AUTHOR : ISTELLA ISSO

Introduction

The payment processor electronics parts wholesale market in India is an integral part of the country’s booming digital payment ecosystem. As the use of digital transactions continues to rise, the demand for high-quality payment processor electronics parts is skyrocketing. From small businesses to large corporations, payment processors play a critical role in ensuring secure, efficient, and seamless transactions. In this article, we’ll dive deep into the factors shaping the payment processor electronics parts wholesale market in India, the key players involved, the challenges faced by wholesalers, and what the future holds for this vibrant industry.

What is a Payment Processor?

A payment processor is a service provider that enables businesses and individuals to make electronic transactions. These transactions can be anything from online purchases, bill payments, or even in-store card payments. Payment processors act as intermediaries, ensuring that funds are transferred securely between the buyer and the seller.

There are two main types of payment processors: Traditional Payment Processors and Digital Payment Processors. Payment Processor Electronics Parts Wholesale Market In India Traditional processors handle card transactions while digital processors handle online payments like mobile wallets and e-commerce transactions.

Growth of the Electronics Market in India

India’s electronics market has been growing rapidly, with the demand for payment processor parts following a similar upward trajectory. Electronic component[1] The increasing adoption of digital payments, coupled with government initiatives like Digital India, has created a surge in demand for payment processors and their components. In fact, the Indian electronics market is expected to grow to $400 billion by 2025, with payment processors accounting for a significant portion of this growth.

Key Players in the Indian Payment Processor Market

Several key players dominate the payment processor market in India, including Razorpay, Paytm, PhonePe, and Citrus Pay. These companies are major drivers of demand for Electronics industry[2] parts related to payment processing, such as POS terminals, card readers, and digital wallets. The market share of these companies continues to increase as digital payments become the norm for everyday transactions.

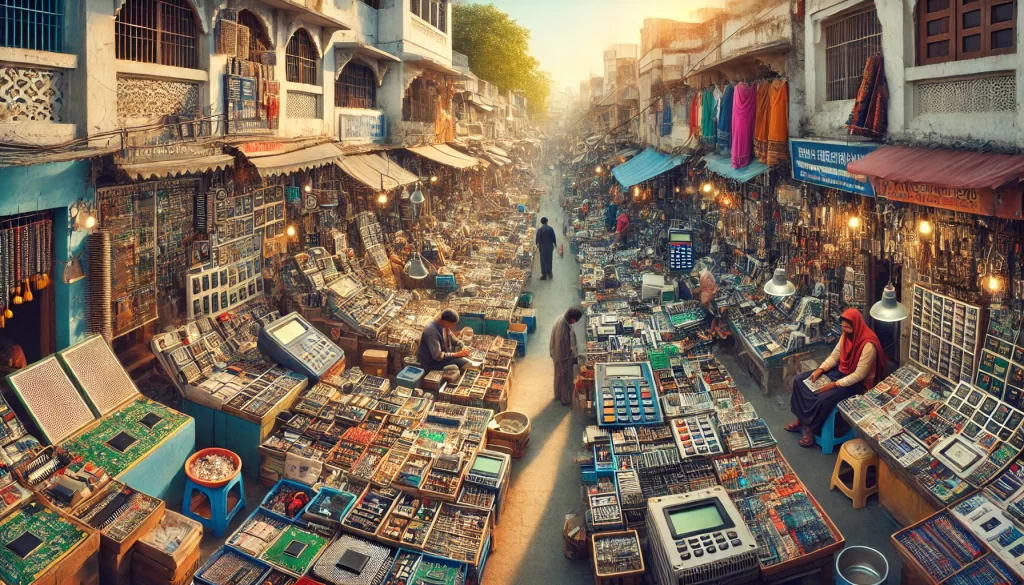

Wholesale Electronics Market in India

Wholesale in the context of electronics parts refers to bulk purchasing of components from manufacturers or authorized distributors at a lower cost. Electronic markets[3] This model allows retailers and businesses to purchase components in large quantities, which they then distribute or sell to end-users at a markup.

In India, there is a growing network of wholesale distributors for payment processor parts. Companies like RS Components, Element14, and Sankyo Electronics are some of the key players in the wholesale market, providing essential parts for payment processors.

