AUTHOR:HAZEL DSOUZA

DATE:21/12/2023

In the intricate web of Indian commercial, the heartbeat of transactions resonates in the efficiency of payment processing. From age-old traditional methods to the forefront of digital innovation, the journey of payment processing has redefined the dynamics of commercial networking in India.

Historical Overview of Payment Processing in India

Traditional Methods

In the not-so-distant past, commerce relied heavily on Networking In India tangible currency and checks. The limitations of physical transactions often led to delays, inefficiencies, and heightened security concerns.

Transition to Digital Payment Solutions

The turning point arrived with the advent of digital payment solutions[1]. From the introduction of credit cards to the proliferation of mobile wallets, businesses began embracing a more streamlined approach to financial transactions Payment Processing for Commercial.

Challenges in the Payment Processing Landscape

Security Concerns

As digital transactions gained momentum, Commercial Networking In India so did concerns about security. Safeguarding sensitive financial information became a paramount challenge for businesses adapting to the digital era.

Technical Challenges

The landscape wasn’t without its hurdles, as technical glitches and system downtimes posed threats to the seamless flow of transactions, demanding constant technological vigilance.

Regulatory Hurdles

Navigating through the labyrinth of evolving regulations posed its own set of challenges. Adapting to new Digital Payment Methods[2] while staying compliant became a delicate balancing act for businesses.

The Impact of Payment Processing on Commercial Networking

Streamlining Transactions

Efficient payment processing emerged as the linchpin in streamlining business transactions. The transition from cumbersome processes to swift, secure payments became a hallmark of a progressive commercial network.

Enhancing Business Efficiency

The integration of digital payment solutions significantly enhanced the overall efficiency of commercial networking. Businesses found themselves operating with unprecedented speed and precision.

Key Players in the Indian Payment Processing Industry

Major Payment Service Providers

With the digital revolution, Mobile Payments[3] key players emerged in the payment processing industry, offering diverse solutions tailored to the unique needs of businesses.

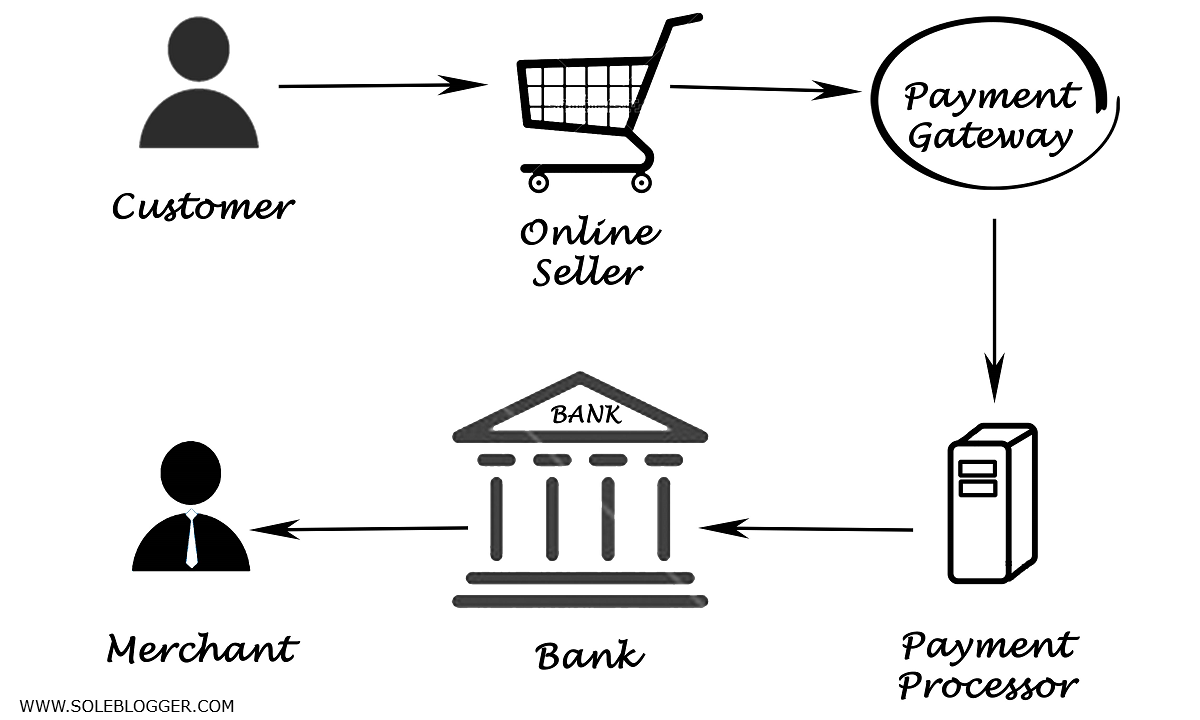

Collaborations with Banking Institutions

Partnerships between payment service providers and banking institutions further solidified the financial ecosystem. Secure Payment System[4] The collaboration paved the way for seamless integration and enhanced financial services.

