AUTHOR NAME : JASMINE

DATE : 21/12/2023

Introduction

In recent years, collaborative commerce has emerged as a game-changer in the Indian business landscape. This innovative approach brings together businesses, suppliers, and consumers on digital platforms, fostering a sense of community and shared economy. As collaborative commerce[1] gains momentum, it becomes imperative to delve into the intricacies of payment processing within this dynamic ecosystem.

Payment Processing in Collaborative Commerce

The seamless flow of payments is the lifeblood of collaborative commerce. Efficient payment processing[2] not only ensures smooth transactions but also contributes to building trust among users. However, this aspect comes with its own set of challenges, ranging from technological constraints to regulatory complexities.

Current Payment Landscape in India

Before exploring the nuances of payment processing in collaborative commerce, let’s take a snapshot of the current payment landscape in India. The country has witnessed a remarkable shift from traditional cash transactions to a plethora of digital payment options. Mobile wallets, UPI, and digital banking have become integral parts of the Indian consumer experience.

Key Players in Indian Collaborative Commerce

Collaborative[3] commerce platforms, such as marketplaces and sharing economy services, play a pivotal role in shaping consumer behavior. These platforms not only connect buyers and sellers but also influence the payment preferences of millions. Understanding how major players approach payment processing provides valuable insights into industry trends.

Regulatory Framework for Payments

As collaborative commerce continues to evolve, it operates within the framework of government regulations. The Reserve Bank of India (RBI) and other regulatory bodies set the guidelines for secure and compliant payment processing Collaborative commerce platforms must navigate these regulations to ensure the legality and trustworthiness of their transactions.

Technological Advancements in Payment Processing

Technology acts as an enabler for efficient payment processing[4]. Artificial Intelligence (AI) and blockchain technology are revolutionizing how financial transactions take place. Integrating these technologies into collaborative commerce platforms enhances security, reduces transaction times, and opens new possibilities for innovation.

User Experience and Payment Security

A user-friendly payment interface is paramount in collaborative commerce. Users should be able to navigate through the payment process effortlessly. Simultaneously, ensuring the security of financial transactions is non-negotiable. Payment processing for Collaborative commerce platforms must invest in robust security measures to safeguard user data and financial information.

Challenges and Solutions in Payment Processing

Despite the advancements, collaborative commerce faces challenges in payment processing. From payment delays to technical glitches, addressing these issues is crucial for the sustained growth of the industry. Innovative solutions, such as real-time transaction monitoring and proactive issue resolution, can enhance the efficiency of payment processing.

Case Studies

Examining successful collaborative commerce[5] platforms provides valuable insights into effective payment processing strategies. Platforms that have overcome challenges and established trust among users offer valuable lessons for others in the industry. Case studies highlight the diverse approaches to payment processing and the impact on overall business success.

Future Trends in Payment Processing for Collaborative Commerce

Anticipating future trends in payment processing is essential for staying ahead in the collaborative commerce landscape. The adoption of contactless payments, the integration of voice commands in transactions, and the exploration of decentralized finance (DeFi) are potential game-changers. Industry players must stay agile to embrace these forthcoming advancements.

Benefits of Efficient Payment Processing

Efficient payment processing goes beyond transactional convenience. It directly influences user trust and satisfaction. Collaborative commerce platforms that prioritize seamless payments witness increased user loyalty, positive reviews, and sustained business growth. The benefits extend to all stakeholders involved in the ecosystem.

Importance of Collaboration Between Platforms and Payment Gateways

Collaboration between collaborative commerce platforms and payment gateways is mutually beneficial. Seamless integration enhances the overall user experience, reducing friction in transactions. Establishing strong partnerships ensures that both platforms and payment gateways evolve together, adapting to the changing needs of users.

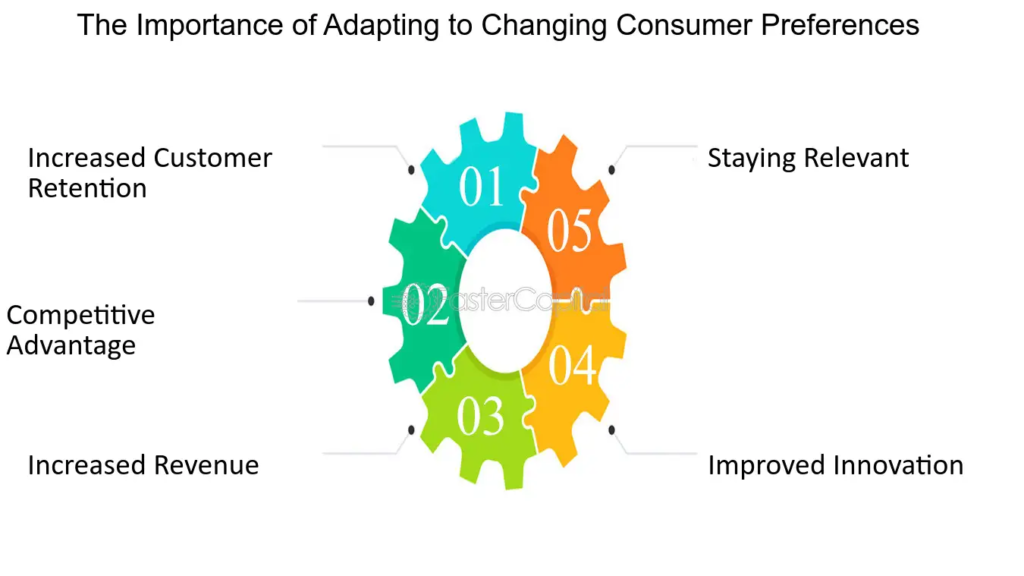

Adapting to Consumer Preferences

Understanding the evolving preferences of Indian consumers is crucial for collaborative commerce platforms. Payment methods must align with user expectations and cultural nuances. Platforms that offer a variety of payment options tailored to diverse preferences are more likely to capture and retain a broader user base.

Educational Initiatives for Users

Promoting awareness about secure payment practices is a shared responsibility. Collaborative efforts between platforms, regulatory bodies, and financial institutions can contribute to educating users on the importance of financial safety. This proactive approach enhances the overall security posture of collaborative commerce.

Conclusion

In conclusion, payment processing is the force of collaborative commerce in India. As the industry continues to evolve, addressing challenges and accept innovations in payment technology is paramount. The success of collaborative commerce hinges on providing users with a seamless, secure, and suited payment experience.

Frequently Asked Questions (FAQs)

- Is collaborative commerce the same as traditional e-commerce?

- Collaborative commerce differs from traditional e-commerce by emphasizing shared economies, community engagement, and a sense of collaboration among users.

- How can collaborative commerce platforms ensure the security of financial transactions?

- Collaborative commerce platforms can enhance security through robust encryption, two-factor proof, and continuous monitoring of transactions.

- What role does government regulation play in payment processing for collaborative commerce?

- Government regulations set the legal framework for payment processing, secure compliance, security, and trust in collective commerce transactions.

- How do technological advancements like AI and blockchain impact payment processing?

- AI and blockchain enhance payment processing by providing faster, more secure, and transparent transactions, ultimately improving the overall user experience.

- What are the upcoming trends in payment processing for collaborative commerce in India?

- Emerging trends include the rise of contactless payments, voice-command transactions, and the exploration of decentralized finance (DeFi) within collective commerce platforms.