AUTHORS: PUMPKIN KORE

DATE: 01/03/2024

In the dynamic landscape of digital transactions, payment processors and downloadable apps have become integral components, revolutionizing the way individuals and businesses conduct financial transactions. This article delves into the evolving realm of payment processors and the growing significance of downloadable apps in India.

The global surge in online transactions has underscored the pivotal role played by payment processors. These entities facilitate secure and efficient monetary exchanges, playing a crucial role in the seamless functioning of e-commerce platforms. As the digital economy expands, the demand for reliable payment processing solutions continues to soar.

Challenges in the Indian Market

India, with its diverse population and varied preferences, presents unique challenges for payment processors. Understanding and accommodating the preferences of a vast user base, coupled with addressing security concerns, is paramount for success in this market.

The evolution of downloadable apps has been a game-changer. With the proliferation of smartphones, consumers are increasingly relying on mobile applications for a myriad of services, including financial transactions[1]. This shift in consumer behavior has prompted businesses to adapt and integrate payment processors seamlessly into their apps.

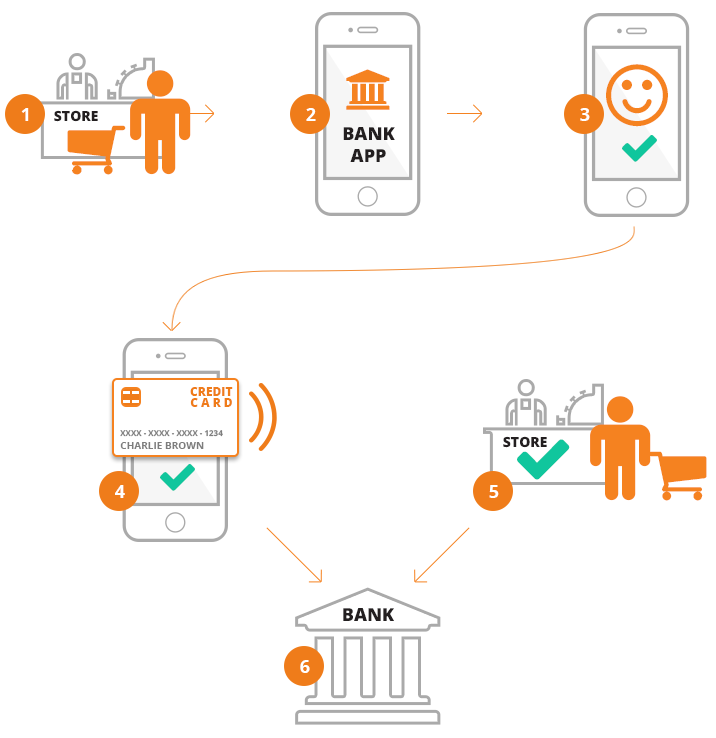

Integration of Payment Processors in Apps

The integration of payment[2] processors into downloadable apps goes beyond mere functionality. It enhances the overall user experience, offering a seamless and convenient way for users to make transactions within the app. This integration is not just a technological upgrade but a strategic move to streamline and simplify the payment process.

Popular Payment Processors in India

Several payment processors dominate[3] the Indian market, each bringing unique features and advantages to the table. From traditional banking systems to digital wallets and UPI-based solutions, users have options to choose from in the vibrant landscape of digital payments in India.

Downloadable Apps and User Convenience

User-friendly interfaces and intuitive design are pivotal to the success of downloadable apps[4]. Payment processors integrated into these apps prioritize user convenience, offering a smooth and hassle-free payment experience. This user-centric approach is instrumental in driving the widespread adoption of digital payment solutions.

Security Measures in Payment Processing

Ensuring the security of financial transactions is a paramount[5] concern. Payment processors, cognizant of this, employ robust encryption technologies and stringent security measures. Incorporating user testimonials to narrate firsthand experiences, illustrating the positive impact on everyday transactions.

Future Trends in Payment Processing and Apps

The future holds exciting possibilities for payment processing and downloadable apps. Innovations in payment technologies coupled with emerging trends in app development are poised to reshape the landscape further. From contactless payments to voice-enabled transactions, the future is a dynamic and evolving ecosystem.

Examining successful case studies provides insights into the positive impact of integrating payment processors into downloadable apps. Businesses that have these technologies have increased customer satisfaction, higher conversion rates, and a significant boost in overall revenue.

Tips for App Developers

For app developers looking to optimize their offerings, understanding the intricacies of payment features is crucial. Tailoring payment options to cater to diverse user preferences, ensuring a smooth user interface, and staying abreast of technological advancements are essential for success in this competitive landscape.

User Feedback and Reviews

The importance of user feedback and reviews cannot be overstated. As we navigate through the landscape of payment processor downloadable apps in India, it’s evident that a transformative journey awaits. App developers and payment processors should actively seek and also value customer opinions to continuously improve and refine their services.

Impact on Small Businesses

The integration of payment processors into downloadable apps plays a pivotal role in leveling the playing field for small businesses. Access to digital payment solutions empowers these enterprises, enabling them to compete more effectively in the market and also contribute to economic growth.

Conclusion

In conclusion, the symbiotic relationship between payment processors and downloadable apps has significantly transformed the way transactions are conducted in India. user-friendly solutions, revolutionizing the digital payment landscape. Explore features, top players, and real-life success stories. Dive into a cashless era effortlessly.

FAQs

- Are payment processors secure for online transactions?

- Yes, payment processors employ advanced encryption technologies to ensure the security of online transactions.

- Which payment processors are popular in India?

- Popular payment processors in India include traditional banks, digital wallets, and UPI-based solutions.

- How do downloadable apps enhance user convenience in payments?

- Downloadable apps offer user-friendly interfaces, simplifying the payment process and enhancing overall convenience.

- What are the future trends in payment processing?

- Future trends include innovations such as contactless payments and voice-enabled transactions.

- How do payment processors impact small businesses?

- Payment processors empower small businesses by providing access to digital payment solutions, leveling the playing field in the market.