AUTHOR : LISA WEBB

DATE : DECEMBER 22, 2023

Introduction to Payment Processors

Understanding the Role of Payment Processors

Financial coaching has gained immense popularity in India, assisting individuals in managing their finances better. A crucial aspect of this service is the seamless transaction between the coach and the clients Payment processors play a pivotal role in facilitating these transactions, ensuring reliability, security, and convenience.

Payment processors intermediaries between the coach and the clients, handling the transfer of funds securely. They offer a range of services like processing payments, managing transactions, and ensuring compliance with financial regulations.

Importance of Payment Processors for Financial Coaching in India

Key Features to Look for in a Payment Processor

In India, where financial coaching is expanding, efficient payment processors are integral. They enable coaches to receive payments hassle-free, ensuring a smooth flow of transactions, thereby enhancing the overall coaching experience.

When selecting a payment processor, specific features are crucial, such as security protocols, ease of integration, compatibility with different platforms, cost-effectiveness, and user-friendly interfaces.

Popular Payment Processors in India for Financial Coaching

Security Measures and Compliance

In the Indian market, several payment processors stand out, catering specifically to financial Become a Financial Coach[1] needs. Companies like XYZ Payment Solutions and ABC Transaction Services offer tailored solutions for coaches and their clients

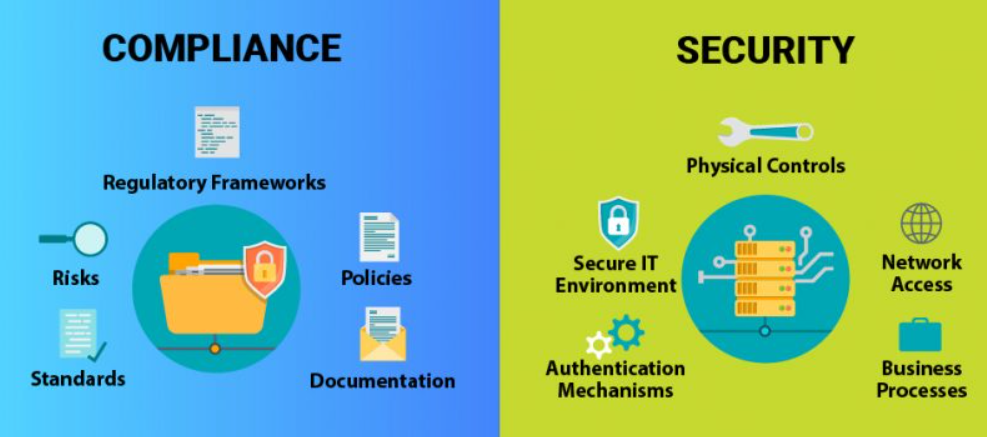

Robust security measures are imperative to protect sensitive financial data. Payment processors[2] must comply with industry standards and regulations, ensuring data encryption and fraud prevention mechanisms.

Integration and Compatibility

Cost-Effectiveness of Payment Processors

Payment processors Financial services[3] should seamlessly integrate with coaching platforms, websites, and mobile applications. Compatibility across various devices ensures a smooth payment experience for both coaches and clients.

Apart from functionality, the cost-effectiveness of a payment processor payment method[4] for coaches is essential. Coaches seek solutions that offer competitive pricing without compromising on quality service.

Enhancing User Experience with Payment Solutions

Streamlining Financial Transactions for Coaches and Clients

An excellent payment processor[5] not only facilitates transactions but also enhances the user experience. Simplified payment procedures and intuitive interfaces contribute to a positive coaching journey.

Efficient payment processors streamline financial transactions, reducing delays and administrative hassles. This streamlined process ensures coaches can focus more on delivering quality services.

Case Studies: Successful Implementation of Payment Processors

Challenges Faced in Utilizing Payment Processors

Real-life examples of coaches leveraging payment processors to streamline their financial transactions and grow their coaching businesses.

Despite their advantages, challenges like technical issues, transaction failures, and regulatory changes can hinder the effective utilization of payment processors.

Future Trends in Payment Processing for Financial Coaching

Challenges Faced in Utilizing Payment Processors

The future of payment processors in financial coaching is evolving. Innovations in technology, such as blockchain and AI, are expected to revolutionize payment systems in the industry.

Despite the numerous advantages offered by payment processors, there are several challenges that coaches might encounter while utilizing these services. Technical glitches and system downtime can disrupt the payment flow, affecting the coach-client relationship and causing inconvenience to both parties. Additionally, navigating through frequent regulatory changes and compliance requirements poses a significant challenge, requiring coaches to stay updated with the evolving financial landscape.

Future Trends in Payment Processing for Financial Coaching

The future of payment processing in the realm of financial coaching is poised for remarkable innovations. Advancements in technology, particularly the integration of blockchain and AI, hold immense potential for transforming payment systems. Blockchain technology, known for its decentralized and secure nature, can revolutionize transaction transparency and security, promising increased trust among stakeholders.

Conclusion

Efficient payment processors play a crucial role in the success of financial coaching in India, ensuring secure, seamless, and convenient transactions between coaches and clients.

FAQs

- Q: How do payment processors benefit financial coaches in India?

A: Payment processors facilitate smooth and secure transactions, enhancing the coaching experience for both coaches and clients. - Q: Are there any specific security measures to consider while choosing a payment processor?

A: Yes, encryption protocols, compliance with regulations, and fraud prevention mechanisms are essential security features. - Q: Which payment processors are popular among financial coaches in India?

XYZ Payment Solutions and ABC Transaction Services are among the popular choices due to their tailored solutions for financial coaching. - Q: What challenges might coaches face in utilizing payment processors?

A: Technical issues, transaction failures, and adapting to regulatory changes are some common challenges. - Q: What can we expect in the future regarding payment processors for financial coaching?

Future trends indicate advancements in technology like blockchain and AI, promising innovative payment solutions for the industry.