AUTHOR : ROSE KELLY

DATE : 25/12/23

Introduction

Significance of Credit Management in India

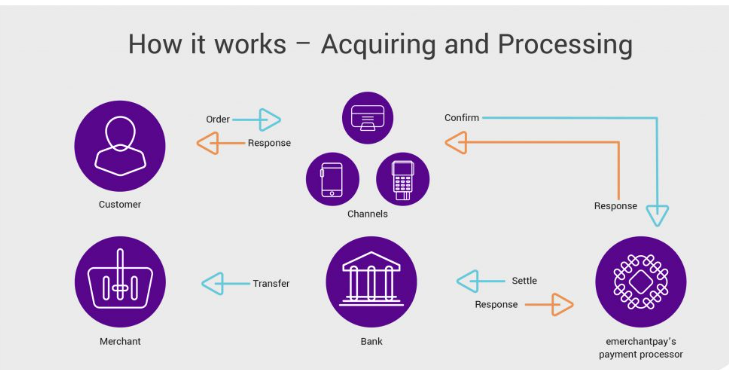

Payment processors act as intermediaries between merchants and financial institutions, facilitating secure and seamless transactions. In the context of credit management, these processors play a pivotal role in ensuring the smooth flow of funds and the timely processing of payments.

Credit management is the strategic handling of a company’s financial obligations to optimize cash flow. In the Indian context, where diverse businesses coexist, effective credit management becomes imperative for sustained growth and financial stability.

The Need for Efficient Payment Processing in Credit Management

Challenges in Traditional Payment Methods

Traditional payment methods often pose challenges such as delays, manual errors, and limited scalability. In the realm of credit management, these challenges can lead to disruptions in cash flow and hinder the growth of businesses payment processor for Credit management in india

Payment processors address the limitations of traditional methods by automating transactions, reducing the risk of errors, and providing real-time monitoring. This significantly contributes to the efficiency of credit management processes.

Key Features of an Ideal Payment Processor

Integration Capabilities

Ecommerce Payment Processing[1] the security of financial transactions, implementing robust encryption and fraud detection measures to safeguard sensitive information.

Seamless integration with existing financial systems and software is crucial for a payment processor. This ensures a smooth transition and minimal disruption to daily operations.

User-Friendly Interface

Top Payment Processors in India

User experience is paramount. A Payment Processing Systems[2]with an intuitive interface simplifies the payment process for both businesses and consumers, enhancing overall satisfaction.

Company A is a leading payment processor[3] known for its widespread presence and reliability. The processor offers advanced analytics tools, enabling businesses to gain valuable insights into their transactions.

Noteworthy Attributes

Company B specializes in catering to the unique needs of small and medium-sized enterprises (SMEs). Their processor boasts quick setup times and low transaction fees, making it an attractive option for emerging businesses

Company C is renowned for its innovative approach to payment Integrated[4] , incorporating blockchain technology.

Benefits of Using Advanced Payment Processors for Credit Management

The use of blockchain ensures enhanced security and transparency in transactions, setting Company C apart in the market.

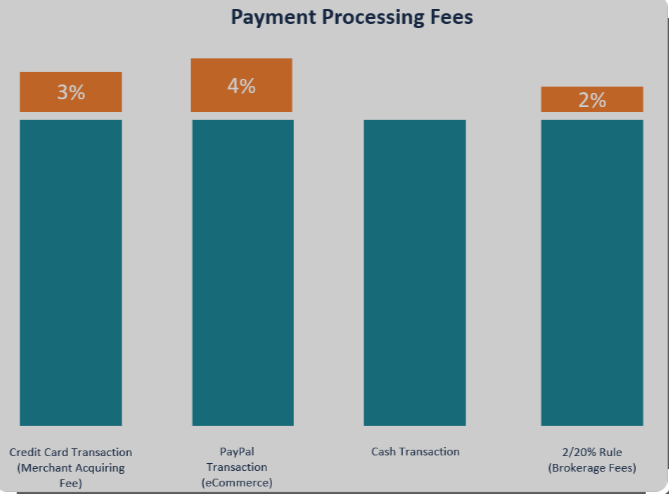

Advanced Credit card payment processing[5] expedite transaction processes, reducing delays and ensuring timely payments. This, in turn, contributes to the efficient management of credit.

Enhanced Security Measures

Real-Time Monitoring and Reporting

The implementation of cutting-edge security measures by advanced processors minimizes the risk of fraud and unauthorized access, instilling confidence in both businesses and consumers.

Businesses can benefit from real-time monitoring and reporting features, allowing them to make informed decisions and adapt their credit management strategies on the fly.

Challenges in Implementing Payment Processors for Credit Management

Resistance to Change

While the long-term benefits are significant, businesses may encounter initial setup costs when integrating advanced payment processors. However, the return on investment often justifies these expenses.

Adopting new payment processing methods may face resistance from employees accustomed to traditional systems. Effective training and change management strategies are crucial to overcoming this challenge.

Technical Complexities

Successful Implementation Stories

The integration of advanced payment processors may pose technical challenges. Businesses need to ensure they have the necessary infrastructure and expertise to navigate these complexities.

Several businesses in India have experienced notable improvements in credit management after adopting advanced payment processors. These success stories serve as inspiration for others considering a similar transition.

Future Trends in Payment Processing for Credit Management

Emerging Technologies

Examining cases where implementation did not meet expectations provides valuable insights into potential pitfalls and helps businesses make more informed decisions.

The future of payment processing in credit management may witness the integration of emerging technologies such as artificial intelligence and machine learning, further optimizing processes and reducing risks.

Anticipated Developments

Expert Insights on Choosing the Right Payment Processor

Continuous advancements in payment processing technologies are expected, offering businesses even more sophisticated tools for credit management.

Leading experts in the field share their perspectives on the crucial factors businesses should consider when selecting a payment processor for credit management.

Factors to Consider

Key considerations include the specific needs of the business, scalability, and the ability of the processor to adapt to evolving industry standards.

Conclusion

In conclusion, the efficient management of credit in India is intrinsically linked to the adoption of advanced payment processors. From overcoming traditional challenges to providing real-time insights, these processors play a pivotal role in shaping the financial landscape for businesses.

Selecting the right payment processor is a strategic decision that can significantly impact a company’s credit management efficiency. an informed choice that aligns with their unique needs and goals, ensuring seamless and secure transactions for sustained financial growth

FAQs

How does a payment processor improve credit management?

A payment processor streamlines transactions, reduces delays, and enhances security, contributing to the efficient management of credit. Real-time monitoring features also aid businesses in making informed decisions.

Are there any risks associated with using payment processors?

While the benefits are substantial, businesses may face initial setup costs and potential resistance to change. Technical complexities during integration are also challenges that need to be addressed.

What makes a payment processor secure?

Security measures such as robust encryption and fraud detection contribute to the security of payment processors. Additionally, the use of emerging technologies enhances the overall security of transactions.

Can small businesses benefit from advanced payment processors?

Absolutely. Many payment processors, especially those tailored for SMEs, offer quick setup times, low transaction fees, and user-friendly interfaces. These features make them highly beneficial for small businesses.

How do payment processors contribute to financial inclusion?

By providing efficient and secure payment solutions, processors contribute to financial inclusion by enabling businesses of all sizes to participate in the digital economy. This fosters economic growth and accessibility.