Name: Buddy Kim

Date: 21/12/23

In the intricate web of corporate supply chains in India[1], the efficiency of payment processing is a linchpin that determines the smooth flow of transactions. As the business landscape evolves, the traditional modes of payment are gradually giving way to more sophisticated and streamlined solutions. In this article, we delve into the nuances of payment processing for corporate supply chains in India, exploring the challenges, emerging trends, and the advantages of embracing digital payment solutions.

Introduction

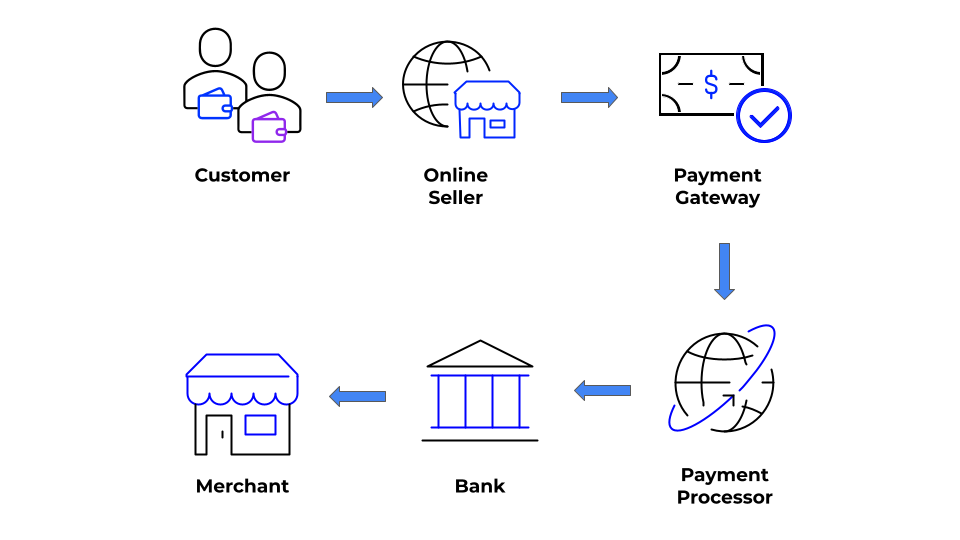

Corporate supply chains[2] form the backbone of the Indian economy, with businesses relying on a network of suppliers, manufacturers, and distributors. Amidst this complex web of transactions, efficient payment processing is paramount. The term “payment processing” encompasses the entire lifecycle of a financial transaction, from initiation to settlement.

Importance of Efficient Payment Processing

Efficient payment processing[3] is not merely a financial function; it is a strategic imperative for businesses. In the context of corporate supply chains, delays or errors in payment processing can disrupt the entire supply chain, leading to inventory issues, strained supplier relationships, and, ultimately, a negative impact on the bottom line.

Key Challenges in Corporate Payment Processing

Despite its importance, payment processing in corporate supply chains comes with its own set of challenges. One of the foremost concerns is the security of financial transactions. With the increasing frequency of cyber threats and financial fraud, businesses must adopt payment solutions that provide robust security features.

Emerging Trends in India

India is witnessing a transformative phase in payment processing for corporate supply chains. The advent of digital technologies has paved the way for innovative solutions, such as real-time payment processing, blockchain-based transactions, and integrated platforms that connect all stakeholders in the supply chain[4].

Advantages of Digital Payment Solutions

The adoption of digital payment solutions brings forth a myriad of advantages for corporate supply chains. One of the primary benefits is the speed of transactions. Digital payments enable real-time processing, reducing the time taken for funds to move between entities in the supply chain.

Tailored Solutions for Corporate Supply Chains

Unlike generic payment solutions, there is a growing trend towards specialized platforms catering specifically to the unique needs of corporate supply chains. These platforms offer features such as automated invoicing, bulk payment processing, and seamless integration with enterprise resource planning (ERP) systems[5].

Case Studies: Success Stories in Indian Corporates

Examining real-world success stories sheds light on the tangible benefits of adopting advanced payment processing solutions. Businesses that have embraced digital payment platforms report increased operational efficiency, reduced payment errors, and improved cash flow management.

Regulatory Framework in India

Navigating the regulatory landscape is a critical aspect of payment processing in corporate supply chains. Businesses must ensure compliance with the Reserve Bank of India (RBI) guidelines and other relevant regulations to maintain the legality and integrity of financial transactions.

Steps to Implement Efficient Payment Processing

Implementing efficient payment processing in corporate supply chains requires a strategic approach. Businesses should consider factors such as the scalability of the chosen solution, ease of integration with existing systems, and the training needs of stakeholders.

Cost Considerations

While the advantages of efficient payment processing are evident, businesses must also evaluate the cost implications of adopting digital solutions. A careful analysis of costs, including setup fees, transaction fees, and ongoing maintenance costs, is essential for making informed decisions.

Future Outlook

The future of payment processing for corporate supply chains in India looks promising. With continuous advancements in technology, we can expect more sophisticated and user-friendly payment solutions that further enhance the efficiency and security of financial transactions.

Expert Opinions

Gaining insights from industry experts is invaluable in understanding the evolving landscape of payment processing. Experts can provide guidance on selecting the right solutions and navigating the complexities of payment processing in corporate supply chains.

Common Misconceptions

Dispelling myths and misconceptions surrounding payment processing is crucial for businesses considering the adoption of digital solutions. Educating stakeholders about the security, reliability, and benefits of modern payment processing is essential for widespread acceptance.

Conclusion

In conclusion, the landscape of payment processing for corporate supply chains in India is undergoing a significant transformation. Embracing digital solutions is no longer an option but a necessity for businesses looking to thrive in a rapidly changing business environment. Efficient payment processing is the key to unlocking operational excellence and maintaining robust supply chain relationships.

Frequently Asked Questions

- Are digital payment solutions secure for corporate supply chains?

- Yes, digital payment solutions come with advanced security features, ensuring the secure and encrypted transfer of funds in corporate supply chains.

- How can businesses navigate the regulatory landscape for payment processing in India?

- Businesses should stay informed about RBI guidelines and relevant regulations, ensuring compliance in their payment processing practices.

- What are the primary advantages of adopting digital payment solutions in corporate supply chains?

- Digital payment solutions offer speed, efficiency, and tailored features that enhance the overall operational effectiveness of corporate supply chains.

- Can small businesses in India benefit from advanced payment processing solutions?

- Yes, tailored solutions and the scalability of modern payment platforms make them accessible and beneficial for businesses of all sizes.

- What role do expert opinions play in selecting the right payment processing solutions?

- Expert opinions provide valuable insights into industry trends, helping businesses make informed decisions when choosing payment processing solutions.