AUTHOR: LUCKY MARTINS

DATE: 26/12/2024

A Seamless Solution for Your Business

In the ever-growing jewelry industry[1], offering flexible payment options is crucial to attracting and retaining customers. One of the best ways to make jewelry more accessible to a wide range of clients is by incorporating a payment gateway[2] with recurring billing. This solution not only enhances the customer experience but also provides jewelry businesses with a steady, predictable cash flow[3]. In this article, we will explore what a payment gateway with recurring billing is, its benefits for jewelry businesses, and how it can help you streamline your operations and boost customer satisfaction.

What is a Payment Gateway with Recurring Billing?

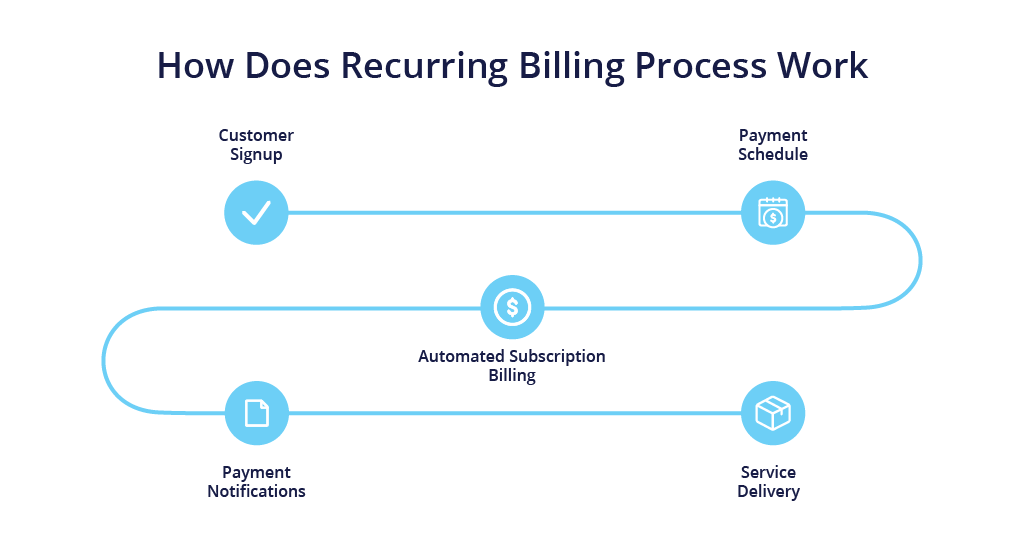

It acts as a bridge between the customer and the merchant, ensuring that payment transactions[4]are processed smoothly. Recurring billing[5], on the other hand, is a system where payments are automatically charged to a customer’s account on a scheduled basis, typically for subscription services or products.

When combined, a payment gateway with recurring billing allows jewelry businesses to offer their customers subscription services, enabling them to pay for their jewelry items in installments. This could be particularly beneficial for high-ticket items like engagement rings, necklaces, or custom jewelry pieces, making it easier for customers to afford their purchases.

Benefits of a Payment Gateway with Recurring Billing for Jewelry

1. Increased Customer Accessibility

Many customers are hesitant to purchase expensive jewelry upfront, especially if they are not sure about committing to a large payment at once. With recurring billing, they can spread out the cost of their purchase over time, making it more manageable. This increase in affordability can lead to higher conversion rates and more frequent purchases.

2. Steady Cash Flow

For jewelry businesses, recurring billing provides a consistent and predictable revenue stream. Rather than relying on one-time payments, businesses can count on regular payments at scheduled intervals, which helps with cash flow management and planning.

3. Customer Retention

Subscription models and recurring payments help build long-term customer relationships. When customers sign up for recurring billing, they are more likely to stay engaged with your brand over a longer period. Additionally, recurring billing can help you offer loyalty programs and rewards to further enhance customer satisfaction and retention.

4. Simplified Payment Processing

A payment gateway with recurring billing automates the payment collection process, saving time and reducing the risk of errors. Since payments are automatically processed, there is no need for manual intervention each month, which leads to a more efficient workflow for your business.

