows to easily add the payment gateway to their product.

Future Trends in Payment Gateway Vendor Relationships

Innovations Shaping the Industry

The landscape of payment gateways is continually evolving. Exploring emerging technologies and trends provides a glimpse into the future of vendor relationships in the industry. As India continues its digital transformation, the future of payment gateway vendor relationships holds immense potential.

Potential Challenges on the Horizon

According to their website Cash free Payments, it enables a powerful and scalable payments platform for business payments needs in India Anticipating challenges is crucial for proactive adaptation. Examining potential hurdles ensures that the industry remains resilient in the face of evolving market dynamics.

Conclusion

In conclusion, the article underscores the critical role of strong vendor relationships in the Indian payment gateway sector. It emphasizes that trust, security, and adaptability are key pillars for sustainable growth in the ever-expanding digital ecosystem.

FAQs

- Q: How do payment gateways ensure the security of online transactions?

- A: Payment gateways employ encryption technologies and adhere to stringent security protocols to safeguard sensitive information during online transactions.

- Q: What role do emerging startups play in the Indian payment gateway industry?

- A: Emerging startups bring innovation and agility, fostering healthy competition and contributing to the evolution of the payment gateway landscape.

- Q: How can businesses navigate regulatory challenges in the payment gateway sector?

- A: Businesses can navigate regulatory challenges by staying informed, collaborating with legal experts, and maintaining proactive compliance measures.

- Q: What are the key factors for successful vendor relationships in the payment gateway industry?

- A: Clear communication, trust, flexibility, and collaboration are key factors that contribute to successful vendor relationships in the payment gateway industry.

- Q: What future trends can we expect in payment gateway vendor relationships?

- A: Future trends may include the integration of advanced technologies like blockchain, increased personalization, and a focus on sustainability in payment gateway vendor relationships.