AUTHOR : ROSE KELLY

DATE : 25/12/23

Introduction

In the dynamic realm of finance, debt settlement stands out as a critical process for individuals and businesses seeking financial relief. This article delves into the world of payment processors, exploring their significance in the context of debt settlement in India.

Understanding Debt Settlement in India

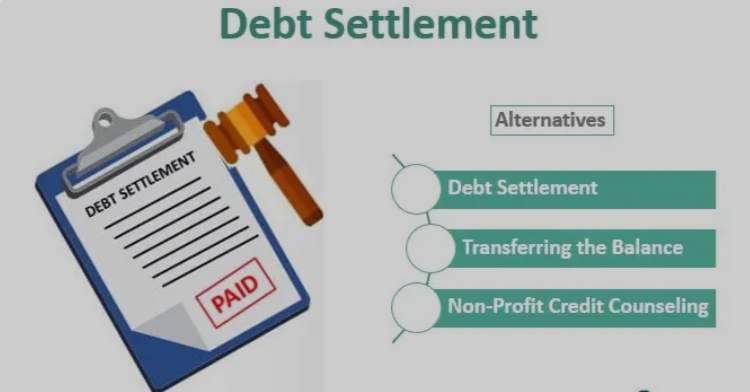

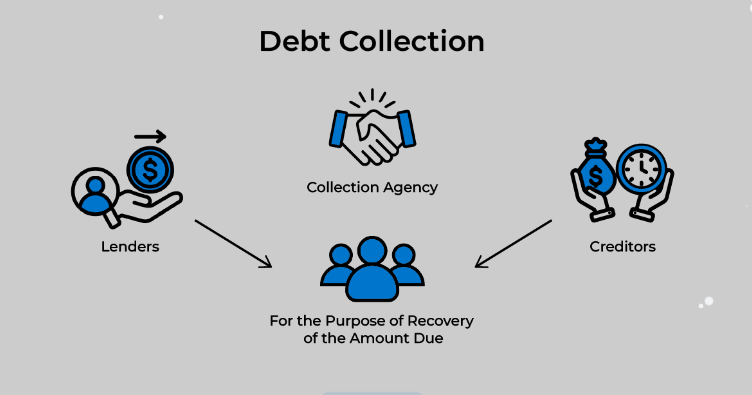

The current scenario of debt settlement in India presents both challenges and opportunities. Individuals and businesses often face hurdles in navigating the complexities of debt resolution. Efficient payment processing emerges as a crucial factor in overcoming these challenges.

Choosing the right payment processor involves considering key features such as security, transaction speed, reliability, and user-friendly interfaces. A robust payment processor can significantly enhance the debt settlement process.

Benefits of Using a Payment Processor for Debt Settlement

From faster Debt consolidation[1] to increased transparency, the benefits of employing a payment processor are manifold. Streamlined record-keeping and reporting further contribute to a more efficient and organized debt settlement experience.

Top Payment Processors for Debt Settlement in India

This section provides an in-depth analysis of three leading payment processors[2], highlighting their unique features and advantages. A comparative assessment helps individuals and businesses make informed choices.

Selecting the ideal payment processor requires a thoughtful evaluation of individual needs, security measures, and transaction fees. This section offers practical tips to guide readers in making informed decisions.

Real-life Success Stories

Explore real-life case studies showcasing successful debt resolution facilitated by reliable payment[3] processors. These stories illustrate the tangible impact of efficient payment processing on financial well-being.

Future Trends in Payment Processing for Debt Settlement

As technology undergoes continuous evolution, the landscape of payment processing similarly transforms, introducing innovative transactional methodologies and advanced financial solutions. Business process[4] This section examines emerging trends and potential innovations, providing a glimpse into the future of debt settlement.

Tips for Effective Debt Settlement

Beyond payment processors, effective debt settlement[5] involves negotiation strategies, budgeting, and financial planning. Readers gain valuable insights into navigating the intricacies of debt resolution. Automation and digital tools play a pivotal role in modern debt resolution. This section explores how technology enhances the efficiency and effectiveness of debt settlement processes.

Addressing Common Concerns

Privacy and security issues, along with misconceptions about debt settlement, often deter individuals from seeking financial relief. This section addresses common concerns, providing clarity on the role of payment processors. Financial experts share their thoughts on the importance of payment processors in debt settlement. Readers gain valuable recommendations on choosing the right processor for their unique needs.

Conclusion

In conclusion, a reliable payment processor is a cornerstone in the journey of debt settlement. By embracing technology, considering individual needs, and learning from success stories, individuals and businesses can navigate the path to financial recovery with confidence. Payment processors meticulously safeguard the integrity of financial transactions through a combination of advanced encryption methods, secure authentication procedures, and vigilant transactional monitoring, ensuring the utmost security for each monetary exchange.

FAQs

- Is debt settlement the right choice for everyone?

- Debt settlement is a viable option for individuals facing financial challenges, but it may not be suitable for everyone. Consult with financial experts to determine the best course of action for your specific situation.

- Payment processors employ sophisticated encryption algorithms, stringent authentication protocols, and cutting-edge transaction monitoring systems to ensure the robust security of financial transactions, safeguarding sensitive information throughout the entire transactional process.

- Can I negotiate with creditors directly without using a payment processor?

- While it’s possible to negotiate directly with creditors, a payment processor can streamline the process and enhance transparency, leading to more effective debt resolution.

- What role does technology play in modern debt settlement?

- Technology automates various aspects of debt settlement, making the process more efficient. Digital tools also assist in budgeting, financial planning, and record-keeping.

- Are there any hidden fees associated with using payment processors for debt settlement?

- It’s essential to carefully review the terms and conditions of payment processors in order to understand any potential fees. Transparent processors often provide clear information on transaction costs.