AUTHOR: SELENA GIL

DATE: 1/1/2024

Introduction

In the vibrant landscape of e-commerce, collective buying offers have gained immense popularity among consumers. This innovative approach allows individuals to leverage the power of group purchasing to access discounts and deals that might otherwise be unattainable. However, for such collective buying endeavors to thrive in India, a robust payment processor is fundamental.

Challenges in Collective Buying in India

While the concept of collective buying offers is enticing, several hurdles hinder its seamless operation in India. The existing payment infrastructure often grapples with limitations that impede swift and secure transactions. Additionally, prevailing security concerns in online transactions pose a significant challenge for consumers and businesses alike.

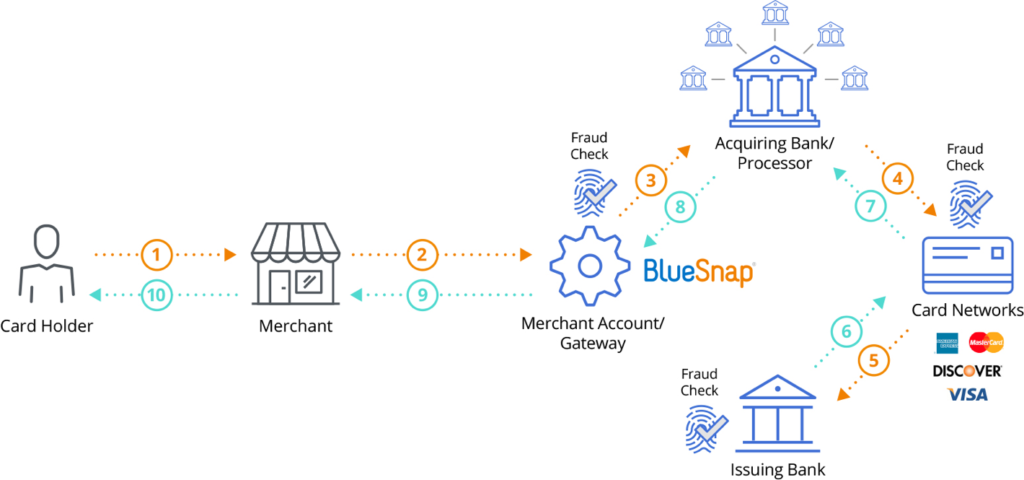

Role of Payment Processors

Payment processors play a pivotal role in alleviating the challenges encountered in collective buying. They streamline payment processes, offering user-friendly interfaces that simplify transactions. Moreover, these processors ensure the security of financial data, fostering trust among consumers engaging in collective buying offers.

Criteria for Choosing a Payment Processor

When selecting a payment processor[1] for collective buying, certain criteria must be considered. The ease of integration with existing platforms, robust security features, and transparent transaction fees are key factors that businesses and consumers evaluate.

Popular Payment Processors for Collective Buying in India

In the Indian market, multiple payment gateway[2] processors stand out for their efficacy in supporting collective buying endeavors. Notable names include Paytm, Razorpay, Instamojo, and Cashfree, each offering distinct features tailored to the needs of businesses and consumers.

Comparison of Payment Processors

Analyzing these underrstand payment processors[3] involves an in-depth exploration of their features, service offerings, and user experiences. User reviews and insights into the efficiency of these platforms shed light on their practical utility in collective buying scenarios.

How Payment Processors Impact Collective Buying Platforms

The integration of efficient payment processing system[4] significantly enhances the user experience on collective buying platforms. Moreover, the credibility and payment processor trust associated with renowned payment processors in India amplifies the confidence of consumers engaging in these offers.

Future Trends in Payment Processing for Collective Buying

Looking ahead, the landscape of payment processing for collective buying is poised for advancement. Emerging technologies and evolving consumer preferences [3] are likely to shape the trajectory of payment processors, making transactions even more seamless and secure.