Payment Processor Electronics Parts: Demand and Supply

The demand for payment processor electronics parts has been driven by the digital payments revolution in India. Consumers and businesses now expect faster, safer, and more reliable payment processing systems, creating high demand for cutting-edge Consumer electronics[4] components. However, the supply side faces some challenges due to factors like import dependencies, manufacturing limitations, and supply chain disruptions.

Market Segmentation: Types of Payment Processor Electronics Parts

The payment processor electronics parts market is segmented into several categories based on the types of components used:

- POS Terminals: These are devices used for processing card payments in retail outlets.

- Card Readers: Essential for reading magnetic stripe and chip-enabled credit/debit cards.

- Payment Gateways: These are software applications that facilitate online payments.

- Microchips and Semiconductors: These are at the heart of payment processors, enabling secure transactions.

Manufacturing and Sourcing of Payment Processor Parts

When it comes to manufacturing, India relies both on local production and imports. While some components like microchips are imported, many parts such as POS terminals and card readers are increasingly being manufactured locally. National Electronic Distributors[5] This shift not only reduces costs but also strengthens India’s position in the global electronics supply chain.

The sourcing of payment processor parts also involves collaborations with international suppliers. While this opens up a wider range of options, it also presents challenges in terms of cost and quality control.

Technological Advancements in Payment Processor Electronics

India’s payment processor electronics market is experiencing a surge in innovation. Near Field Communication (NFC) technology, biometric authentication, and contactless payments are transforming the way payments are processed. These advancements are pushing the demand for more sophisticated components that are faster, more secure, and capable of handling larger volumes of transactions.

Regulatory Framework and Compliance

The Indian government has put in place several regulations to ensure the smooth functioning of digital payment systems. The Reserve Bank of India (RBI) governs the industry, ensuring that payment processors meet compliance standards. These regulations help maintain security and protect consumers, fostering trust in digital payment systems.

Wholesale Market Distribution Channels

The distribution channels for payment processor parts have evolved significantly in recent years. Traditional wholesale models still dominate, but e-commerce platforms like Amazon Business and IndiaMart are playing a significant role in expanding access to parts for payment processors. These platforms allow wholesalers to reach a larger audience, including small businesses and startups looking for cost-effective solutions.

Cost Structure of Payment Processor Electronics Parts

The price of payment processor electronics parts can vary based on the complexity and functionality of the component. Factors like demand, import tariffs, manufacturing costs, and technological advancements contribute to the overall cost structure. In recent years, prices have been fluctuating due to supply chain disruptions and increased demand for high-tech components.

Challenges in the Payment Processor Electronics Parts Wholesale Market

The wholesale market for payment processor electronics faces several challenges, including:

- Supply Chain Disruptions: Global supply chain issues can affect the availability of crucial components.

- Price Wars: Intense competition among wholesalers can lead to price reductions, affecting profitability.

- Technological Advancements: Rapid technological changes mean wholesalers must constantly adapt their inventory to meet the latest demands.

Future Outlook for the Payment Processor Electronics Parts Market in India

The future of the payment processor electronics parts market in India looks promising. With the growth of digital payments and the ongoing push for financial inclusion, demand for these parts is expected to continue increasing. However, the industry will need to navigate challenges like supply chain stability and technological innovation.

Conclusion

The payment processor electronics parts wholesale market in India is poised for significant growth, driven by a booming digital economy, technological advancements, and evolving consumer expectations. Key players in the market, as well as wholesalers, must adapt to this dynamic landscape, ensuring they meet the growing demand for high-quality payment processing solutions.

FAQs

- What are the key components of a payment processor?

- The key components include POS terminals, card readers, payment gateways, and microchips.

- Who are the major suppliers of payment processor parts in India?

- Companies like RS Components, Sankyo Electronics, and Element14 supply these parts.

- How is the demand for payment processors in India increasing?

- The rise of digital payments and government initiatives like Digital India have fueled the demand for payment processors and their components.

- What challenges do wholesalers face in the payment processor parts market?

- Wholesalers face challenges like supply chain disruptions, competition, and keeping up with technological advancements.

- What is the future outlook for the payment processor electronics parts market in India?

- The market is expected to grow steadily due to increasing adoption of digital payments and innovations in payment processing technology.