AUTHOR: KHOKHO

DATE: 28/12/2023

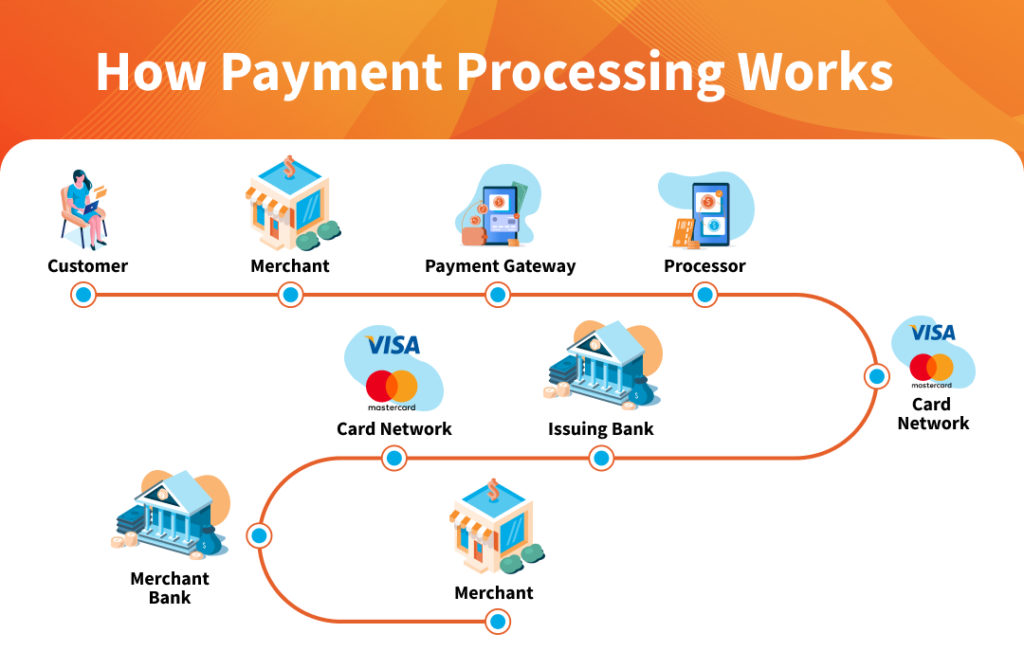

In the bustling world of digital services in India, the need for a reliable and efficient payment processor has become more critical than ever. With the growing popularity of online platforms offering diverse digital services, from e-learning to e-commerce, finding the right payment processor[1] is a game-changer for businesses aiming for seamless transactions and customer satisfaction.

Current Payment Landscape in India

India has witnessed a significant shift towards digital transactions in recent years. From traditional cash transactions to various digital payment options, the landscape has evolved. However, the existing payment options often pose challenges for digital service providers due to their generic nature and limitations in catering to the specific needs of online businesses.

Need for Specialized Payment Processors

Digital services come with unique requirements, such as recurring payments, subscription models, and the need for a secure and user-friendly payment interface. Traditional payment methods, while effective for general transactions, fall short when it comes to meeting the specialized demands of the digital services[2] industry.

Key Features of an Ideal Payment Processor

An ideal payment processor for digital services must encompass several key features. Security is paramount, with robust fraud prevention measures in place. Seamless integration with various digital platforms ensures a smooth user experience, while multi-currency support adds flexibility for businesses catering to a global audience.

Leading Payment Processors in India

Several payment processors have emerged as industry leaders in India. Analyzing their features, security measures and user feedback is crucial for digital service providers looking to make an informed decision. A comparative analysis helps identify the processor that aligns best with the specific needs of a business.

Regulatory Compliance

Adhering to Indian regulations is non-negotiable for any payment processor. Understanding how payment processors ensure compliance is essential for businesses to operate legally and build trust with their customers.

Case Studies

Exploring the success stories of digital service providers who have effectively utilized payment processors provides valuable insights. These case studies highlight the significance of choosing the right processor and share lessons learned from real-world experiences.

Challenges Faced by Payment Processors

While payment processors play a crucial role, they are not without challenges. Technical issues, downtime, and customer support can impact the efficiency of transactions. Understanding these challenges prepares businesses for potential issues and helps in selecting a processor that can address them effectively.

Innovations in Payment Processing

As technology evolves, so does the landscape of payment processing. Emerging technologies like artificial intelligence and blockchain are reshaping the future of digital transactions[3]. Staying informed about these innovations is key for businesses looking to stay ahead in the competitive digital services market.

Customer Experience and Satisfaction

A user-friendly interface is paramount for a positive customer experience. Examining feedback and reviews from digital service providers who have used specific payment processors provides valuable insights into their day-to-day usability and satisfaction levels.

Future Trends in Digital Payments

Predicting future trends in digital payments[4] is crucial for businesses planning long-term strategies. From new technologies to changing consumer behaviors, staying ahead of the curve ensures businesses remain relevant and competitive in the evolving digital landscape.

Choosing the Right Payment Processor for Your Business

Selecting the right payment processor involves careful consideration of various factors. Businesses must evaluate their specific needs, the features offered by processors, and compatibility with their digital platforms[5]. Taking the time to make an informed decision pays off in the long run.

Cost Analysis

Understanding the costs associated with payment processors is essential for budgeting. A detailed breakdown of fees and charges helps businesses find the balance between cost and the value provided by the processor.

Security Measures for Digital Transactions

Security is a top priority in the digital age. Exploring the encryption and data protection measures employed by payment processors ensures the safety of sensitive information and protects businesses and their customers from potential cyber threats.

Conclusion

In conclusion, the role of a reliable payment processor in the success of digital services in India cannot be overstated. From ensuring security to providing a seamless user experience, the right payment processor is the backbone of online transactions. Businesses that carefully evaluate their options and choose a processor that aligns with their unique needs are poised for success in the dynamic digital landscape.

Frequently Asked Questions (FAQs)

- What makes a payment processor suitable for digital services?

- A payment processor must offer security, seamless integration, and flexibility to cater to the unique needs of digital service providers.

- How do payment processors ensure regulatory compliance in India?

- Payment processors adhere to Indian regulations by implementing robust systems and processes to comply with legal requirements.

- What are the common challenges faced by payment processors?

- Technical issues, downtime, and customer support are common challenges that payment processors may encounter.

- How can businesses stay updated on future trends in digital payments?

- Keeping an eye on emerging technologies, consumer behaviors, and industry reports helps businesses stay informed about future trends.

- What factors should businesses consider when choosing a payment processor?

- Businesses should consider their specific needs, security features, integration capabilities, and overall compatibility with their digital platforms.