AUTHOR: PUMPKIN KORE

DATE: 23/02/2024

Introduction

In the ever-evolving landscape of B2B direct marketing the role of innovation cannot be overstated. Pair that with the power of B2B direct marketing in India, and you’ve got a potent combination. This article delves into the intricate dance between payment processors and B2B direct marketing, exploring the evolution, challenges, integration, and success stories in the Indian business realm. To comprehend the current scenario, it’s essential to trace the roots of payment processors. From the early days of manual transactions to the seamless digital processes we witness today, the evolution has been monumental. Technological factors have played a crucial role in shaping the efficiency and security of payment processors.

B2B Direct A Game-Changer

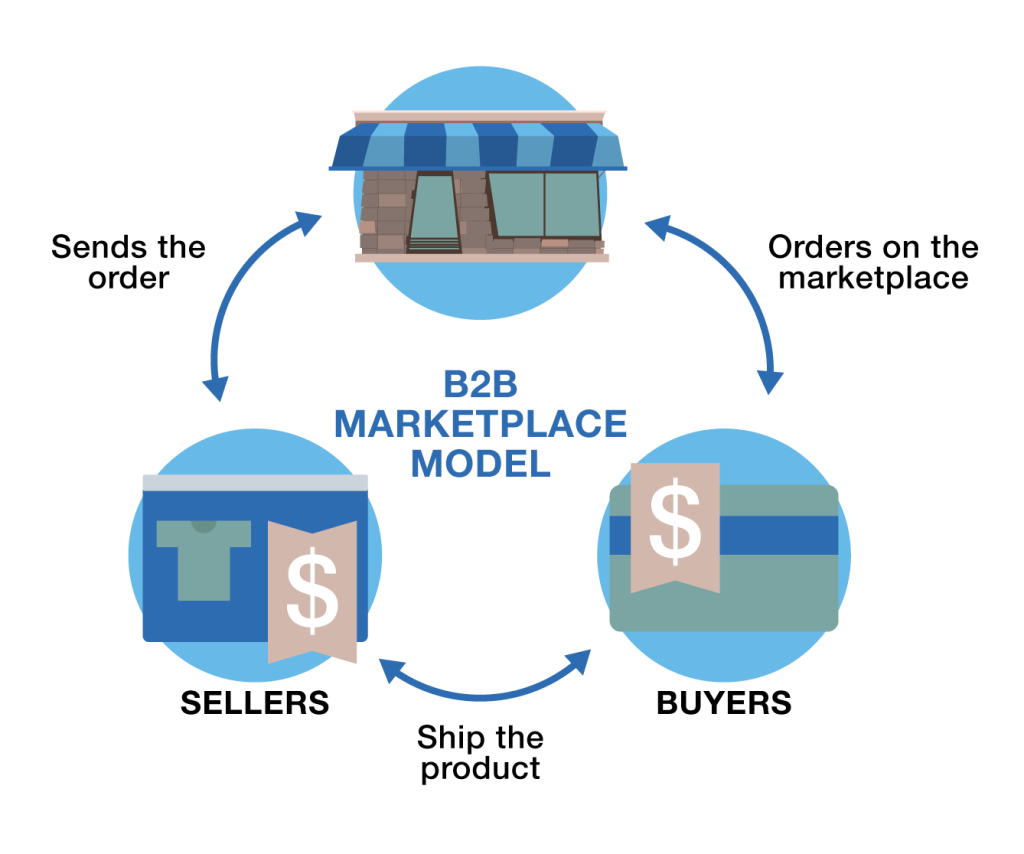

payment processor B2B direct marketing, in simple terms, is the process of businesses selling products or services directly to other businesses. In the vast Indian market, this strategy has proven to be a game-changer, providing a direct line of communication between sellers and buyers. We’ll explore its definition, significance, and the latest trends shaping this marketing approach. However, the road to successful B2B direct marketing isn’t without its challenges. Businesses in India encounter payment processing issues, and marketing hurdles that can hinder their growth. Businesses that strategically integrate payment processors into their B2B marketing strategies position themselves for success in the dynamic Indian market. payment processor B2B Direct Marketing in India

