AUTHOR : ROSE KELLY

DATE : 27/12/23

Introduction

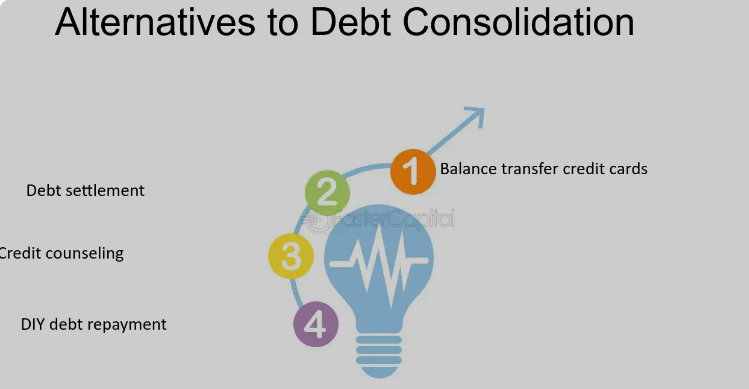

Debt consolidation[1] has become a popular strategy for individuals in India seeking to manage their financial obligations more effectively. Centra to this process is the role of a reliable payment processor, which serves as the linchpin for seamless transactions and debt management. In this article, we delve into the nuances of selecting the right payment processor for debt consolidation alternatives in India.

Challenges in Debt Consolidation

Debt consolidation, while advantageous, comes with its own set of challenges. These challenges underscore the need for a robust payment processor that can handle the details of merging multiple debts into one manageable payment. Without efficient payment processing, the entire debt combination process can be marred by problems.

The Role of Payment Processors

Payment processors play a pivotal role in the debt-combination landscape. Their role extends beyond mere transaction facilitation, encompassing the orchestration of a streamlined and secure process that ensures creditors are paid promptly and debtors experience a more manageable repayment structure.

Key Features to Look For

When considering payment processors for debt combination, certain features stand out as crucial. Security and encryption are paramount; verify the confidentiality of sensitive financial information[2]. A user-friendly interface and seamless integration capabilities also contribute to the efficiency of the debt consolidation process.

Top Payment Processors in India for Debt Consolidation

In the vast landscape of payment processors in India, a few stand out for their compatibility with debt consolidation services. Let’s compare the top options, weighing their pros and cons, to help individuals make an informed decision.

- Processor A:

- Pros: High security standards, comprehensive integration

- Cons: Slightly higher transaction fees

- Processor B:

- Pros: Competitive pricing, user-friendly interface

- Cons: Limited integration with certain debt consolidation platforms

Case Studies

To illustrate the effectiveness of payment processors[3] in debt consolidation, let’s explore real-life case studies. These examples highlight successful debt consolidation journeys facilitated by reliable payment processors, showcasing positive outcomes and satisfied clients.

Regulatory Considerations

Navigating the regulatory landscape is crucial for any financial service in India. We examine how payment processors adhere to local regulations and verify that users can trust the legitimacy and compliance of the chosen platform.

Future Trends in Payment Processing for Debt Consolidation

Evolution in technology transforms payment processing, reshaping transaction methods, processing, and security in the financial ecosystem.

. Explore the emerging trends that are expected to shape the future of debt consolidation, making the process even more efficient and user-friendly.

User Experience and Interface

Debt consolidation success relies on efficient payment processors and user-friendly interfaces for positive customer experiences and financial stability.[4]

Security Measures in Payment Processing

Considering the sensitive nature of financial transactions in debt consolidation, security measures are paramount. Delve into the various security protocols employed by payment processors to safeguard users’ financial information.

Cost Analysis

While debt consolidation offers financial relief,[5] it’s essential to analyze the costs associated with payment processors. Understanding the breakdown of fees and charges helps users choose the most cost-effective option for their specific needs.

