AUTHOR : ANNU CHAUHAN

DATE : 10/12/2023

Introduction

In a rapidly evolving digital landscape, the dynamics of financial transactions have undergone a paradigm shift. One of the pivotal players in this transformation is Payment Processor Direct Marketing This article delves into the nuances of this innovative approach and its impact on the Indian market.

Payment Processor Direct Marketing involves leveraging payment processing platforms for targeted and personalized marketing campaigns. This approach utilizes transactional data to tailor marketing strategies directly to consumers.

Importance in the Indian Market

As India embraces a digital economy, the significance of Payment Processor Direct Marketing becomes increasingly pronounced. Its ability to combine financial transactions with marketing strategies creates a synergy that benefits businesses and consumers alike.

Evolution of Payment Processors in India

Historical Overview

The journey of payment processors in India can be traced back to the advent of electronic banking. From traditional methods to the integration of digital technologies, the evolution has been monumental.

Technological Advancements

With the proliferation of smartphones and internet accessibility payment processors have evolved to offer seamless and instant transactions, contributing to the growth of the digital economy.

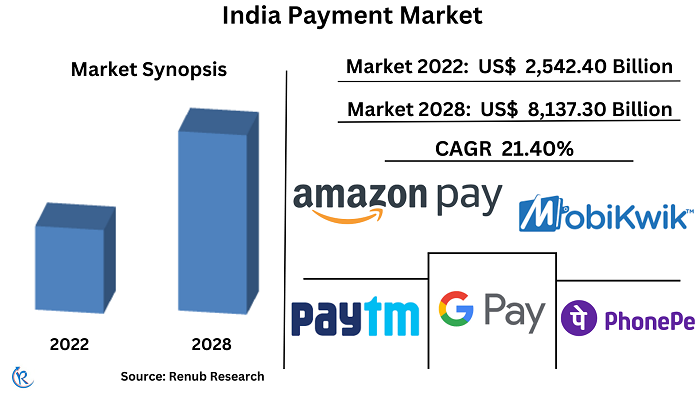

Key Players in Indian Payment Processor Direct Marketing

Major Companies

Key players in the Indian market include well-established financial institutions and emerging fintech companies. Understanding their roles and market share is crucial for assessing the landscape.

Market Share Analysis

Analyzing the market share of these companies provides insights into the competitive dynamics and the influence they wield in shaping the industry.

Benefits of Payment Processor Direct Marketing

Efficiency and Speed

One of the primary advantages is the efficiency and speed with which marketing messages[1] can reach consumers. Leveraging transactional data ensures timely and relevant communication.

Cost-Effectiveness

Compared to traditional marketing channels, Payment Processor Direct Marketing[2] offers a cost-effective way to engage with a targeted audience. It optimizes marketing budgets and enhances ROI.

Enhanced Security

The integration of marketing with payment processors guide[3] necessitates robust security measures. This dual-focus ensures not only effective campaigns but also safeguards sensitive financial data.

Challenges in Payment Processor Direct Marketing

Regulatory Hurdles

Navigating the regulatory landscape poses challenges for marketers. Adhering to data protection and privacy regulations is crucial to avoid legal complications.

Consumer Concerns

Building trust is essential, as consumers may express concerns about the privacy implications of personalized marketing based on their transaction history.

Trends and Innovations

Mobile Wallets and Apps

The rise of mobile wallets and apps has opened new avenues for Payment Processor Direct[4] Marketing. Marketers can leverage these platforms to engage with users seamlessly.

Contactless Payments

As contactless payments gain popularity marketers need to adapt their strategies to align with the changing preferences of consumers who prioritize convenience and safety.

Case Studies

Case studies highlight the impact of payment processor direct[5] marketing on brand visibility and customer engagement.

Examining campaigns that faced challenges offers valuable lessons for marketers. Understanding failures is as crucial as celebrating successes.

Strategies for Effective Payment Processor Direct Marketing

Target Audience Identification

Identifying the target audience is the cornerstone of successful campaigns. Payment Processor Direct Marketing allows for precise audience segmentation based on transaction behavior.

Tailoring messages based on individual transaction histories enhances the effectiveness of marketing campaigns.

Future Outlook

Emerging Technologies

The integration of emerging technologies like blockchain and artificial intelligence holds immense potential for the future of payment processor Direct marketing.

Anticipated Developments

Predicting the trajectory of the industry allows businesses to proactively prepare for upcoming changes. Anticipating developments is key to staying ahead of the curve.

Real-Life Success Stories

Impact on Businesses

Businesses that have successfully integrated payment processor direct marketing share their experiences. Understanding the impact on revenue and brand visibility provides valuable insights.

