AUTHOR : Sook

DATE : 25/12/2023

Payment Processor for Credit Dispute in India

In today’s digital age, the handling of credit disputes has become an integral part of financial services. India, with its burgeoning economy, requires an efficient payment processing[1] system tailored to address credit dispute resolutions effectively. Let’s delve into the nuances of payment processors For Credit Dispute in India, their significance, challenges, and the evolving landscape of this essential sector.

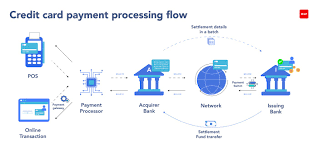

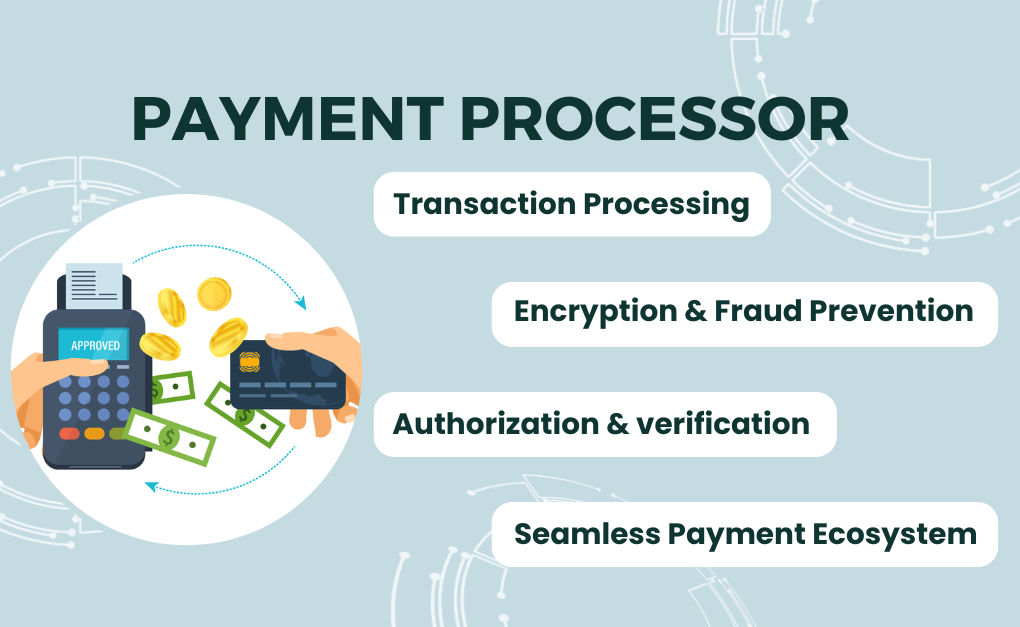

Understanding Payment Processors

Payment processors play a pivotal role in facilitating transactions and resolving processors for credit disputes. These entities serve as intermediaries between merchants, banks, and consumers, ensuring the smooth flow of funds while addressing any discrepancies that may arise during transactions. A Reliability, availability and serviceability[2] boasts features like swift resolution, secure transactions, and comprehensive reporting tools.

Challenges in Credit Dispute Resolution in India

The Indian market presents its unique challenges concerning Payment Processor For credit dispute resolution. Regulatory complexities, diverse consumer rights, and protection mechanisms often pose hurdles in streamlined conflict resolution. As a result, there’s a growing need for specialized payment processors equipped to navigate these intricacies efficiently.

The Need for Specialized Payment Processors in India

To meet the specific requirements of the Indian market, specialized payment processors[3] are crucial. Tailored solutions that address cultural nuances and technological barriers can significantly enhance the efficiency of credit dispute resolution, ensuring a smoother experience for all stakeholders involved.

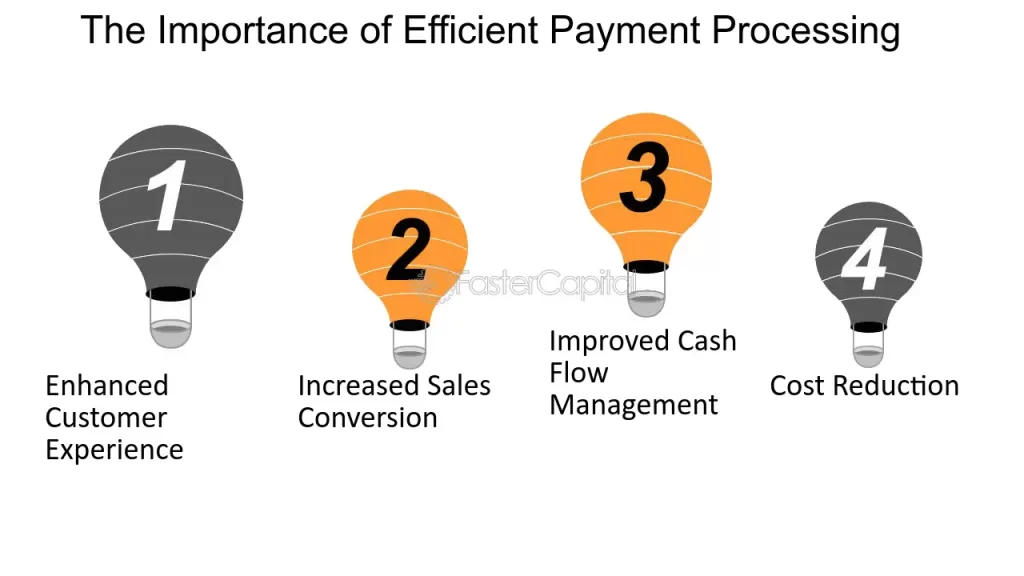

Advantages of Implementing Efficient Payment Processors

Implementing efficient payment processors offers multifaceted advantages. Notably, it streamlines the resolution process, mitigates risks associated with disputes, and enhances consumer trust and confidence in the financial ecosystem. Payment Processor For Credit Dispute In India

Key Players in the Indian Payment Processing Industry

Several key players dominate the Indian E-commerce payment system[4]. Understanding their services, offerings, and comparative analysis helps businesses and consumers make informed choices based on their unique requirements.

Factors to Consider When Choosing a Payment Processor

When selecting a payment processor, several factors demand consideration. Security measures, integration capabilities, scalability, and user-friendliness are crucial aspects that influence the effectiveness of the chosen processor.

The Future of Payment Processors in India

The future of payment processors in India is promising. Innovations driven by technological advancements are expected to revolutionize the industry, offering more efficient, secure, and user-centric solutions for credit dispute resolutions credit dispute resolution[5] .

CONCLUSION

In conclusion, a robust payment processing system tailored for credit dispute resolution is imperative for India’s evolving financial landscape. Embracing specialized processors capable of addressing unique challenges will pave the way for smoother, more secure transactions, fostering trust and confidence among all stakeholders.

FAQs

- What is a credit dispute?

- A credit dispute occurs when a consumer challenges information on their credit report.

- How do payment processors help in credit dispute resolution?

- They act as intermediaries, facilitating secure transactions and addressing discrepancies.

- What are the challenges in the Indian credit dispute resolution process?

- Regulatory complexities and diverse consumer rights pose significant hurdles.

- Why are specialized payment processors crucial in India?

- They cater to the unique market needs and cultural nuances, ensuring efficient resolution.

- What factors should one consider when choosing a payment processor?

- Security measures, integration capabilities, and scalability are vital considerations.