AUTHOR : RUBBY PATEL

DATE : 22/12/23

Introduction

The Indian Business Landscape

In the dynamic landscape of Indian business, the role of payment processors has become pivotal in fostering growth. Traditional payment methods are proving inadequate in meeting the demands of modern businesses, necessitating a shift towards efficient and secure alternatives.

India boasts a vibrant and diverse business environment, spanning various sectors such as retail, technology, and services. With the advent of the digital age, businesses are increasingly relying on technology for their operations.

Challenges in Traditional Payment Methods

Role of Payment Processors in Business Growth

However, traditional payment methods present significant challenges. Lengthy transaction times, limited accessibility, and security concerns have paved the way for advanced payment processing solutions.

Payment processors play a crucial role in facilitating online transactions, offering a seamless experience to both businesses and customers. By streamlining financial processes, these solutions contribute to increased efficiency and overall growth.

Popular Payment Processors in India

In the Indian market, several payment processors[1] have gained prominence, each offering unique features. Understanding the differences between them is essential for businesses seeking the most suitable solution.

Security Measures in Payment Processing

Adopting Mobile Wallets for Business

Security is a top priority in the digital businesses[2] especially concerning financial transactions. Payment processors employ advanced encryption and authentication measures to ensure the safety of sensitive information.

With the rise of smartphone usage, mobile wallets have become increasingly popular. Population growth[3] Integrating mobile wallet solutions not only enhances customer convenience but also opens up new avenues for business.

Integrating UPI for Seamless Transactions

Customized Payment Solutions for Businesses

The Unified Payments Interface[4] (UPI) has revolutionized payment methods in India. Businesses can leverage UPI for seamless transactions, providing a user-friendly and efficient payment experience.

Recognizing that one size doesn’t fit all, payment processors offer customized solutions tailored to the specific needs of businesses .Economic growth[5] This flexibility ensures that businesses can choose the features that align with their operations.

Case Studies

Real-world examples of businesses successfully implementing advanced payment processors underscore the positive impact on efficiency, customer satisfaction, and overall growth.

Regulatory Compliance in Payment Processing

Evaluating Costs and Fees

Navigating the regulatory landscape is crucial for businesses integrating payment processors. Adhering to guidelines ensures the sustainability and credibility of the business.

Transparent pricing models are paramount when selecting a payment processor. Avoiding hidden fees allows businesses to plan their finances effectively.

Educating Employees and Customers

Measuring the Impact on Business Growth

The transition to advanced payment methods requires educating both employees and customers. Training staff ensures smooth internal operations, while customer education fosters a positive transition.

Tracking metrics such as transaction volume, customer satisfaction, and revenue growth provides insights into the effectiveness of payment processor integration.

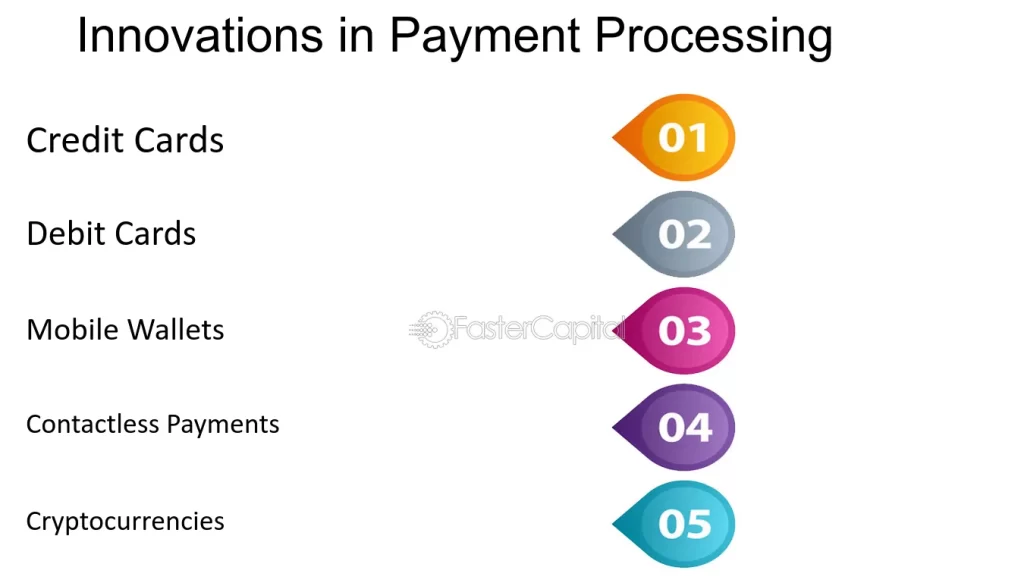

Innovations in Payment Processing

Continuous innovation is a hallmark of the tech industry, and payment processors are no exception. Expect to see advancements in areas such as biometric authentication, artificial intelligence, and blockchain, further enhancing the speed and security of transactions.

Expanding E-commerce Opportunities

With the growing trend of online shopping, businesses that integrate advanced payment processors can tap into the vast opportunities presented by the e-commerce market. Seamless transactions and secure payments contribute to a positive online shopping experience, fostering customer loyalty.

Global Integration of Payment Solutions

As businesses increasingly operate on a global scale, payment processors that offer cross-border solutions become invaluable. The ability to accept and make payments in different currencies simplifies international transactions, opening doors to a broader customer base.

The Role of Cryptocurrency in Payments

The rise of cryptocurrencies has spurred discussions about their role in the payment processing landscape. While not yet mainstream, the integration of cryptocurrencies into payment options could be a game-changer, providing businesses with an additional avenue for transactions.

Conclusion

In conclusion, adopting advanced payment processors is a strategic move for businesses in India aiming for growth. From enhancing transaction efficiency to providing a secure environment, these solutions contribute significantly to the overall success of a business.

FAQs

- Q: Are payment processors secure for online transactions?

- A: Yes, payment processors employ advanced security measures, including encryption, to ensure the safety of online transactions.

- Q: How can businesses choose the right payment processor for their needs?

- A: Businesses should consider factors such as features, pricing, and scalability when choosing a payment processor.

- Q: Can small businesses benefit from advanced payment processing solutions?

- A: Absolutely. Many payment processors offer tailored solutions suitable for small businesses, contributing to their growth.

- Q: What role does regulatory compliance play in payment processing?

- A: Adhering to regulatory guidelines is crucial for the credibility and sustainability of businesses using payment processors.

- Q: How can businesses measure the success of payment processor integration?

- A: Tracking metrics such as transaction volume, customer satisfaction, and revenue growth provides a clear picture of the impact on business growth.