AUTHOR : JAYOKI

DATE : 26/12/2023

In a world where financial challenges are a common occurrence, debt consolidation has emerged as a crucial solution for individuals seeking financial stability. Managing multiple debts can be overwhelming, and in India, where financial intricacies are unique, the need for a reliable payment processor[1] becomes paramount.

Introduction

Brief Overview of Debt Consolidation

Merging various debts into one easily manageable payment characterizes the process of debt consolidation It simplifies financial management and offers a structured approach to debt repayment.

Importance of a Reliable Payment Processor

Choosing the right payment processor is integral to the success of debt consolidation[2]. It ensures secure and streamlined transactions, making the debt repayment journey smoother for individuals.

Understanding Debt Consolidation in India

Definition and Purpose

Debt consolidation, in the Indian context, is a strategic financial move aimed at simplifying the repayment process and reducing the burden on individuals.

Common Challenges Faced by Individuals

High-interest rates, complex financial structures, and diverse loans contribute to the challenges faced by individuals in managing multiple debts.

The Role of Technology in Debt Consolidation

Advancements in technology play a pivotal role in transforming the debt consolidation landscape in India. Digital solutions offer efficiency and convenience.

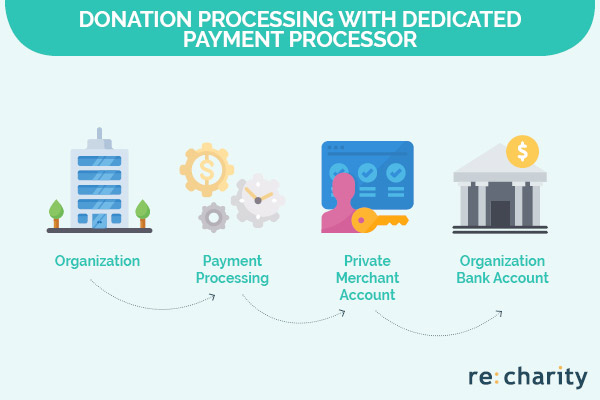

The Need for a Dedicated Payment Processor

Challenges with Traditional Payment Methods

Traditional payment methods may lack the flexibility and security needed for complex debt repayment structures.

Security Concerns in Financial Transactions

Financial transactions[3] require robust security measures. A dedicated payment processor addresses these concerns, ensuring the safety of sensitive information.

Streamlining the Debt Repayment Process

A reliable payment processor streamlines the debt repayment process, making it user-friendly and efficient for individuals seeking financial relief[4].

Features of an Ideal Payment Processor

User-Friendly Interface

An ideal payment processor should offer a simple and intuitive interface, ensuring ease of use for individuals with varying levels of technological proficiency.

Integration Capabilities with Financial Institutions

The ability to integrate with various financial institutions enhances the payment processor’s effectiveness, providing users with diverse options.

Security Protocols and Encryption

Security is paramount in financial transactions. The payment processor should employ advanced encryption and security protocols to safeguard users’ financial data.

Top Payment Processors for Debt Consolidation Assistance

Processor A: Features and Benefits

Highlighting the unique features and benefits of Processor A in facilitating debt consolidation for users.

Processor B: Advantages for Users

Exploring the advantages that Processor B offers to individuals seeking assistance in debt consolidation.

Processor C: Tailored Solutions for Debt Consolidation

Examining how Processor C provides customized solutions to address the specific needs of users in debt.

How Payment Processors Simplify Debt Repayment

Automated Payment Scheduling

The role of automated payment scheduling in reducing the burden on individuals and ensuring timely debt repayment.

Real-Time Transaction Tracking

The importance of real-time transaction tracking for users to stay informed about their financial activities throughout the debt consolidation process.

Customized Repayment Plans

Payment processors offer flexibility with customized repayment plans, accommodating individual financial situations.

Overcoming Challenges with Burstiness in Debt Repayment

Addressing Sudden Financial Fluctuations

How payment processors address burstiness by providing options to manage sudden financial fluctuations.

Flexible Payment Options

Exploring the flexibility offered by payment processors in adapting to users’ changing financial circumstances.

Customer Support and Assistance

The role of responsive customer support in helping users navigate challenges and uncertainties during the debt repayment journey.

The Impact of a Reliable Payment Processor on Debt Consolidation Success

Improved Financial Management

How a reliable payment processor contributes to improved financial management[5] for individuals consolidating their debts.

Enhanced User Experience

The positive impact on the overall user experience, making debt consolidation a more manageable and less stressful process.

Building Trust Among Users

The trust built between users and payment processors, fostering long-term relationships and successful debt consolidation.

Choosing the Right Payment Processor for Your Needs

Assessing Individual Requirements

Guidance on assessing individual requirements to match them with the features offered by various payment processors.

Reading Reviews and Testimonials

The importance of reading reviews and testimonials to make informed decisions when selecting a payment processor.

Seeking Professional Advice

Highlighting the role of financial professionals in providing personalized advice for individuals exploring debt consolidation options.

Case Studies: Success Stories with Payment Processors

Real-Life Examples of Individuals Benefiting from Debt Consolidation

Showcasing real-life success stories of individuals who have successfully navigated debt consolidation with the help of payment processors.

Positive Outcomes with the Use of Dedicated Payment Processors

Highlighting specific instances where individuals experienced positive outcomes by choosing dedicated payment processors for debt consolidation.

Future Trends in Payment Processors for Debt Consolidation

Evolving Technology and Its Impact

Predicting how evolving technology will shape the future of payment processors and debt consolidation assistance in India.

Predictions for the Future of Debt Consolidation Assistance in India

Anticipating future trends and developments in the field of debt consolidation assistance.

Conclusion

In conclusion, navigating the complex landscape of debt consolidation in India requires not only a strategic approach but also the assistance of a reliable payment processor. As we’ve explored the intricacies of this financial journey, it’s evident that the right payment processor can significantly impact the success of debt consolidation efforts.

FAQs

1. How Does Debt Consolidation Work in India?

Answering the fundamental question of how the debt consolidation process operates in the unique financial landscape of India.

2. Are Payment Processors Secure for Financial Transactions?

Addressing concerns about the security of using payment processors for financial transactions and debt consolidation.

3. Can I Use Multiple Payment Processors for Debt Consolidation?

Providing insights into the feasibility and benefits of using multiple payment processors in the debt consolidation process.

4. What Role Does Automation Play in Debt Repayment?

Explaining the significance of automation in simplifying the debt repayment process for individuals.

5. How Do I Choose the Best Payment Processor for My Situation?

Offering practical advice on selecting the most suitable payment processor based on individual financial situations.