Author : Sweetie

Date : 27/12/2023

Introduction

In the fast-evolving landscape of e-commerce in India, the role of payment gateways[1] has become increasingly pivotal. As businesses transition towards digital platforms, the demand for secure, seamless, and efficient payment processing solutions has surged. This article delves into the dynamics of payment gateways for web goods in India, exploring their evolution, key features, popular options, benefits, challenges, and future trends.

Definition of Payment Gateway

A payment gateway is a technology-driven service that facilitates online transactions[2] by acting as a bridge between the merchant’s website and the financial institutions It ensures secure and real-time processing of payments, playing a crucial role in the success of e-commerce businesses.

Evolution of Payment Gateways in India

Early Challenges

In the nascent stages of e-commerce in India, businesses faced challenges such as limited payment options, security concerns, and technological constraints. However, these challenges fueled innovation, leading to the evolution of more sophisticated payment gateways.

Technological Advancements

Advancements in technology, including the widespread adoption of mobile devices and improved internet connectivity, have propelled the evolution of payment portals. The shift towards digital payments[3] has been a game-changer, prompting the development of user-friendly and secure solutions.

Current Landscape

Today, India boasts a vibrant landscape of payment gateways catering to businesses[4] of all sizes. From startups to settled ventures, the availability of diverse payment solutions has democratized access to digital transactions.

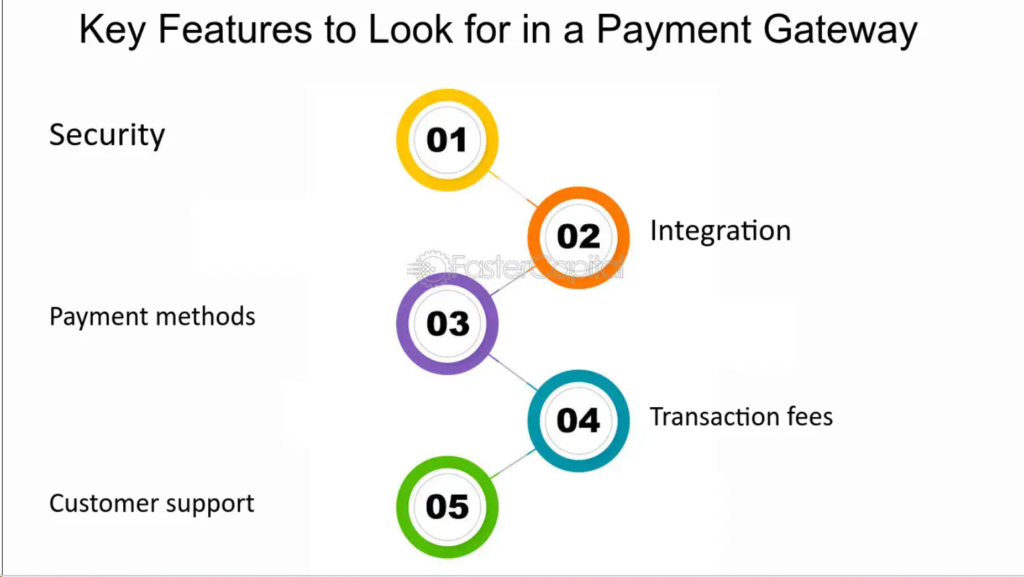

Key Features of Payment Gateways

Security Measures

Security remains an essential concern in online transactions. Payment portals employ robust encryption protocols and fraud detection mechanisms to ensure the integrity of financial data and protect users from cyber threats.

Integration Options

One of the key advantages of payment portals is their versatility in integration. They seamlessly integrate with various e-commerce[5] platforms, content management systems, and mobile applications, providing businesses with flexibility and ease of use.

User-Friendly Interfaces

The success of a payment gateway lies in its user interface. Intuitive designs and user-friendly interfaces contribute to a positive customer experience, encouraging repeat business and enhancing the overall reputation of the merchant.

Popular Payment Gateways in India

Razorpay

Known for its simplicity and comprehensive features, Razorpay has emerged as a popular choice for businesses of all sizes. Its customizable solutions and transparent pricing have made it a preferred payment gateway.