5. Flexible Payment Options

Payment gateways often support a wide range of payment methods, including credit cards, debit cards, bank transfers, and digital wallets. This flexibility ensures that customers can choose their preferred payment method, which can improve the overall customer experience.

How to Implement Recurring Billing for Jewelry

1. Choose the Right Payment Gateway

Some of the most popular options for e-commerce businesses include PayPal, Stripe, and Square. Make sure to choose one that integrates easily with your existing jewelry store platform and offers a secure, user-friendly experience for both you and your customers.

2. Set Up Subscription Plans

Next, you will need to create subscription plans for your jewelry products. This could include options for different payment intervals (e.g., weekly, monthly, quarterly) and different payment amounts. Offering tiered subscription options can also give your customers more flexibility in choosing a plan that fits their budget.

3. Integrate Recurring Billing with Your Website

Once your payment gateway and subscription plans are in place, integrate the recurring billing system with your website or e-commerce platform. Most payment gateways provide plugins or APIs that make this integration process seamless. This allows customers to easily select their preferred subscription plan, input their payment information, and start their recurring payments.

4. Communicate the Subscription Model to Customers

It’s important to clearly communicate how the recurring billing works to your customers. Display this information prominently on your product pages and during checkout. You can also send confirmation emails or receipts detailing the payment schedule, the amount being charged, and any other relevant terms.

5. Monitor and Manage Subscriptions

Once your recurring billing system is in place, be sure to regularly monitor and manage your subscriptions. Keep track of payment statuses, customer cancellations and renewals. Payment gateways often provide reporting tools that make it easy to track recurring payments and spot any issues that might arise.

Best Practices for Recurring Billing in Jewelry Businesses

1. Offer Incentives for Subscriptions

To encourage customers to choose recurring billing, offer incentives such as discounts, free shipping, or exclusive access to new collections. These perks can make the subscription model more attractive and encourage customers to commit to a longer-term payment plan.

2. Be Transparent with Pricing

Transparency is key when it comes to recurring billing. Clearly outline the total cost, the frequency of payments, and any applicable taxes or fees. Avoid hidden charges, as these can lead to frustration and cancellations.

3. Offer a Hassle-Free Cancellation Policy

This not only builds trust but also enhances customer satisfaction. A smooth cancellation process can lead to positive reviews and recommendations.

4. Ensure Secure Transactions

Security is critical when dealing with online payments. Make sure your payment gateway uses encryption and follows the latest security standards to protect your customers’ sensitive information.

Conclusion

Implementing a payment gateway with recurring billing is a smart strategy for jewelry businesses looking to improve customer access to their products, increase revenue, and streamline payment processing. By offering flexible payment options, you can attract more customers, retain them longer, and improve their overall shopping experience. Make sure to choose the right payment gateway, clearly communicate your subscription plans, and offer incentives to maximize the benefits of recurring billing for your jewelry business.

FAQ:

1. Can I offer recurring billing for one-time jewelry purchases?

Yes, you can offer recurring billing for one-time jewelry purchases, such as high-end engagement rings or luxury watches. By breaking the total cost into smaller payments, customers can afford these items more easily.

2. What happens if a customer’s payment fails?

Most payment gateways have automatic retry features. If a payment fails, the system will attempt to charge the customer again after a set period. You can also set up email notifications to alert customers of failed payments and give them the option to update their payment details.

3. Is it possible to offer different subscription options for different jewelry pieces?

Absolutely. You can set up different recurring billing options for different products. For example, you might offer a 6-month payment plan for a necklace and a 12-month plan for a higher-priced bracelet.

4. How can I track recurring payments?

Most payment gateways provide dashboards that allow you to track recurring payments, cancellations, and renewals. You can view reports, transaction histories, and other details to keep track of your subscriptions.

5. Are there any additional fees for using recurring billing?

Payment gateways typically charge a transaction fee, which may vary depending on the service provider. Some gateways might charge additional fees for recurring billing features, so be sure to review the pricing structure before committing.