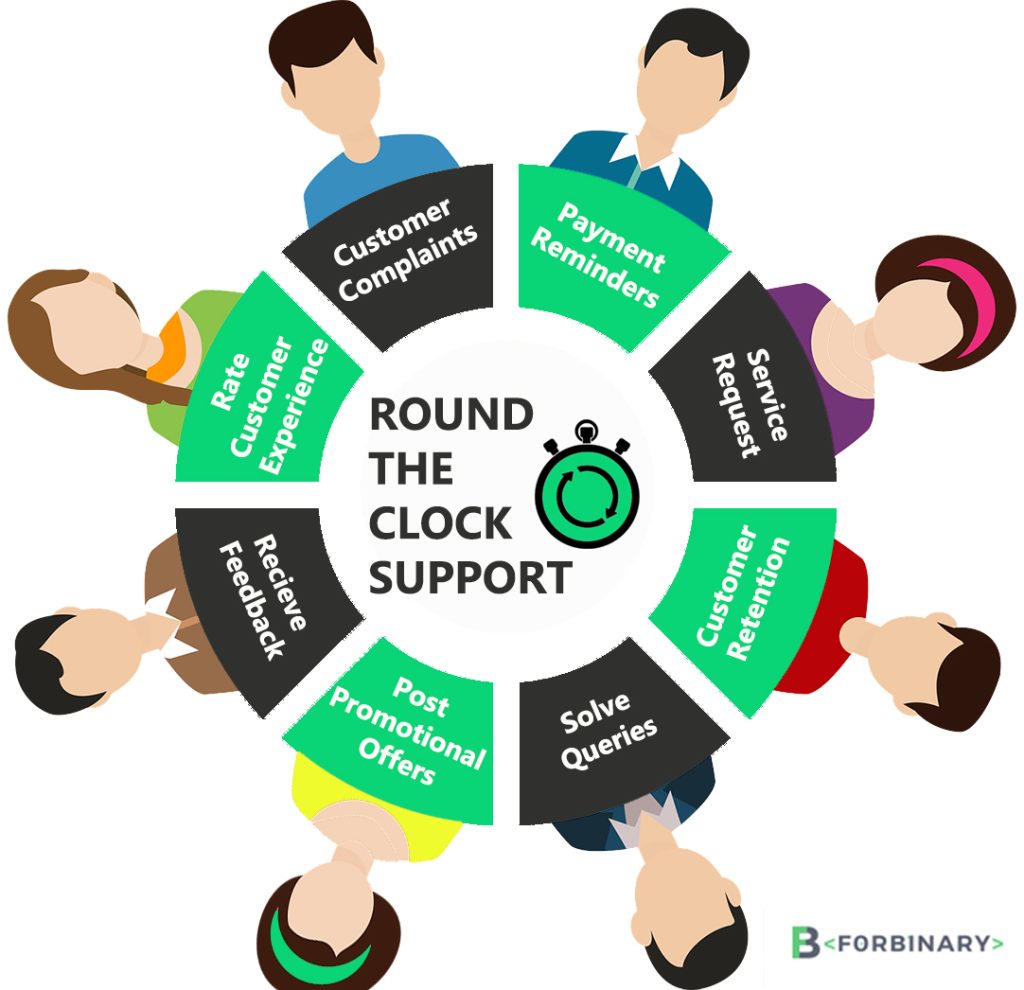

Customer Support

Responsive customer support is a valuable asset in the realm of debt consolidation. Explore how efficient customer support contributes to a smoother process by addressing concerns and inquiries promptly.

Tips for Effective Debt Consolidation

In addition to selecting the right payment processor, there are general tips that individuals can follow for effective debt consolidation. These tips, when combined with the capabilities of a reliable payment processor, enhance the chances of a successful debt management strategy.

Conclusion

In conclusion, the choice of a payment processor is pivotal to the success of debt consolidation efforts in India. By carefully considering the outlined factors and conducting thorough research, individuals can embark on a journey toward financial freedom with confidence.

Frequently Asked Questions (FAQs)

- What is debt consolidation?

- Debt consolidation is a strategic financial maneuver that encompasses the amalgamation of multiple debts into a single, more manageable payment, streamlining the entire transactional process for enhanced fiscal control.

- How does a payment processor facilitate debt consolidation?

- A payment processor handles the transactions involved in debt consolidation, ensuring seamless and secure payments to creditors.

- Are there any risks involved in using payment processors for debt consolidation?

- Prioritize platforms with strong security measures as payment processors boost efficiency, safeguarding users against potential risks.

- Can individuals with bad credit benefit from debt consolidation services?

- Yes, debt consolidation can be beneficial for individuals with bad credit, providing a structured approach to managing and repaying debts.

- How do I choose the right payment processor for debt consolidation?

- Consider factors such as security, user interface, integration capabilities, and cost when selecting a payment processor for debt consolidation.