Paytm

A household name in India, Paytm offers a diverse range of services, including a robust payment gateway. With a massive user base, Paytm provides businesses with access to a vast customer network.

Instamojo

Catering to the needs of small and medium-sized enterprises, Instamojo stands out for its easy setup and reasonable cost. It empowers entrepreneurs to start accepting payments with minimal hassle.

Benefits of Using Payment Gateways for Web Goods

Seamless Transactions

Payment gateways streamline the payment process, offering customers a hassle-free experience. The ability to process transactions in real-time contributes to the efficiency of online businesses, reducing cart abandonment rates.

Increased Customer Trust

The implementation of secure payment portals enhances the trustworthiness of an online business. Customers feel more confident sharing their financial information, leading to increased conversions and customer loyalty.

Enhanced User Experience

A positive user experience is crucial for the success of any online venture. Payment gateways contribute to a seamless and enjoyable shopping experience, fostering customer satisfaction and encouraging repeat business.

Challenges and Solutions

Transaction Failures

Despite technological advancements, transaction failures remain a challenge. Addressing issues such as network glitches, payment gateway downtime, and user errors requires proactive solutions and continuous monitoring.

Security Concerns

Payment gateways must stay ahead of potential security breaches by implementing robust security measures, regular audits, and educating users about safe online practices.

Customer Support Solutions

In the event of issues or concerns, prompt and efficient customer support is essential. Payment gateways must invest in responsive support systems to address customer queries and provide timely assistance.

Future Trends in Payment Gateways

Blockchain Integration

The integration of blockchain technology holds immense potential for payment gateways. Blockchain can enhance security, reduce fraud, and provide a decentralized framework for transparent and efficient transactions.

Biometric Authentication

As technology evolves, biometric authentication methods such as fingerprint and facial recognition are gaining traction. Integrating these features into payment gateways can further enhance the security and convenience of transactions.

Artificial Intelligence

Artificial intelligence (AI) is poised to revolutionize payment gateways by enabling predictive analysis, fraud detection, and personalized user experiences. AI-driven solutions can adapt to evolving trends and enhance the overall efficiency of payment processing.

Tips for Choosing the Right Payment Gateway

Scalability

Consider the scalability of the payment gateway to accommodate the growth of your business. A scalable solution ensures that the payment infrastructure can adapt to increasing transaction volumes.

Transaction Fees

Evaluate the transaction fees associated with different payment gateways. While some gateways offer competitive rates, it’s essential to understand the overall cost structure and any additional fees.

Customer Support

Prioritize payment gateways that offer reliable and responsive customer support. In the dynamic world of online transactions, having access to quick and effective support can make a significant difference.

The Future of Payment Gateways in India

Emerging Technologies

The future of payment gateways in India is intertwined with emerging technologies. Exploring innovative solutions such as contactless payments, voice-activated transactions, and the Internet of Things (IoT) will shape the landscape in the coming years.

Market Predictions

Industry experts predict continued growth in the adoption of payment gateways in India. As technology evolves and consumer behaviors shift, payment gateways will play a central role in shaping the future of e-commerce in the country.

Conclusion

In conclusion, payment gateways for web goods in India have transformed the digital landscape, providing businesses with the tools to facilitate secure and efficient online transactions. From addressing early challenges to embracing emerging technologies, payment gateways have become integral to the success of e-commerce ventures.

Frequently Asked Questions (FAQs)

- What is the role of a payment gateway in e-commerce?

Payment gateways facilitate secure and real-time online transactions by acting as a bridge between the merchant’s website and financial institutions. - Which payment gateways are popular in India?

Popular payment gateways in India include Razorpay, Paytm, and Instamojo, each offering unique features and benefits. - How can businesses address transaction failures when using payment gateways?

Businesses can proactively monitor for network glitches, implement robust security measures, and ensure responsive customer support to address transaction failures. - What are the future trends in payment gateways, particularly in India?

Future trends include blockchain integration, biometric authentication, and the widespread use of artificial intelligence to enhance security and user experiences. - How does the regulatory environment, especially RBI guidelines, impact payment gateways in India? The Reserve Bank of India (RBI) plays a crucial role in regulating payment gateways, and businesses must adhere to guidelines to ensure legal and secure transactions.