AUTHOR : HAANA TINE

DATE:26/12/2023

Introduction

In the bustling financial landscape of India, managing debts can often become overwhelming. This is where the concept of debt consolidation steps in, providing individuals with a structured approach to handling their financial obligations. In this article, we delve into the crucial role of payment processors in enhancing the benefits of debt consolidation.

Understanding Debt Consolidation in India

Consolidating debts[1] is a financial tactic that encompasses the amalgamation of various financial obligations into a single. This process is particularly relevant in the Indian context, where diverse financial obligations can accrue from various sources, including loans, credit cards, and other forms of credit.

Role of Payment Processors in Debt Consolidation

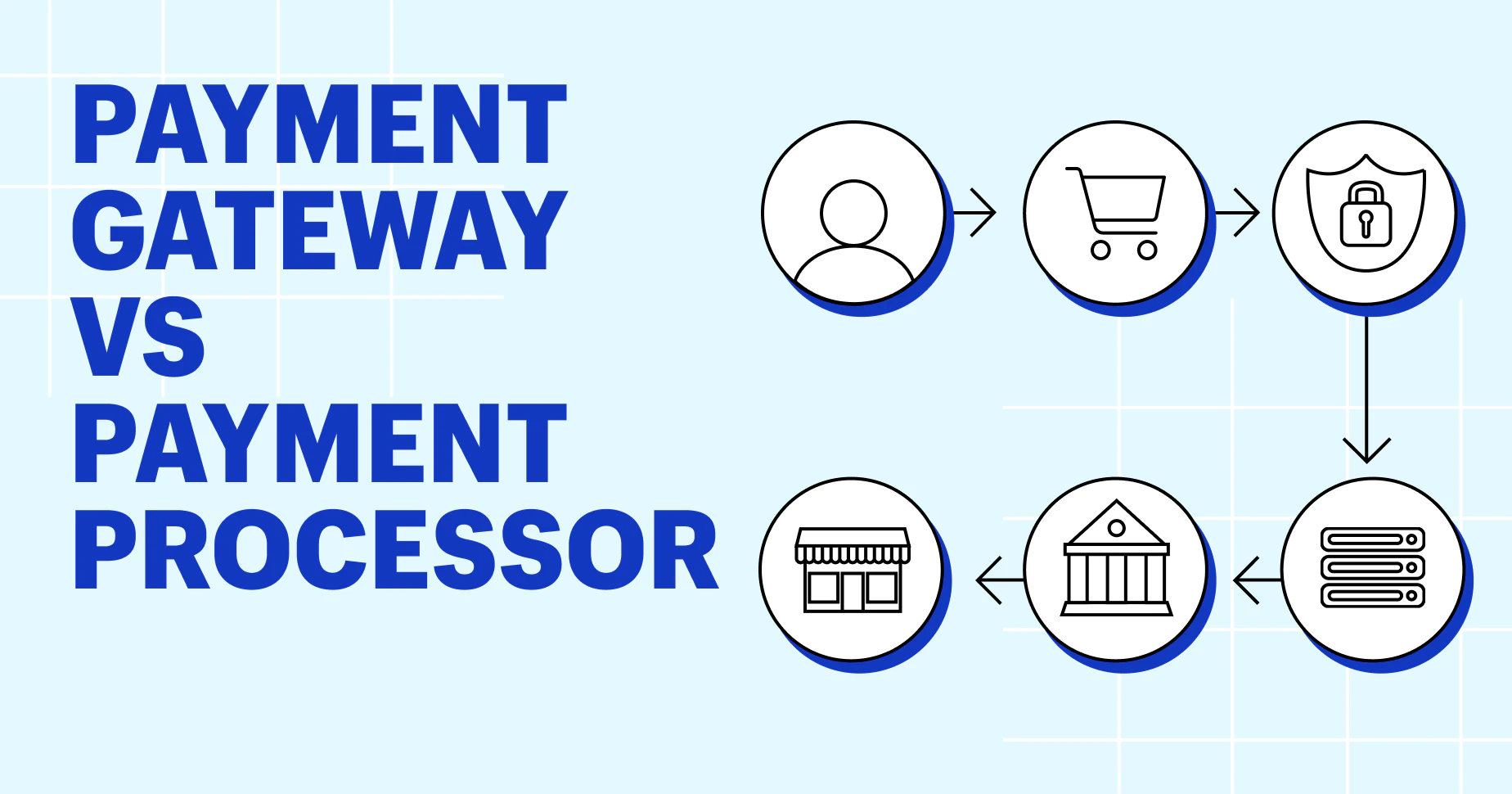

Payment processors[2] play a pivotal role in the debt consolidation landscape by streamlining payment processes. In a scenario where individuals deal with multiple creditors, having a reliable payment processor ensures that transactions are seamless, secure, and occur without delays.

Key Features of an Ideal Payment Processor

Choosing the right payment processor is critical for a successful debt consolidation journey. An ideal processor should offer integration capabilities, allowing users to link their various accounts. Payment Processor for Debt Consolidation Benefits in India Customization options and robust security measures are equally important, ensuring that personal financial information remains confidential.

Popular Payment Processors for Debt Consolidation in India

Several payment processors cater specifically to the Indian market. Examining the features of each, such as the user interface, transaction speed, and customer support, allows individuals to make informed decisions based on their unique needs and preferences.

Choosing the Right Payment Processor for Your Debt Consolidation

Selecting the appropriate payment processor involves considering factors such as transaction fees, user experience, and the processor’s ability to adapt to individual financial situations. Real-life case studies can provide valuable insights into successful debt consolidation stories.

Challenges in Debt Consolidation and How Payment Processors Address Them

Common challenges in debt consolidation, such as missed payments and confusion regarding due dates, can be effectively addressed by payment processors. Payment Processor for Debt Consolidation Benefits in India Automation features ensure that payments are made on time, preventing additional fees and penalties.

Future Trends in Payment Processing for Debt Consolidation

