AUTHOR : ROSE KELLY

DATE : 26/12/23

Introduction

In the dynamic landscape of financial transactions, the need for a robust payment processor is more pronounced than ever, especially in the context of credit inquiries in India. This article delves into the intricacies of credit inquiry processing, the challenges involved, and the pivotal role payment processors play in ensuring a seamless and secure experience.

Understanding Credit Inquiries

Credit inquiries are requests made by various entities, such as lenders or financial institutions, to obtain an individual’s credit information. These inquiries can be classified into two types: “soft” inquiries, which don’t impact credit scores, and “hard” inquiries, which can affect credit scores. Understanding these distinctions is crucial for individuals managing their credit profiles.

Challenges in Credit Inquiry Processing

Processing credit inquiries[1] poses significant challenges due to the sensitive nature of financial information. The complexities involved in handling vast amounts of data necessitate reliable systems and technologies. Additionally, the need for secure payment processing is paramount to protect both consumers and businesses involved in credit inquiries. Payment Processor For Soft Inquiry Credit Score[2]

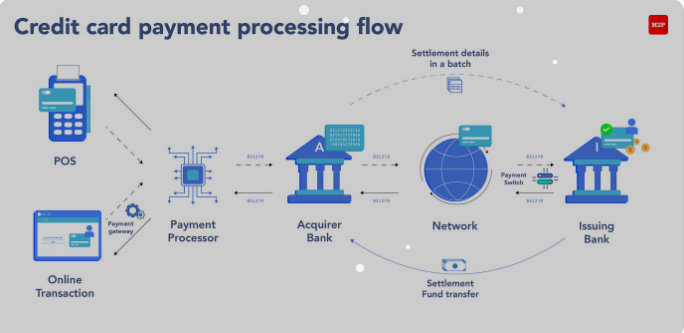

Role of Payment Processors in Credit Inquiry

Payment processors play a pivotal role in the credit inquiry process. Their primary function is to facilitate secure and efficient transactions between the entities seeking credit information and those providing it. By ensuring the confidentiality and integrity of financial transactions, payment processors contribute to a trustworthy Credit Ecosystem[3].

Key Features of an Ideal Payment Processor

An ideal Credit Card Processing[4] inquiries should incorporate robust security measures, providing a shield against potential breaches. A user-friendly interface enhances the overall experience, while integration capabilities with credit inquiry systems streamline the process, saving time and resources.

Top Payment Processors in India

Several payment processors in India have established themselves as leaders in the financial technology space. Understanding their specific features and how they cater to the unique needs of credit inquiries is essential for businesses seeking reliable solutions. The financial sector is highly regulated, and adherence to these regulations is imperative for entities involved in credit inquiries. online payment processing[5] as intermediaries, must comply with stringent guidelines to ensure the legality and legitimacy of transactions.

Benefits of Using Payment Processors in Credit Inquiry

The adoption of payment processors in credit inquiry processes brings forth a myriad of benefits. Faster processing times, enhanced security measures, and an overall improved user experience contribute to the efficiency and effectiveness of credit inquiries. Choosing the right payment processor requires careful consideration of various factors. From security features to integration capabilities, businesses must weigh their options and select a processor that aligns with their specific needs and objectives.

Case Studies: Successful Implementation of Payment Processors

Real-world examples showcase the tangible benefits of implementing reliable payment processors in credit inquiry processes. Businesses that have embraced these technologies have witnessed increased efficiency, reduced errors, and heightened customer satisfaction.

Future Trends in Credit Inquiry Processing

As technology continues to evolve, so does the landscape of credit inquiry processing. Advancements in payment technology, coupled with artificial intelligence and machine learning, are set to shape the future of how credit inquiries are conducted and processed.

Challenges and Solutions in Implementing Payment Processors

While the advantages of payment processors are evident, businesses may encounter challenges during implementation. Identifying common issues and implementing effective solutions is crucial to maximizing the benefits of these technologies. Users who have experienced the benefits of reliable payment processors in credit inquiries share their positive experiences. These testimonials provide insights into how these technologies have positively impacted businesses and individuals alike.

Conclusion

In conclusion, the role of payment processors in credit inquiries cannot be overstated. Their ability to ensure secure transactions, streamline processes, and contribute to overall efficiency makes them indispensable in the modern financial landscape. Businesses looking to enhance their credit inquiry processes should carefully evaluate and integrate a reliable payment processor.

FAQs

- Q: Are payment processors only relevant for large businesses?

- A: No, payment processors cater to businesses of all sizes, providing scalable solutions.

- Q: How do payment processors enhance security in credit inquiries?

- A: Payment processors use advanced encryption and authentication measures to safeguard financial transactions.

- Q: Can payment processors integrate with existing credit inquiry systems?

- A: Yes, many payment processors offer seamless integration capabilities.

- Q: What are the regulatory requirements for payment processors in India?

- A: Payment processors must comply with the guidelines set by regulatory authorities to operate legally.

- Q: How can businesses stay ahead of evolving trends in credit inquiry processing?

- A: Regularly updating technology and staying informed about industry trends is key.