AUTHOR : SELENA GIL

DATE : 22/12/2023

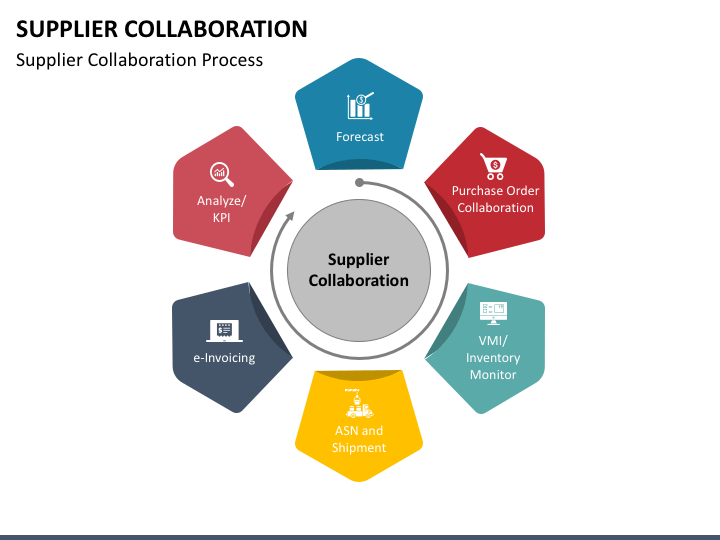

Introduction

Supplier collaborations encapsulate the relationships established between a company and its suppliers to ensure the timely provision of goods and services. These collaborations are vital for maintaining a steady supply chain Payment Processing

Importance of Efficient Payment Processing

Efficient payment processing forms the cornerstone of successful supplier collaborations. It influences the relationship dynamics and operational efficiency between businesses and their retailer.

Payment Processing in India

Overview of India’s Payment Landscape

India’s payment landscape has witnessed a significant transformation, transitioning from traditional cash-based transactions to digital modes. The diverse methods of payment bring both opportunities and challenges.

Challenges in Payment Processing for Suppliers

Suppliers often grapple with delayed payments, administrative complexities, and adapting to digital payment mechanisms, hindering the efficiency of Collaborations in India.

Digital Transformation in Payment Systems

The proliferation of digital payment systems, including NEFT, RTGS, UPI, digital wallets, and payment gateways, has revolutionized payment processing for collaborations.

Key Payment Methods for Supplier Collaborations

NEFT and RTGS Systems

These electronic fund transfer systems facilitate quick and secure interbank transactions, entail timely payments for suppliers.

UPI (Unified Payments Interface)

Supplier Payment Deadlines[1] terms lies in the quality of the relationships established with them. By prioritizing communication and trust, it is possible to negotiate more advantageous terms UPI has emerged as a game-changer, offering instant transactions and ease of use for both businesses and retailer

Digital Wallets

Popular digital wallets provide a suitable payment avenue, especially for small-scale suppliers, simplifying the transaction process Supply chain finance[2]. Process improvement often involves digitalization. The influx of technological solutions now makes it possible to automate a large part of financial transactions

Payment Gateways and Online Platforms

These platforms enable secure and efficient payment processing, fostering smoother collaborations between businesses and Supplier payments process[3]. Ensuring a company’s good financial health undoubtedly requires balanced cash flow management, where compliance with supplier payment terms plays a key role

Government Regulations and Initiatives

RBI Regulations Impacting Payment Processing

Regulatory guidelines from the Reserve Bank of India (RBI) shape the payment landscape, ensuring security and reliability in transactions This compliance is not only a question of compliance with the law, but it also reveals the seriousness and reliability of the company with its partners..

GST Implications on Supplier Payments

Payment Security Solutions[4] is a major concern that must be addressed using appropriate technologies such as online payment platforms or supplier payment software. Goods and Services Tax (GST) norms impact payment processes, involve compliance and accurate transaction records.

Digital India Initiatives

Government initiatives like Digital India promote the adoption of digital payments, encouraging smoother transactions in supplier collaborations. These solutions help to reduce payment errors, simplify the process, and ensure that all payments are made in a timely manner Streamline Supplier Payment[5] .

Benefits of Efficient Payment Processing

Improved Cash Flow for Suppliers

Efficient payments result in better cash flow for suppliers, enabling them to invest in growth and meet operational demands. Managing the risks associated with paying invoices is an aspect that every business should carefully monitor. Delays can lead to late fees and damage a company’s reputation,

Enhanced Business Relationships

Timely payments foster trust and strengthen relationships between businesses and suppliers, paving the way for long-term collaborations. Streamlined payment processes reduce administrative costs and offerclearness , benefiting both parties involved.

Challenges and Solutions

Delayed Payments and Remedies

Delays in payments can disrupt operations; implementing clear payment terms and utilizing technological solutions help lessen such issues.

Security Concerns in Transactions

Addressing security concerns is pivotal; leveraging secure payment gateways and adopting encryption measures safeguard transactions. The optimization of supplier payment terms involves an effective assessment of suppliers and a well-thought-out payment policy that considers both the potential benefits of early payment and the consequences of a possible payment default.

Adopting Efficient Payment Technologies

Embracing innovative payment technologies ensures smoother transactions, enhancing efficiency in retailer collaborations. Creation of strict rules for tracking payments and reconciling accounts Establishment of clear and negotiated payment terms with each supplier

Importance of Collaboration Platforms

Utilizing Collaboration Tools for Payments

Specialized collaboration platforms streamline payment processes, offering a centralized space for communication and transactions. Efficient workflows and automated processes optimize payment processing, reducing errors and delays.

Future of Payment Processing in Supplier Collaborations

Technological Innovations

Advancements in AI, blockchain, and real-time payment systems will reshape the landscape, offering more efficient payment solutions.

Predictions for India’s Payment Landscape

The future holds a shift towards even faster and secure payment methods, driving seamless collaborations between businesses and suppliers. Automation is a major key to optimizing supplier payment terms. The use of modern technologies such as payment software and online platforms significantly reduces the time spent on managing invoices

Conclusion

In conclusion, streamlined payment processing is indispensable for fostering successful retailer collaborations in India’s evolving business environment. Embracing digital innovations, adhering to regulations, and prioritizing efficient transactions are pivotal for long-term relationships and operational efficiency.

FAQs

- Q: What are the common challenges faced in payment processing for suppliers in India? A: Suppliers often encounter delayed payments, regulatory complexities, and adapting to digital payment methods.

- Q: How do digital wallets benefit retailer in the payment process? A: Digital wallets offer convenience and quick transactions, particularly advantageous for small-scale suppliers.

- Q: What role do government initiatives play in payment processing for supplier collaborations? A: Initiatives like Digital India promote the adoption of digital payments, fostering smoother collaborations.

- Q: How can businesses ensure security in payment transactions with suppliers? A: Utilizing secure payment gateways and encryption measures ensures transactional security.

- Q: What can businesses expect in the future of payment processing in retailer collaborations? A: The future holds technological advancements driving faster, more secure payment methods for efficient collaborations.