AUTHOR :HAANA TINE

DATE :20/12/2023

Introduction

Trade negotiations in India have witnessed significant growth and complexity in recent years. As businesses expand their global reach, the need for efficient payment processing becomes paramount. This article delves into the challenges faced in payment processing for trade negotiations in India and explores modern solutions to streamline transactions[1].

Current Payment Challenges

In the current landscape, businesses engaging in trade negotiations often encounter various payment challenges. Delays and complications in transactions can lead to strained relationships and hinder the overall negotiation process. Recognizing these issues is crucial to finding effective solutions.

The Need for Seamless Transactions

Smooth payment processes[2] play a vital role in fostering positive business relationships. The ability to handle transactions seamlessly enhances trust between parties involved in trade negotiations. This article explores the significance of efficient payment Trade Negotiations in contributing to successful trade outcomes.

Introduction to Modern Payment Systems

Trade Negotiations in India As technology advances, traditional payment methods are giving way to more sophisticated systems. Digital transactions, in particular, offer a range of benefits, including speed, accuracy, and accessibility. Businesses involved in trade negotiations must adapt to these modern payment methods[3] to stay competitive.

Security in Payment Processing

One common concern with digital transactions is the security of financial information. Addressing these concerns is essential to building trust among businesses engaged in trade negotiations. This section emphasizes the importance of Security in Payment Processing[4] in fostering a secure trading environment.

Popular Payment Gateways

Analyzing the pros and cons of popular payment gateways helps businesses make informed choices. Whether it’s PayPal, Stripe, or other platforms, understanding the features and limitations of each option is crucial in establishing an efficient payment processing system for trade negotiations.

Government Initiatives in India

Recognizing the importance of robust payment systems, the Indian government has undertaken initiatives to improve transaction processes[5]. Understanding these efforts is key for businesses seeking to navigate the evolving landscape of trade negotiations in India.

Adoption of Digital Wallets

Digital wallets have achieved broad acknowledgment across diverse sectors. Exploring their role in trade transactions sheds light on the benefits they bring to businesses, including convenience, speed, and reduced transaction costs.

Blockchain in Payment Processing

The integration of blockchain technology in payment processing enhances security and transparency. This section explains how blockchain can revolutionize trade negotiations by providing a Decentralized Payment Network and incorruptible ledger of transactions.

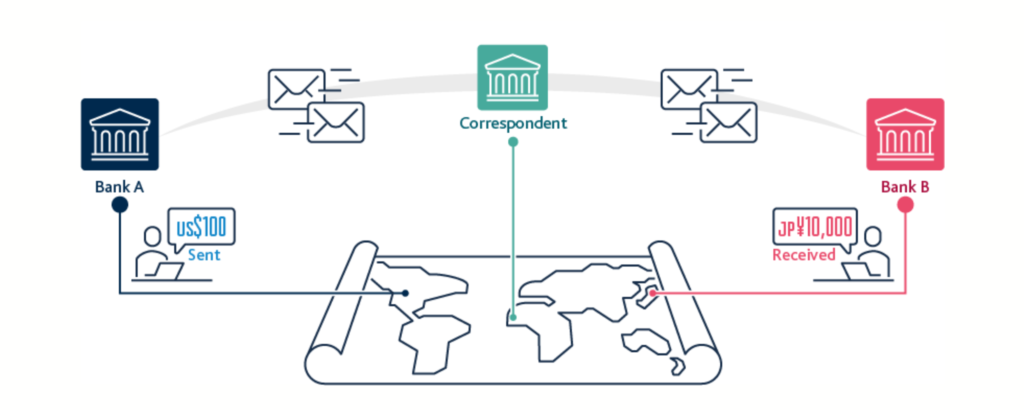

Cross-Border Payment Solutions

Cross-border transactions pose unique challenges that require tailored solutions. Examining the difficulties involved and exploring strategies to streamline international payments is vital for businesses engaged in global trade negotiations.

Impact on Small and Medium Enterprises (SMEs)

While large enterprises may have the resources to navigate complex payment processes, SMEs face unique challenges. This section explores how payment processing impacts SMEs and suggests solutions that cater to the specific needs of smaller businesses.

Case Studies

Real-world examples illustrate successful payment processing in trade negotiations. By examining these cases, businesses can gain insights into effective strategies and learn from the experiences of others.

Future Trends in Payment Processing

Anticipating future trends[2] in payment technology is essential for businesses to stay ahead. This section explores emerging developments that are likely to shape the future of payment processing in the context of trade negotiations.

Best Practices for Trade Negotiation Payments

Guidelines for businesses to enhance payment processes are outlined in this section. From leveraging advanced technologies to fostering transparency, adopting best practices ensures efficiency and reliability in trade negotiation payments.

Conclusion

In conclusion, streamlined payment processing is a cornerstone of successful trade negotiations in India. Embracing modern payment systems, prioritizing security, and staying abreast of industry trends are key to navigating the complexities of international trade transactions.

FAQs

- Q: What are the common challenges in payment processing for trade negotiations?

- A: Delays, complications, and security concerns are common challenges faced in payment processing for trade negotiations.

- Q: How can small and medium enterprises improve their payment processes for trade negotiations?

- A: SMEs can leverage digital wallets, adopt secure payment gateways, and implement best practices tailored to their specific needs.

- Q: What role does the government play in improving payment systems for trade negotiations in India?

- A: The Indian government has initiated efforts to enhance payment systems, contributing to a more reliable and efficient trade environment.

- Q: How can businesses stay updated on future trends in payment processing for trade negotiations?

- A: Businesses can stay informed by regularly monitoring industry publications, attending conferences, and engaging with experts in the field.

- Q: Where can businesses access modern payment solutions for trade negotiations?

- A: Explore reputable payment gateways, digital wallet providers, and stay informed about emerging technologies to access modern payment solutions.