AUTHOR : MICKEY JORDAN

DATE : 28/12/2023

In a rapidly evolving digital landscape, electronic downloads have become an integral part of the Indian e-commerce ecosystem. From software and music to e-books and digital art, consumers are increasingly turning to online platforms for instant access to digital content

Introduction

As India embraces the era of electronic downloads, the need for a reliable payment processor cannot be overstated. This article delves into the intricacies of payment processor, specifically tailored to meet the demands of the electronic download market in India However, the success of electronic downloads is closely tied to the efficiency of payment processors, making it crucial for businesses to choose the right platform to facilitate transactions securely.

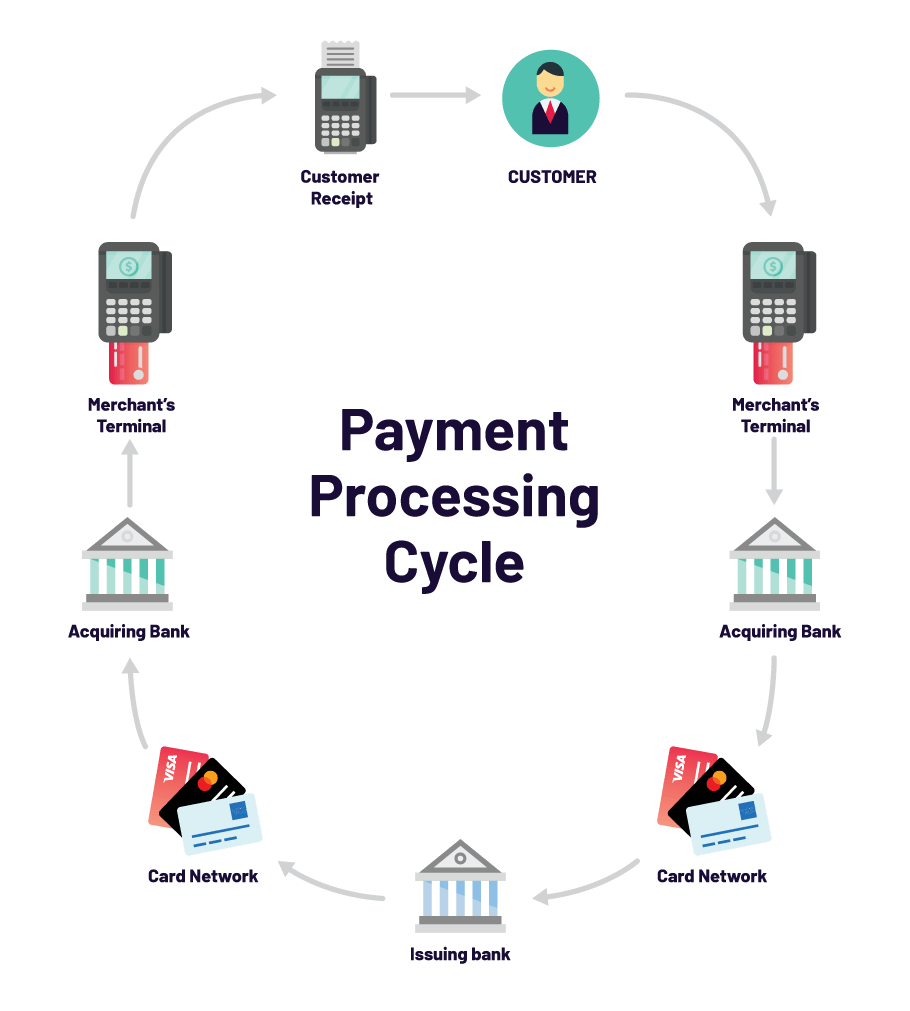

Understanding Payment Processors

Payment processors act as intermediaries between businesses and financial institutions, facilitating secure and seamless transactions. In the digital age, their role has become increasingly significant, ensuring that online payments[1] are processed swiftly and securely.

Challenges in Indian E-commerce

The Indian e-commerce landscape presents unique challenges for businesses involved in electronic downloads. These challenges range from payment delays to concerns about data security. To address these issues, businesses need payment processors designed to handle the specific nuances of the Indian market.

Key Features of an Ideal Payment Processor

For a payment processor to be effective in the realm of electronic downloads, it must possess key features. These include robust security [2] measures, a user-friendly interface, and seamless integration capabilities with various platforms.

Popular Payment Processors Worldwide

Taking inspiration from successful models globally, businesses in India can explore a variety of payment processors. Understanding the global landscape helps in identifying solutions that align with the requirements of the Indian market.

Tailored Payment Solutions for Indian Market

Localization is key when it comes to payment processors for electronic downloads in India. Understanding the preferences and behaviors of Indian consumers allows businesses to tailor their payment solutions for maximum effectiveness.

Regulatory Compliance

Navigating the legal landscape is essential for any business, particularly in the context of electronic downloads[3]. Payment processors must ensure compliance with Indian regulations to operate seamlessly in the market.

Case Studies

Examining case studies of businesses that have successfully integrated reliable payment processors [4] provides valuable insights. These success stories offer practical lessons and strategies for others in the industry.

Tips for Choosing the Right Payment Processor

Choosing the right payment processor involves thorough research, comparisons, and consideration of user reviews. Additionally, assessing the quality of customer support can make a significant difference in the long-term success of a business.

Future Trends in Payment Processing for Electronic Downloads

The landscape of payment processing is dynamic, with emerging technologies shaping the future. Businesses should stay informed about these trends to adapt and remain competitive in the e-commerce[5] landscape.

Benefits for Businesses

Implementing a reliable payment processor for electronic downloads brings multiple benefits. Streamlined transactions and enhanced customer satisfaction contribute to the overall success of a business in the digital marketplace .

Overcoming Payment Processing Challenges

Addressing common challenges, such as payment delays or technical glitches, is crucial for businesses relying on electronic downloads. This section provides insights into overcoming these challenges and implementing preventive measures.

User-Friendly Payment Processors

Simplifying the payment experience for consumers is a priority. User-friendly payment processors reduce friction in transactions, contributing to a positive overall experience for both businesses and customers.

Conclusion

In conclusion, the success of electronic downloads in India hinges on the efficiency and reliability of payment processors. Businesses must prioritize choosing platforms that align with the unique demands of the Indian market to thrive in the digital era.

FAQs

Q1. How secure are payment processors? A: Payment processors employ robust security measures to ensure the confidentiality and integrity of transactions.

Q2. Can payment processors handle high transaction volumes? A: Leading payment processors are equipped to handle high transaction volumes, ensuring scalability for businesses.

Q3. What role does localization play in choosing a payment processor? Localization is essential to cater to the preferences and cultural nuances of the Indian market.

Q4. Are there any specific regulations for electronic downloads in India? A: Yes, businesses must adhere to specific regulations governing electronic downloads to operate legally in India.

Q5. How can businesses ensure data privacy with payment processors? Implementing encryption and following best practices in data security ensures businesses maintain data privacy with payment processors.