Customer Testimonials

Direct feedback from customers offers India has undergone a revolutionary transformation in recent years, thanks to rapid advancements a glimpse into the consumer perspective. Positive testimonials build credibility and trust.

Expert Opinions

Interviews with Industry Leaders

Gaining insights from industry leaders indispensable role of payment processors. Let’s explore how payment processors empower businesses and shape the direct marketing landscape in India. sheds light on the current state of payment processor direct marketing and its potential future developments.

Insights and Predictions

Experts provide valuable predictions about the trajectory of the industry, offering guidance for businesses and marketers.payment processor acts as a digital middleman, facilitating the transfer of funds between a customer and a merchant

Integration with E-commerce

Facilitating Online Transactions

The seamless integration of Payment Processor Direct Marketing with e-commerce platforms enhances the overall online shopping experience for consumers.

Advantages for Businesses

E-commerce businesses can capitalize on this integration to boost sales, improve customer retention, and gain a competitive edge.

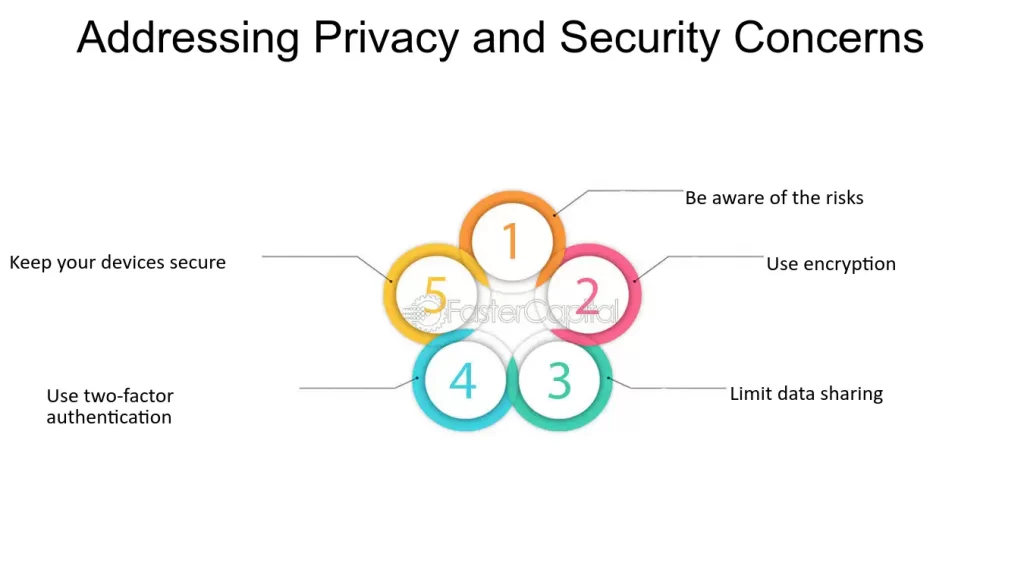

Addressing Security Concerns

Encryption and Fraud Prevention

Implementing robust encryption and fraud prevention measures is imperative. Addressing security concerns is essential to build and maintain consumer trust.

Building Trust Among Consumers

Transparent communication about security measures and initiatives to build trust are integral to the success of payment processor direct marketing.

Reaching Unbanked Populations

Payment Processor Direct Marketing plays a crucial role in reaching unbanked populations, promoting financial inclusion, and bridging the gap between traditional and digital economies.

Bridging the Digital Divide

By making financial services more accessible, In simpler terms, it ensures that the money leaves the buyer’s account and reaches the seller’s account securely and efficiently. Payment Processor Direct Marketing contributes to bridging the digital divide and creating opportunities for underserved communities.

Conclusion

In conclusion, payment processor direct marketing has emerged as a transformative force in the Indian financial landscape. Its efficiency, cost-effectiveness, and ability to bridge the digital divide make it a valuable asset for businesses and consumers alike.

FAQs

- Is Payment Processor Direct Marketing secure for consumers?

- Yes, robust encryption and fraud prevention measures ensure the security of consumer data.

- How does Payment Processor Direct Marketing contribute to financial inclusion?

- By reaching unbanked populations and making financial services more accessible.

- What role do mobile wallets play in Payment Processor Direct Marketing?

- Mobile wallets provide a platform for seamless and targeted marketing campaigns.

- How can businesses address regulatory challenges in Payment Processor Direct Marketing?

- Businesses should stay informed about data protection and privacy regulations and ensure compliance.

- Are there any emerging technologies expected to impact Payment Processor Direct Marketing?

- Yes, technologies like blockchain and artificial intelligence are anticipated to shape the future of the industry.