AUTHOR : LISA WEBB

DATE : FEBRUARY 23, 2024

Introduction

Definition of Payment Processor: Direct Mail

Payment Processor Direct Mail involves the seamless integration of traditional direct mail methods with modern digital payment processing. It provides users with a secure and convenient way to conduct financial transactions.

Importance in the Indian Market

In a country with a diverse and dynamic market like India, the adoption of payment processor direct mail holds immense importance. It addresses the need for secure and efficient payment options that cater to the digital-savvy population.

Evolution of Payment Processors

Emergence of Digital Payment Processors

The advent of digital payment processors revolutionized the financial landscape p From credit cards to mobile wallets, these platforms streamline transactions Payment Processor Direct Mail emerged as a bridge between the digital and physical realms.

Role of Direct Mail in Modern Transactions

Direct mail, traditionally associated with marketing, has found a new role in the payment processing domain. It became a tangible representation of digital transactions, adding an extra layer of security and assurance.

Benefits of Payment Processor Direct Mail

Enhanced Security

One of the primary advantages of Payment Processor Direct Mail is enhanced security. By combining digital encryption with physical transaction records, it creates a robust system that safeguards user information.

Convenience for Users

Users benefit from the convenience of Payment Processor Direct Mail. It offers a tangible confirmation of transactions, reducing the reliance on purely digital receipts. This physical element adds a layer of trust to the process.

Increased Trust in Transactions

The combination of direct mail and digital payments instills confidence in users. The tangible proof of transactions received via mail contributes to a sense of security and transparency in financial dealings.

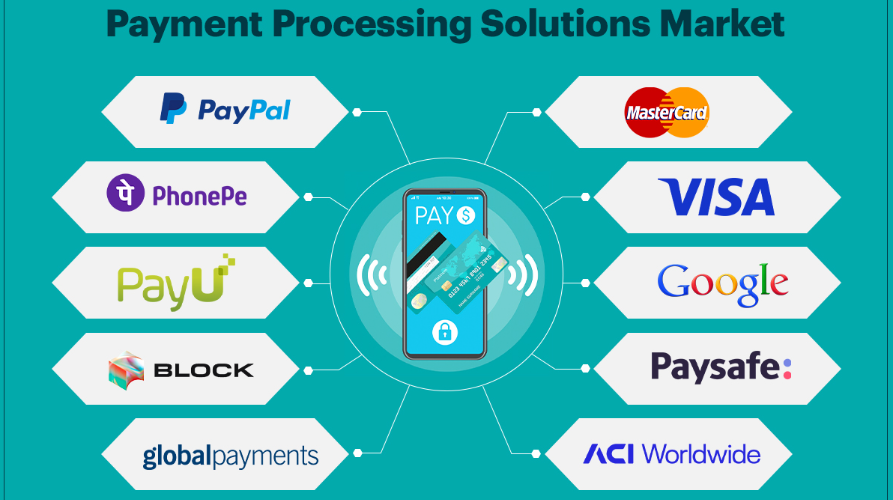

Popular Payment Processors in India

Overview of Leading Platforms

Several multiple payment gateway[1] processors have gained prominence in the Indian market. From established players to emerging platforms, each offers unique features and services.

Features and Offerings

Leading payment processors in India provide a range of features, including secure transactions, user-friendly interfaces, and integration with various financial services.

Market Share and User Base

Understanding the market share and user base of different payment processors helps businesses make informed decisions when choosing a suitable platform.

How Payment Processor Direct Mail Works

Step-by-Step Process

Payment Processor Direct Mail operates through a systematic process that combines digital authorization with the physical confirmation of transactions. Understanding this process is crucial for users and businesses alike.

Integration with Digital Platforms

The seamless integration of Payment Processor Direct Mail[2] with digital platforms ensures a smooth user experience. This integration also enables businesses to track and manage transactions efficiently.

User-Friendly Interfaces

The success of Payment Processor Direct Mail lies in its user-friendly interfaces. Platforms prioritize simplicity and accessibility, catering to users with varying levels of technological proficiency.

Challenges and Solutions

Security Concerns

While Payment Processor Direct privacy Enchaned Mail[3] enhances security, concerns may arise. Addressing these concerns through advanced encryption and authentication measures is essential.

Importance of SEO in Payment Processor Direct Mail

Online Visibility for Payment Processors

SEO plays a crucial role in enhancing the online visibility of payment processors[4]. Implementing effective SEO strategies ensures that these platforms reach a wider audience.

SEO Strategies for Enhanced Market Reach

Optimizing content, using relevant keywords, and maintaining a strong online presence are key components of SEO strategies for payment processors.

The Future of Payment Processor Direct Mail in India

Projected Market Growth

Analysts predict significant growth in the adoption of Payment Processor Direct Mail in India[5]. The convenience and security it offers align with the evolving needs of businesses and consumers.

Adaptation to Evolving Consumer Demands

The future success of Payment Processor Direct Mail hinges on its ability to adapt to the changing demands of consumers. Flexibility and continuous improvement will be vital.

Conclusion

Payment Processor Direct Mail emerges as a transformative solution, combining the best of traditional and digital transactions. Its benefits include enhanced security, user convenience, and increased trust in financial dealings.

FAQs

Q.1: How secure are payment processor direct mail transactions?

Payment Processor Direct Mail transactions are highly secure, combining digital encryption with tangible transaction records for enhanced protection.

Q.2: Can businesses of all sizes benefit from these services?

Yes, Payment Processor Direct Mail caters to businesses of all sizes, providing a scalable and efficient payment processing solution.

Q.3 Are there any limitations to payment processor direct mail?

While highly beneficial, businesses should address concerns like technological barriers and regulatory compliance to fully leverage Payment Processor Direct Mail.

Q.4 How can businesses enhance their SEO for better visibility?

Effective SEO strategies, including keyword optimization and maintaining a strong online presence, contribute to the enhanced visibility of payment processors.

Q.5 What are the anticipated challenges in the future of payment processing?

Future challenges may include staying ahead of technological advancements, addressing security concerns, and navigating evolving regulatory landscapes.