Mobile Wallets and Their Growing Influence

Surging Popularity

Mobile wallets swiftly gained popularity among businesses and consumers alike. The convenience they offered became a driving force in the transformation of payment habits.

Facilitating Business and Consumer Convenience

The widespread adoption of mobile wallets marked a paradigm shift in the way transactions occurred, providing unparalleled convenience for both businesses and consumers.

UPI (Unified Payments Interface)

Revolutionizing Transactions

The introduction of UPI heralded a new era in payment processing. Simplifying transactions, UPI became an integral part of the Indian commercial networking landscape Real-Time Payment Systems[5].

Integration with Commercial Networking Platforms

Commercial networking platforms integrated UPI, offering users a seamless experience in conducting transactions within the business ecosystem.

The Role of Blockchain in Ensuring Secure Transactions

Transparency in Financial Processes

Blockchain technology emerged as a guardian of secure financial transactions. Its decentralized nature ensured transparency in every step of the payment process.

Mitigating Fraud in Payment Processing

The inherent security features of blockchain played a pivotal role in minimizing fraud, instilling confidence in businesses and consumers alike.

Future Trends in Payment Processing

AI and Machine Learning Integration

The future promises further integration of artificial intelligence and machine learning in payment processes, optimizing efficiency and accuracy.

Surge in Contactless Payments

Contactless payments are on the rise, offering a safer and more convenient option in the evolving landscape of payment preferences .Payment Processing for Commercial Networking In India

Benefits for Small and Medium Enterprises (SMEs)

Cost-Effective Solutions

Efficient payment processing extends significant benefits to SMEs, offering them cost-effective solutions that enhance their financial sustainability.

Augmented Accessibility

The accessibility of digital payment options levels the playing field for SMEs in the competitive market, ensuring they can compete on a global scale.

Steps to Boost Payment Processing Efficiency

Regular System Updates

Frequent updates to payment systems ensure they remain robust, secure, and compliant with evolving regulations, contributing to sustained efficiency.

Employee Training Initiatives

Training employees on the latest payment processing technologies is crucial to fostering a workforce equipped to handle advanced payment processes.

Success Stories Illustrating Efficient Payment Processing

Case Studies Highlighting Business Success

Explore real-world examples of businesses that have thrived by embracing efficient payment processing methods, showcasing the tangible benefits for various industries.

Building Customer Trust and Loyalty

Importance of Secure Payment Processing

Building and maintaining customer trust hinges on ensuring the utmost security in payment processing. Security measures instill confidence and loyalty in consumers.

Fostering Consumer Confidence

Secure transactions foster confidence in consumers, leading to loyalty and repeated business. The psychological aspect of trust is as crucial as the technological safeguards.

Government Initiatives and Policies

Support for Digital Payments

Government initiatives actively support the shift towards a digital economy, providing incentives and frameworks that encourage businesses and consumers to adopt digital payment methods.

Driving Towards a Cashless Economy

Policies are designed to encourage a cashless economy, aligning with the global trend towards digital transactions and reducing dependence on physical currency.

Conclusion

In retrospect, the journey of payment processing in India has been transformative, evolving from traditional methods to cutting-edge technologies. As businesses continue to adapt and innovate, the synergy between payment processing and commercial networking propels India towards greater financial inclusivity, paving the way for a digitalized future.

FAQs

- Q: How secure are digital payment methods in India?

- A: Digital payment methods in India employ advanced security measures, including encryption and multi-factor authentication, ensuring a high level of security.

- Q: What role does the government play in promoting digital payments?

- A: The government actively promotes digital payments through initiatives and policies that encourage a cashless economy.

- Q: How do mobile wallets benefit small businesses?

- A: Mobile wallets offer small businesses cost-effective solutions, increasing accessibility and efficiency in financial transactions.

- Q: Are there risks associated with contactless payments?

- A: While contactless payments are generally secure, it’s essential to stay vigilant against potential risks such as unauthorized transactions.

- Q: How can businesses stay updated on the latest payment processing technologies?

- A: Businesses can stay updated through regular training programs for employees and by partnering with innovative payment service providers.