Name: Buddy Kim

Date: 26/12/23

In the dynamic landscape of India’s financial sector, the effective management of credit risk is a critical component for sustainable economic growth. As businesses and consumers engage in an array of financial transactions, the need for specialized payment processors tailored to address credit risk becomes increasingly evident.

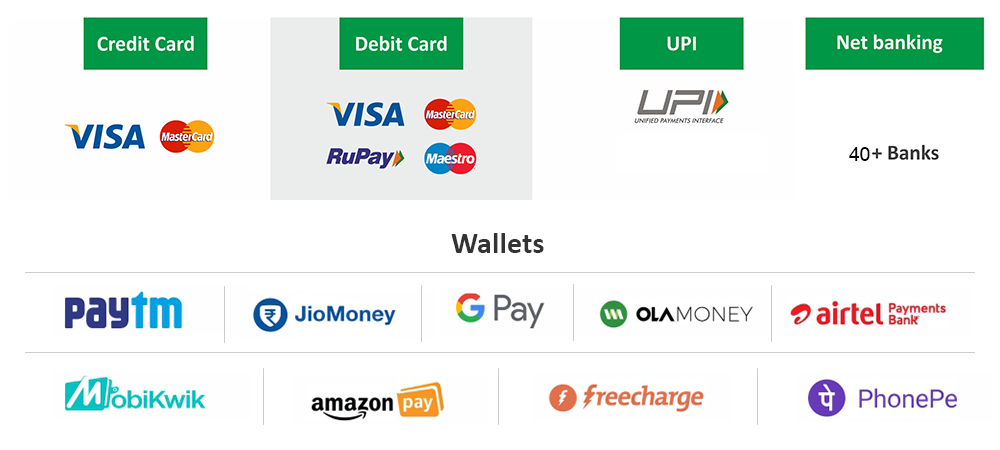

The Diverse Landscape of Payment Processors in India

India boasts a diverse array of payment processors, each playing a unique role in facilitating transactions. From traditional banking institutions to innovative digital wallets, these entities form the backbone of the country’s financial ecosystem. Understanding their functions is crucial for comprehending the intricacies of credit risk management.

Understanding Credit Risk in India

Credit risk[1], influenced by economic conditions, individual financial behavior, and market dynamics, poses a significant challenge in the Indian context. Efficient credit risk management is imperative to maintain financial stability and foster an environment conducive to economic development.

The Limitations of Conventional Payment Processors

Payment[2] Processing Solutions, while integral to the financial infrastructure, often face challenges in effectively addressing the specific credit risk[3] landscape[3] in India. This has given rise to the need for specialized payment processors that can provide targeted solutions to mitigate credit risk effectively.

Key Features of an Ideal Payment Processor for Credit Risk

An ideal High-Risk Credit Card in India should encompass several key features. Robust security measures, seamless integration with credit scoring systems, and adaptability to the unique challenges of the Indian market are paramount. These features collectively contribute to a comprehensive and effective credit risk management strategy[4].

Case Studies: Success Stories in Credit Risk Mitigation

Examining successful implementations of specialized Payment service providers[5] in India provides valuable insights into their impact on credit risk. Real-world case studies demonstrate how these processors have navigated the complex financial landscape, offering tailored solutions to businesses and financial institutions.

Future Trends and Innovations in Payment Processing

The future of payment processors in India holds promise with the continual evolution of technology. Emerging trends, such as the integration of artificial intelligence and blockchain, are set to revolutionize credit risk management, offering innovative and efficient solutions for businesses.

Navigating the Regulatory Landscape

For any payment processor operating in India, navigating the regulatory landscape is paramount. Understanding and adhering to government regulations related to credit risk management ensures not only compliance but also fosters a secure and legally sound financial environment.

Balancing Act: Advantages and Disadvantages

While specialized payment processors offer unique advantages in credit risk management, it’s crucial to consider potential drawbacks. A balanced assessment of the pros and cons empowers businesses to make informed decisions when selecting a payment processing solution.

User Experiences: Real Voices, Real Impact

Testimonials from businesses utilizing specialized payment processors provide firsthand insights into their efficacy. Understanding the challenges faced and the practical solutions provided enhances the overall understanding of the impact of these processors.

Global Insights: Learning from International Practices

Contrasting payment processing for credit risk in India with global practices offers valuable lessons. Learning from international experiences allows for the adaptation of best practices to suit the Indian context, promoting continuous improvement and innovation.

Guiding Businesses: Tips for Selection and Integration

Guidance on selecting the right payment processor for credit risk and best practices for integration is instrumental for businesses navigating the financial landscape. Practical tips ensure optimal performance and risk mitigation, supporting businesses in making informed choices.

Expert Perspectives: Looking Towards the Future

Gaining insights from industry experts offers a forward-looking perspective. Expert opinions and predictions provide businesses with valuable information to shape their strategies and stay ahead in the ever-evolving financial sector.

Conclusion

In conclusion, the integration of specialized payment processors for credit risk in India is not merely a strategic move; it’s a necessity for businesses aiming for financial resilience. As the financial landscape continues to evolve, embracing tailored solutions becomes imperative for sustainable growth.

FAQs

- How do specialized payment processors differ from traditional ones in managing credit risk?

- Specialized processors are designed to address the unique credit risk landscape, providing targeted solutions beyond the capabilities of generic systems.

- What security measures should businesses prioritize in a payment processor for credit risk in India?

- Robust encryption, multi-factor authentication, and real-time monitoring are key security measures to ensure the safe processing of financial transactions.

- Are there specific government regulations for payment processors handling credit risk in India?

- Yes, understanding and complying with government regulations related to credit risk management are essential for payment processors operating in India.

- How can businesses optimize the integration of a specialized payment processor into their existing systems?

- Optimizing integration involves careful planning, employee training, and regular assessments to ensure a seamless transition and maximum efficiency.

- What role do emerging technologies play in the future of payment processors for credit risk in India?

- Emerging technologies such as artificial intelligence and blockchain are expected to revolutionize credit risk management, offering innovative solutions for businesses in India.