The Integration of Payment Processors and B2B Direct Marketing

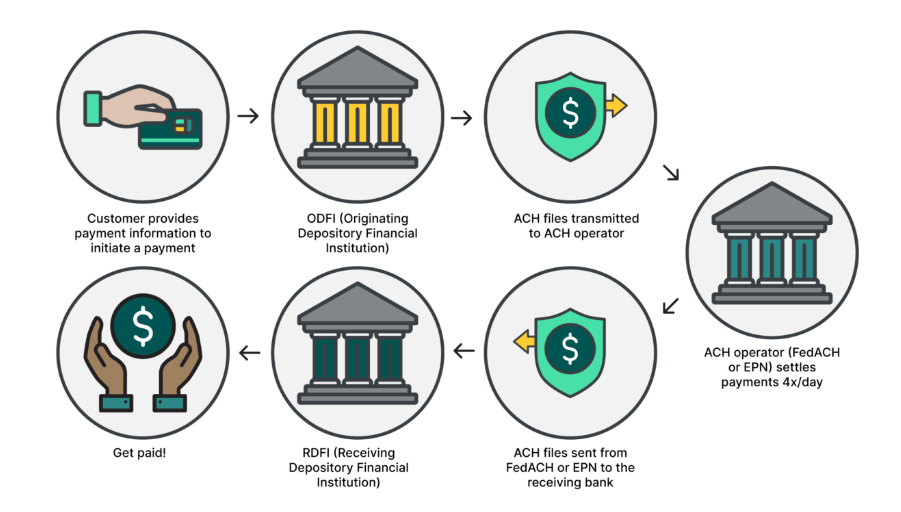

A key turning point in the landscape is the seamless integration of payment processors with B2B direct marketing. The synergy between these two elements has transformed the way businesses operate, offering a range of benefits that cannot be ignored. For this integration to work seamlessly, it’s essential to have a robust payment processor in place. We explore the key features businesses should look for in a payment processor to enhance their B2B marketing efforts. Security measures and user-friendly interfaces take center stage in this discussion.

Taking stock of the current scenario, we examine the adoption rates of payment processors in India and project future trends. Understanding how businesses in India are embracing digital payment solutions sheds light on the changing landscape.

How to Choose the Right Payment Processor for B2B Direct Marketing

With numerous options available, choosing the right payment processor is a critical decision. We break down the factors businesses should consider and provide a comparison of popular processors to guide decision-making. To provide a practical perspective, we delve into case studies, highlighting successful instances where businesses effectively utilized payment processors in their B2B marketing strategies. These real-world examples offer insights and inspiration for others navigating this terrain.

India has its own unique set of regulations, and compliance is paramount. We explore how businesses can navigate regulatory challenges, ensuring both payment processing and B2B marketing in india[1] align with Indian laws while maintaining data security.

The Role of Technology in Enhancing B2B Direct Marketing

Technological innovations continue to reshape B2B direct[2] marketing. Artificial intelligence (AI) and machine learning applications, coupled with automation, enhance efficiency and effectiveness. We delve into the role of technology in driving success in this space. Highlighting success stories from businesses that have effectively implemented payment processors in their B2B marketing strategies[3] provides tangible evidence of the positive impact of such integration.

Addressing Perplexity in B2B Direct Marketing

Perplexity is an inevitable aspect of any business strategy. We discuss strategies to overcome challenges, emphasizing the importance of innovation in maintaining a competitive edge. The payment processing landscape[4] is not immune to bursts of change and trends. Staying ahead of the curve is vital for businesses. We explore the concept of burstiness in payment processing trends and strategies to adapt to rapid changes.

Conclusion

In conclusion, the fusion of payment processors and B2B direct marketing[5] presents a compelling narrative for businesses in India. The symbiotic relationship offers efficiency, security, and direct communication, creating a conducive environment for growth. As technology continues to evolve, the future holds even more exciting possibilities for businesses adopting this integrated approach.

FAQs

- Q: Are payment processors secure for B2B transactions in India?

- A: Yes, modern payment processors employ robust security measures to ensure the safety of B2B transactions.

- Q: How can businesses overcome regulatory challenges in India’s B2B market?

- Businesses can navigate regulatory challenges by staying informed, ensuring compliance, and prioritizing data security.

- Q: What role does technology play in enhancing B2B direct marketing?

- Technology, including AI and automation, enhances efficiency and effectiveness in B2B direct marketing.

- Q: Can small businesses benefit from integrating payment processors into their B2B strategies?

- Absolutely. Payment processors offer scalability, making them beneficial for businesses of all sizes.

- Q: How can businesses stay ahead of the burst in payment processing trends?

- Regularly staying updated on industry trends and adopting agile strategies helps businesses navigate the burst in payment processing trends.