AUTHOR : JAYOKI

DATE : 26/12/2023

Introduction

Debt consolidation, the process of combining multiple debts into a single, more manageable payment is a lifeline for many facing financial challenges. In the Indian context, where financial complexities can be overwhelming, the role of a reliable payment processor in debt consolidation solutions becomes pivotal.

Challenges in Debt Consolidation

Dealing with diverse debts and varying interest rates can be perplexing for individuals seeking financial stability. Streamlining payments is crucial for effective debt management[1].

Role of Payment Processors

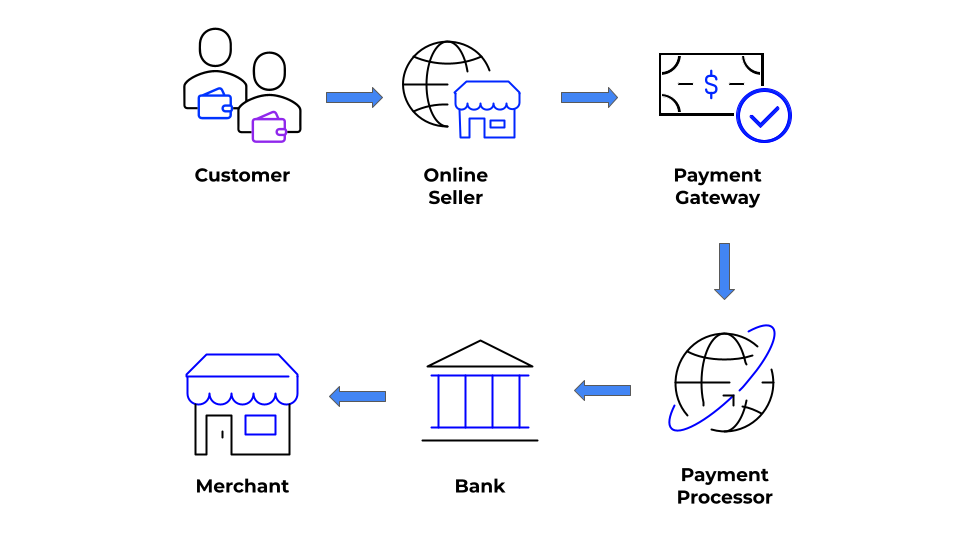

Payment processors[2] play a crucial role in ensuring secure and efficient transactions in the realm of debt consolidation. Their integration with various debt consolidation platforms streamlines the payment process for users.

Criteria for Choosing a Payment Processor

When choosing a payment processor for debt consolidation, certain criteria should be considered payment processor for Debt consolidation solutions in india Security features, integration capabilities, and a user-friendly interface are paramount for a seamless experience.

Top Payment Processors for Debt Consolidation Solutions in India

Features and Benefits

Processor A stands out for its robust security features, ensuring the confidentiality of financial data. payment processor for Debt consolidation solutions in india Its seamless integration with popular debt platforms makes it a preferred choice.

Features and Benefits

With a user-friendly interface, Processor B simplifies the payment process. Its tracking and reporting tools provide users with comprehensive insights into their financial transactions.

Processor C: Features and Benefits

Case Studies

Processor C excels in integration capabilities, allowing users to link their debts. Its advanced security measures protect users from potential fraud, ensuring peace of mind.

Let’s delve into real-life success stories where individuals have successfully gotten out of debt using these payment processors.

How Payment Processors Aid Financial Management

Automation of payments and the availability of tracking and reporting tools make payment processors indispensable tools in effective financial management[3].

Tips for Effective Debt Consolidation

Budgeting advice and effective communication with creditors are crucial aspects of a successful debt consolidation journey.

User Testimonials

Positive experiences from individuals who have used payment processors for debt consolidation[4] shed light on the practical benefits of these solutions.

Future Trends in Payment Processing for Debt Consolidation

As technology advances, we can anticipate enhanced security measures and more modernizing processes in the payment processing landscape.

Common Misconceptions about Payment Processors for Debt Consolidation

Dispelling common misconceptions surrounding payment processors ensures that users make informed decisions.

Comparison of Indian and Global Payment Processors

Understanding the unique features of Indian payment processors and the global options available in India can guide users in choosing the most suitable option.

Regulatory Compliance in Debt Consolidation Transactions

A discussion on the importance of adhering to regulatory standards in debt consolidation transaction ensures users operate within legal frameworks.

The Personalization Paradigm: Tailoring Solutions for Individuals

In the realm of debt consolidation, one size does not fit all. Payment processors recognize the diverse financial situations individuals face. Processor F, for instance, specializes in debt consolidation solutions based on users’ unique circumstances a personalized approach to financial recovery[5].

Demystifying the Credit Score Conundrum

Credit scores often play a pivotal role in debt consolidation. Payment processors are demystifying the credit score conundrum by providing users with insights into how their financial behaviors impact their scores. This transparency allows individuals to take proactive steps towards their creditworthiness.

Accessibility Across Devices and Platforms

Recognizing the prevalence of smartphones and the varied preferences for digital platforms, payment processor prioritize accessibility. Whether through mobile apps or web interfaces, users can manage their debt consolidation journey from the device of their choice, enhancing convenience and the user experience.

Conclusion

In conclusion, the integration of payment processors into debt consolidation solutions is a game-changer for individuals striving for financial stability. By modernizing payments, ensuring security, and providing valuable insights, these processors contribute significantly to the success of debt consolidation efforts.

FAQs

- What is debt consolidation?

- Debt consolidation involves the amalgamation of various outstanding debts into a single and more easily manageable payment.

- How do payment processors enhance debt consolidation solutions?

- Payment processors streamline the payment process, ensuring secure and efficient transactions and making debt consolidation more manageable.

- Are payment processors secure for handling financial transactions?

- Yes, reputable payment processors employ advanced security measures to safeguard users’ financial data.

- Can I use any payment processor for debt consolidation?

- While many processors can be used, it’s crucial to choose one with features like security, integration, and user-friendliness tailored for debt consolidation.

- How long does it take for payment processors to show results?

- The timeline for results varies, but payment processors generally contribute to the effectiveness of debt consolidation over time.