AUTHOR : SELENA GIL

DATE : 16/12/2023

Introduction

The world of finance has been significantly transformed by the evolution of payment platforms[1]. From traditional cash transactions to seamless digital processes, the way we handle payments has undergone a remarkable change. In Malaysia, this evolution has been particularly impactful, reshaping the country’s financial landscape and empowering businesses and consumers alike. Payment Platform Malaysia.

Understanding Payment Platforms

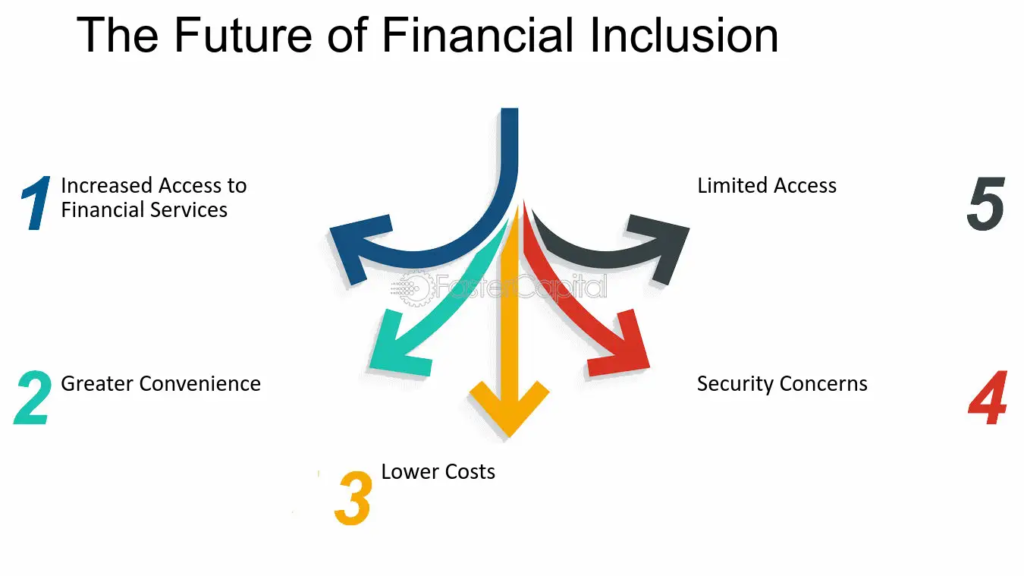

At its core, a payment platform acts as an intermediary between buyers and sellers, facilitating the exchange of funds electronically. These platforms encompass various services, including online wallets, mobile banking apps, and digital payment[2] gateways. Their significance lies in streamlining transactions, providing convenience, and fostering financial inclusion. Payment Platform Malaysia.

Evolution of Payment Platforms

The journey of payment platforms traces back to the early barter system and has evolved through the ages. The advent of credit cards, online banking, and the emergence of fintech innovations like blockchain technology has propelled these platforms[3] to new heights. Each development has contributed to shaping the modern payment ecosystem we experience today.

Malaysia’s Payment Landscape

Malaysia[4] boasts a diverse payment ecosystem, with a mix of traditional financial institutions and innovative fintech startups. The country’s robust infrastructure and government initiatives have paved the way for a wide array of payment solutions catering to different needs and preferences.

Popular Payment Platforms

In Malaysia, several platforms[5] dominate the payment sphere. From household names like Maybank QRPay and Boost to international giants like PayPal and Alipay, users have access to a plethora of options. These platforms offer distinct features, ranging from cashless transactions to loyalty programs, catering to the varied demands of consumers and businesses.

Security Measures and Challenges

Security remains a paramount concern in online transactions. Payment platforms in Malaysia employ encryption, multi-factor authentication, and stringent security protocols to safeguard user information and prevent fraud. However, challenges persist, including regulatory complexities and the need to earn consumer trust in adopting digital payment methods.

Future Trends and Economic Impact

Looking ahead, the future of payment platforms in Malaysia appears promising. Innovations such as contactless payments, biometric authentication, and the integration of AI are poised to revolutionize the industry further. This evolution not only enhances convenience but also contributes significantly to Malaysia’s economic growth and digitalization efforts.

The Shifting Dynamics of Payment Platforms

The dynamics of payment platforms are in a constant state of flux, adapting to technological advancements and changing consumer behaviors. In Malaysia, this evolution is a testament to the country’s embrace of digital transformation.

Technological Innovations

Innovations like blockchain, contactless payments, and biometric authentication are reshaping how transactions occur. These advancements not only streamline payments but also enhance security and user experience.

Consumer Behavior and Preferences

The preferences of Malaysian consumers are instrumental in driving the evolution of payment platforms. With an increasing reliance on smartphones and a preference for seamless transactions, the demand for more user-friendly and efficient payment methods is rising.

Merchant Integration and Acceptance

While major players dominate the payment landscape, ensuring widespread merchant integration and acceptance remains crucial. Encouraging businesses of all sizes to adopt digital payment methods fosters a more inclusive financial environment.

Regulatory Framework and Compliance

Navigating regulatory frameworks is a key challenge for payment platforms. Striking a balance between innovation and compliance while adhering to data protection laws is vital for sustained growth and consumer trust.

Empowering Businesses and Consumers

The impact of payment platforms extends beyond transactions; they empower both businesses and consumers in numerous ways. For businesses, these platforms offer a gateway to wider markets, enabling smoother transactions with customers both locally and globally. Small businesses, in particular, benefit from reduced barriers to entry and access to a broader customer base.

Financial Inclusion and Convenience

For consumers, these platforms provide financial inclusion by allowing access to various services regardless of geographic constraints. Moreover, the convenience of digital payments simplifies everyday transactions, from paying bills to shopping online.

Educational Initiatives and Adoption

Educational initiatives play a pivotal role in encouraging the adoption of digital payment methods. Promoting financial literacy and the advantages of digital transactions can further accelerate the shift towards a cashless society.

Conclusion

The payment platform landscape in Malaysia continues to evolve, offering diverse and innovative solutions to meet the changing needs of businesses and consumers. As technology advances and consumer behaviors shift, these platforms will play an increasingly integral role in shaping the country’s financial future.

FAQs

- Are payment platforms in Malaysia secure?

- Yes, platforms implement robust security measures to protect user data.

- What are the advantages of using digital payment platforms?

- Convenience, faster transactions, and rewards or cashback programs are some benefits.

- Do all businesses in Malaysia accept digital payments?

- While the adoption rate is increasing, not all businesses have fully embraced digital payment methods.

- Can I use international payment platforms in Malaysia?

- Yes, many international platforms are accessible and widely used in the country.

- What role do payment platforms play in Malaysia’s economy?

- They contribute to economic growth by fostering digitalization and enabling smoother financial transactions.