AUTHOR : RUBBY PATEL

DATE : 25/12/23

Introduction

In the ever-evolving landscape of debt collection in India, the role of payment processors has become pivotal. As collection agencies strive to streamline their operations, choosing the right payment processor becomes a critical decision. This article delves into the nuances of selecting a payment processor tailored for collection agencies in India.

Key Considerations for Collection Agencies

When opting for a payment processor, collection agencies must prioritize security, compliance, and integration capabilities. Ensuring robust security measures is imperative to protect sensitive client data, while seamless integration with existing systems enhances operational efficiency. Additionally, understanding transaction fees and overall costs is crucial for long-term sustainability.

Top Payment Processors in India

Among the myriad options available, Razorpay, PayU, and Instamojo stand out as reliable payment processors in the Indian context. Each offers unique features, catering to the specific needs of collection agencies. Payment Processor for Collection Customization options, detailed reporting and analytics, and a user-friendly interface are essential features that collection agencies should seek in a payment processor. These elements contribute to a smoother workflow and an improved user experience.

Future Trends in Payment Processing

Examining real-world case studies provides valuable insights into successful implementation stories and challenges overcome by collection agencies. Understanding these scenarios aids in making informed decisions when selecting a payment processor[1]. As technology continues to advance, payment processors are expected to incorporate enhanced security measures. Staying abreast of these trends ensures that collection agencies are well-prepared for future challenges.

How to Choose the Right Payment Processor

To make an informed decision, Collection Agent Should[2] assess their business needs, read reviews, and consider testimonials from other users. This step-by-step approach guarantees a well-matched payment processor. Collaboration between collection agency teams and tech experts is crucial for seamless integration. Additionally, meticulous planning for data migration ensures a smooth transition to the new payment processing system.

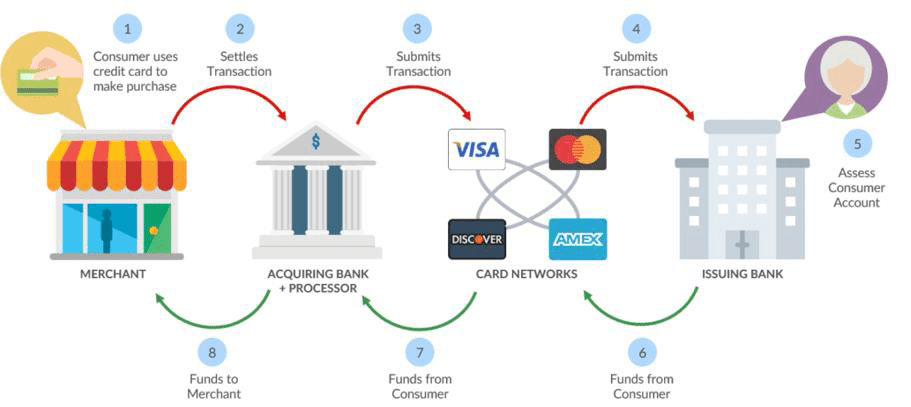

The Role of Payment Processors in Debt Collection

Payment processors play a pivotal role in streamlining payment collection[3] for collection agencies, minimizing the risks associated with financial transactions. Addressing concerns related to data security and ensuring robust customer support are essential aspects of choosing a payment processor.

Comparison of Indian and Global Payment Processors

Choosing between localized solutions and global players involves weighing the pros and cons. Understanding the specific needs of the Indian market is crucial for optimal decision-making, The advent of real-time payment processing brings numerous benefits for collection agencies[4], Payment Processor for Collection Agencies in India although it comes with implementation challenges that must be addressed.

Enhancing Customer Experience

Offering multiple Digital Payment Methods[5] and maintaining a user-friendly interface are key factors in enhancing the overall customer experience.

Industry Regulations and Compliance

Adherence to RBI guidelines and other legal standards is non-negotiable for payment processors serving collection agencies in India. Payment collection As your collection agency grows, so will your transaction volume. It’s essential to choose a payment processor that can scale with your business, ensuring a seamless payment experience for an expanding clientele.

Mobile Compatibility

With the rise of mobile transactions, ensuring that the chosen payment processor is mobile-friendly is paramount. Mobile compatibility not only caters to the preferences of modern consumers but also facilitates convenient payments on the go. A good payment processor should offer resources and support to educate both the collection agency and its clients. Clear documentation, tutorials, and responsive customer service contribute to a positive user experience.

Conclusion

In conclusion, selecting the right payment processor is a strategic decision that significantly impacts the efficiency and success of collection agencies in India. By considering the outlined factors and staying abreast of industry trends, agencies can navigate the evolving landscape with confidence.

FAQs

- Is it mandatory for collection agencies to adhere to RBI guidelines when choosing a payment processor?

- Yes, adherence to RBI guidelines is crucial to ensure legal compliance and data security.

- What role does real-time payment processing play in debt collection?

- Real-time processing enhances efficiency, providing immediate confirmation of payments and minimizing delays.

- How do payment processors contribute to minimizing risks in debt collection?

- Payment processors implement robust security measures, reducing the risk of fraud and ensuring secure transactions.

- Can collection agencies customize their payment processing solutions?

- Yes, customization options are available to tailor solutions to the specific needs of collection agencies.

- What is the significance of a user-friendly interface for payment processors?

- A user-friendly interface improves the overall customer experience, making payment processes seamless and accessible.