As technology continues to evolve, payment processing for debt consolidation is expected to witness significant advancements. Anticipated changes include enhanced security measures, faster transaction speeds, and increased integration with financial planning[3] tools.

User Testimonials

Real-life experiences of individuals who have successfully navigated the debt consolidation process with the assistance of payment processors highlight the tangible benefits of this approach. These testimonials serve as a testament to the positive impact that the right payment processor can have on one’s financial journey[4].

Tips for Efficient Debt Repayment Through Payment Processor

Efficient debt repayment involves strategic budgeting and the use of automated payment features provided by processors .Payment Processor for Debt Consolidation Benefits in India By using these tools, individuals can simplify their financial management[5] and also accelerate their journey toward debt freedom.

The Regulatory Landscape for Payment Processors in India

Understanding the regulatory environment is crucial when selecting a payment processor. Compliance with local laws and regulations ensures consumer protection and adds an extra layer of security to the debt consolidation process.

Case Study: Successful Debt Consolidation Journey with a Payment Processor

To illustrate the effectiveness of payment processors, a detailed case study explores the successful debt consolidation journey of an individual. This analysis provides actionable insights and demonstrates the positive outcomes achievable through strategic financial planning and the right payment processor.

Conclusion

In conclusion, a reliable payment processor is a valuable ally in the journey towards debt consolidation. By simplifying payment processes, ensuring security, and offering user-friendly interfaces, these processors contribute significantly to the financial well-being of individuals in India.

FAQs

- Q: Can I use any payment processor for debt consolidation?

- While many processors cater to debt consolidation, it’s essential to choose one that aligns with your specific needs and financial situation.

- Q: How do payment processors ensure the security of my financial information?

- Reputable payment processors employ encryption technologies and other security measures to safeguard users’ financial data.

- Q: Will using a payment processor affect my credit score?

- A: Using a payment processor responsibly can positively impact your credit score by ensuring timely payments.

- Q: What happens if I miss a payment through a processor?

- A: Most processors offer automated reminders, but if a payment is missed, it’s crucial to address it promptly to avoid additional fees.

- Q: Are there fees associated with using payment processors for debt consolidation?

- Transaction fees may apply, and it’s essential to review the terms of the processor to understand any associated costs.