AUTHOR : RUBBY PATEL

DATE : 21/12/23

Introduction

In the dynamic landscape of commercial collaborations in India, the seamless flow of transactions is paramount. Efficient payment processing not only ensures smooth financial transactions but also plays a crucial role in establishing and maintaining trust among collaborators[1].

Importance of Payment Processing in Commercial Collaborations

In the realm of business collaborations, the importance of payment processing cannot be overstated. It serves as the backbone, ensuring that financial transactions between collaborators occur seamlessly. Beyond the practical aspect, efficient payment processing[2] contributes significantly to building trust among collaborators, fostering a healthy and sustainable business relationship. payment processing for Commercial collaborations in india

Popular Payment Methods in India

India, with its rapidly growing digital ecosystem, offers a variety of payment methods. Digital wallets, UPI (Unified Payments Interface), credit and debit cards, and net banking are among the most widely used options. Understanding the nuances of each method is crucial for businesses engaged in commercial collaborations[3].

Challenges in Payment Processing for Commercial Collaborations

Despite the convenience offered by digital payment methods, there are challenges that businesses must navigate. Currency conversion issues, security concerns, and regulatory compliance are common hurdles that need careful consideration to ensure a robust payment processing[4] system.

Choosing the Right Payment Processor

Selecting the right payment processor for Commercial[5] is a critical decision for businesses. Thorough research into available options, consideration of transaction fees, and examination of security features are key factors in making an informed choice.

Streamlining Payment Processes

To enhance efficiency, businesses can implement automated systems and utilize invoicing tools. These measures not only save time but also reduce the likelihood of errors in the payment process.

Successful Payment Processing in Commercial Collaborations

Examining real-world examples of successful payment processing in commercial collaborations provides valuable insights. Case studies highlight strategies and best practices that have proven effective in different business scenarios.

Future Trends in Payment Processing

The landscape of payment processing is continually evolving. Businesses need to stay abreast of emerging technologies and the evolving regulatory landscape to remain competitive. Future trends may include the widespread adoption of blockchain technology and the integration of artificial intelligence in payment systems.

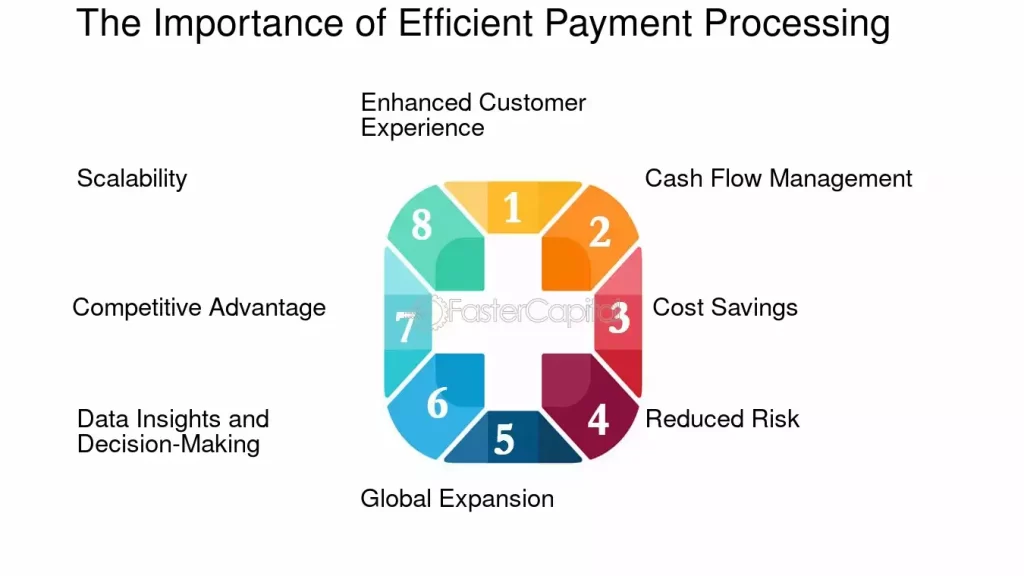

Benefits of Efficient Payment Processing

Efficient payment processing goes beyond transactional convenience; it positively impacts business relationships. Collaborators experience a smoother and more reliable collaboration, leading to improved overall satisfaction.

Tips for Secure Transactions

Ensuring the security of transactions is paramount. Implementing two-factor authentication and conducting regular security audits are proactive measures to safeguard against potential threats.

Educating Collaborators on Payment Procedures

Clear communication and the provision of guidelines are essential in ensuring that collaborators understand and adhere to established payment procedures. This transparency fosters a cooperative and informed business environment.

Impact of Digital Transformation on Payment Processes

The ongoing digital transformation has reshaped traditional payment processes. The transition to digital methods has resulted in increased efficiency, transparency, processing for Commercial collaborations and accessibility in financial transactions.

Adapting to Cross-Border Collaborations

For businesses engaged in international collaborations, addressing cross-border payment challenges is crucial. Considering global payment options and understanding the intricacies of international transactions are key to success in the global marketplace.

The Role of Technology in Payment Security

Technology plays a pivotal role in ensuring payment security. Encryption and robust data protection measures, coupled with advanced fraud detection technologies, contribute to creating a secure payment environment.

Conclusion

In conclusion, payment processing is a foundational element in the success of commercial collaborations in India. From selecting the right payment processor to adapting to emerging technologies, businesses must navigate various aspects to establish a seamless and secure payment ecosystem. By prioritizing efficient payment processing, businesses can enhance collaboration experiences and contribute to the overall growth of the commercial landscape.

FAQs

- Q: How do I choose the right payment processor for my business in India?

- A: Research available options, consider transaction fees, and prioritize security features to make an informed decision.

- Q: What are the future trends in payment processing?

- A: Future trends may include blockchain adoption and the integration of artificial intelligence in payment systems.

- Q: How can businesses ensure the security of transactions in commercial collaborations?

- A: Implement two-factor authentication and conduct regular security audits to safeguard against potential threats.

- Q: What role does technology play in payment security?

- A: Technology, including encryption and fraud detection measures, is pivotal in ensuring the security of payment processes.

- Q: How can businesses adapt to cross-border collaborations in terms of payment processing?

- A: Address international payment challenges by considering global payment options and understanding the intricacies of international transactions.