Challenges in the Payment Processing Landscape

In the Indian market, the landscape of payment transaction processing[5] presents a myriad of challenges, especially concerning collective buying offers. The existing infrastructure often grapples with limitations in scalability and interoperability. Many small and medium-sized enterprises (SMEs) engaged in collective buying find it challenging to seamlessly integrate payment gateways due to technical complexities.

Moreover, security concerns loom large in the minds of both consumers and businesses. Instances of data breaches and fraudulent activities have led to apprehensions, hindering the widespread adoption of collective buying offers. The need for robust cybersecurity measures within payment processors is paramount to instilling confidence among users.

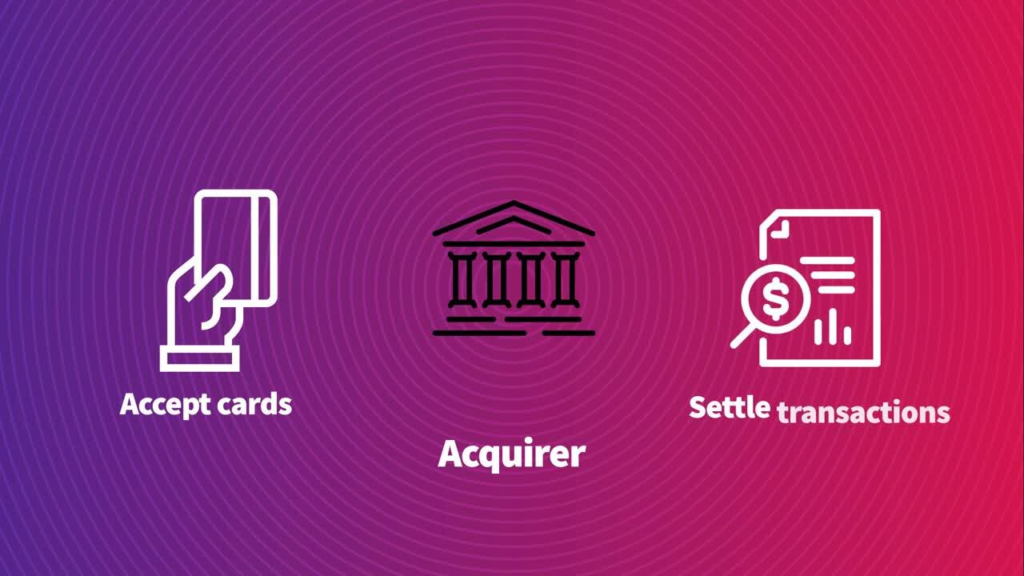

The Crucial Role of Payment Processors in Collective Buying

Amidst these challenges, payment processors emerge as the linchpin that holds together the collective buying ecosystem. Payment Processor for Collective Buying Offers in India

Their role extends beyond just facilitating transactions; they act as guardians of trust and reliability. Streamlining the payment process by offering intuitive interfaces and ensuring the security of financial data are among their primary functions.

The seamless integration of payment gateways into collective buying platforms significantly influences the success of these ventures. A frictionless payment experience enhances user satisfaction, encourages repeat engagements, and fosters a loyal customer base.

Conclusion

In the realm of collective buying offers in India, the role of payment processors cannot be overstated. These processors not only streamline transactions but also instill trust and confidence among consumers and businesses, fostering a thriving ecosystem for collective buying.

FAQs

1. Why are payment processors crucial for collective buying?

Payment processors simplify transactions and ensure the security of financial data, which is crucial for the success of collective buying.

2. How do payment processors impact the user experience?

Efficient payment processors enhance the user experience by offering seamless and secure transaction processes.

3. What criteria should one consider when choosing a payment processor?

Integration ease, security features, and transparent transaction fees are key factors to consider when selecting a payment processor.

4. Are there emerging trends in payment processing for collective buying?

Yes, emerging technologies and changing consumer preferences are shaping the future of payment processing in collective buying.

5. Which payment processors are popular in the Indian market for collective buying?

Paytm, Razorpay, Instamojo, and Cashfree are among the popular payment processors in India for collective buying.