AUTHOR : ROSE KELLY

DATE : 26/12/23

Introduction

In the bustling landscape of personal finance, many individuals find themselves juggling multiple debts, leading to financial stress and confusion. This article delves into the realm of debt consolidation in India, specifically focusing on the pivotal role that payment processors[1] play in streamlining the debt repayment process.

Understanding Debt Consolidation

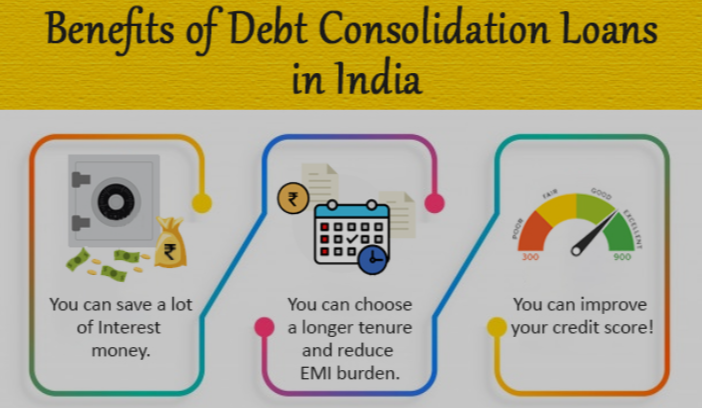

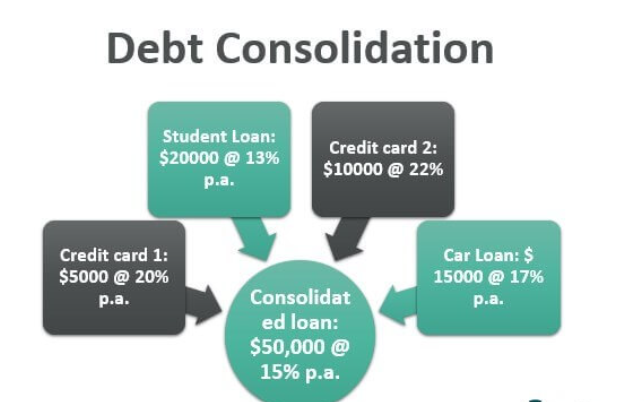

Debt consolidation, a financial strategy[2] gaining traction, involves merging multiple debts into a single payment. This not only simplifies financial management but also often leads to reduced interest rates. For many individuals facing the complexities of multiple debts, debt consolidation serves as a beacon of financial clarity.

Why India Needs Debt Consolidation Solutions

India’s economic landscape has witnessed dynamic shifts, contributing to the rise in debt-related challenges. With the increasing need for effective debt management solutions[3], debt consolidation has emerged as a viable option for those looking to regain control over their finances.

The Importance of Payment Processors

At the heart of successful debt consolidation lies the efficiency of payment processors. These platforms facilitate seamless transactions, automate debt payments, and contribute to a more organized approach to financial planning.

Choosing the Right Payment Processor

Selecting an appropriate payment processor is crucial for effective debt consolidation. Considerations such as security, ease of use, and compatibility with individual financial goals[4] play a pivotal role in making an informed decision.

How Payment Processors Facilitate Debt Repayment

Payment processors offer real-time tracking and reporting, empowering individuals to monitor their debt repayment progress. Robust security measures ensure the safe handling of sensitive financial information, fostering trust among users.

Benefits of Using Payment Processors for Debt Consolidation

The advantages of incorporating payment processors into debt consolidation strategies are multifaceted. From improved financial transparency to reduced stress, these platforms provide a holistic solution for individuals navigating the complexities of debt.

Case Studies

Real-world success stories highlight the transformative impact of using payment processors for debt consolidation. These cases serve as testimonials, showcasing the tangible benefits experienced by individuals who embraced this financial strategy[5].

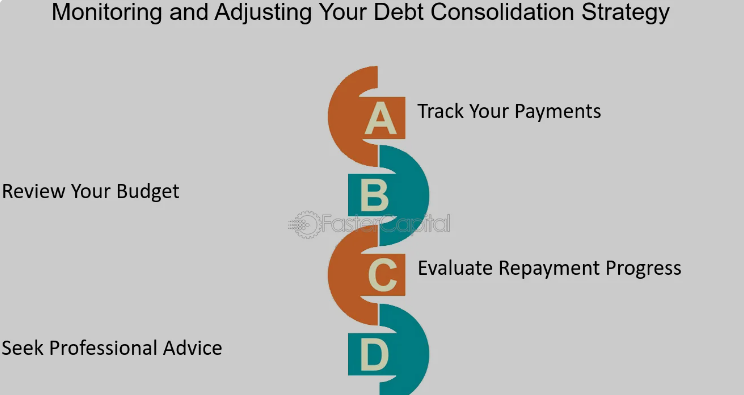

Tips for Effective Debt Management with Payment Processors

For optimal results, users are encouraged to set up automatic payments and regularly monitor their accounts for any discrepancies. These proactive steps contribute to a smoother debt consolidation journey.

The Future of Debt Consolidation in India

As technology continues to advance, so does the landscape of debt consolidation. Emerging trends promise enhanced user experiences, making it easier for individuals to take control of their financial destinies.

Common Misconceptions about Payment Processors in Debt Consolidation

Addressing prevalent myths surrounding payment processors is crucial for dispelling misconceptions. By providing clarity, individuals can make informed decisions about integrating these platforms into their debt consolidation plans.

Challenges in Implementing Payment Processors for Debt Consolidation

While payment processors offer significant advantages, it’s essential to acknowledge and address challenges such as security concerns and technological barriers. Finding solutions to these issues ensures a smoother implementation process.

Comparison of Different Payment Processor Platforms

A detailed comparison of various payment processor platforms offers insights into their features, benefits, and user experiences. Real user reviews and testimonials provide valuable perspectives for those in the decision-making process.

Expert Recommendations

Financial experts weigh in on the efficacy of using payment processors for debt consolidation. Their recommendations provide additional guidance for individuals seeking professional insights into optimizing their financial strategies.

Conclusion

In conclusion, payment processors emerge as invaluable allies in the journey of debt consolidation in India. As individuals strive for financial stability, these platforms offer practical solutions, paving the way for a brighter financial future.

FAQs

- Can I use multiple payment processors for different debts simultaneously?

- Yes, in many cases, users can leverage multiple processors based on their specific debt obligations.

- Are payment processors secure for handling sensitive financial information?

- Absolutely. Reputable payment processors implement stringent security measures to safeguard user data.

- Can payment processors help negotiate lower interest rates on debts?

- While payment processors themselves don’t negotiate rates, they can assist in organizing debts, making it easier to explore negotiation options.

- Is debt consolidation through payment processors suitable for all financial situations?

- It depends on individual circumstances.

- Consulting with a financial advisor can provide personalized guidance, offering valuable insights into optimizing your financial strategy and addressing specific transactional concerns.

- How quickly can one expect to see results with debt consolidation using payment processors?

- Results vary, but many individuals experience a sense of financial relief and organization shortly after implementing a payment processor for debt consolidation.