AUTHOR: RUBBY PATEL

DATE: 01/01/24

Introduction

Navigating the intricacies of group purchase discounts in India requires a keen understanding of payment processing dynamics In this article, we delve into the world of payment processors tailored for group purchases exploring the challenges, solutions, and best options available in the Indian market

Understanding Group Purchase Discounts

Group purchase discounts involve collective buying to unlock better deals. Imagine the power of a community pooling their purchases to enjoy significant discounts. However, the success of this model hinges on a seamless payment process that accommodates multiple contributors.

Challenges in Handling Group Payments

Managing payments in a group setting poses unique challenges, from the complexity of tracking individual contributions to the paramount issue of security. Fraud prevention and maintaining transparency in financial transactions are critical considerations for businesses venturing into group purchases.

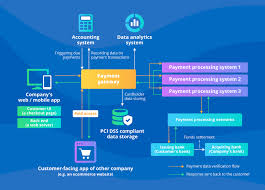

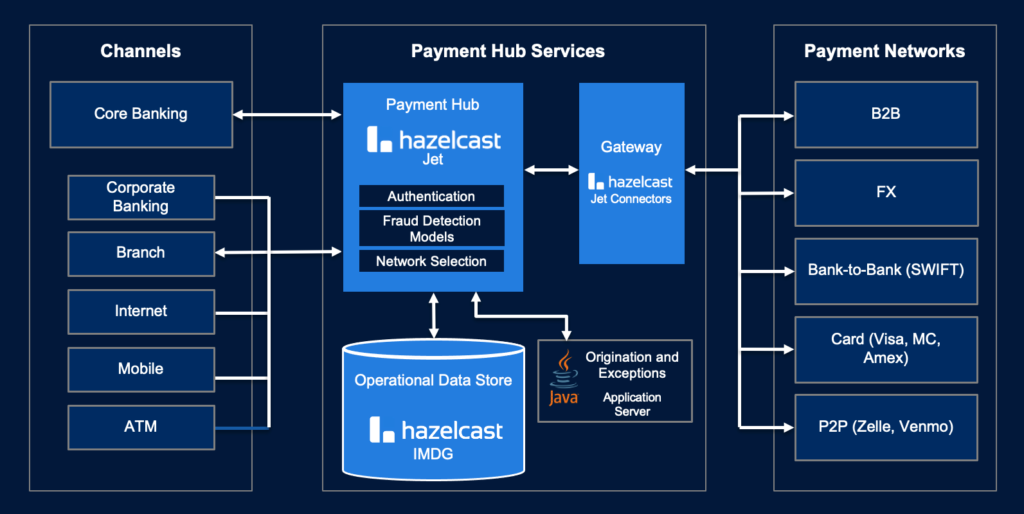

Importance of a Reliable Payment Processor

Enter the hero of the story: a reliable payment managemet[1] processor. Beyond facilitating transactions, a robust payment processor streamlines the group payment process, ensuring efficiency security, and transparency. But what makes a payment processor ideal for handling group purchases?

Key Features of an Ideal Payment Processor

Scalability, integration capabilities, and a user-friendly interface are paramount features businesses should look for in a understanding payment processor. The ability to adapt to the varying scales of group purchases and seamlessly integrate[3] with existing systems can make or break the user experience. for in

Comparison of Payment Processors in India

The Indian market boasts several payment processors, each with its own unique set of features. Let’s compare some of the leading options, shedding light on their strengths and how they cater to the specific needs of businesses managment[4] with group purchases. Payment Processor for Group Purchase Discounts in India

Popular Payment Processor Options

- Paytm

- Overview of features

- Integration capabilities

- Razorpay

- Scalability and flexibility

- User interface analysis

- Instamojo

- Focus on small and medium enterprises

- Security measures are in place

- UPI-based Processors

- Understanding the UPI landscape

- Advantages and disadvantages of group purchases

Case Studies

To illustrate the practical impact of efficient payment processors, we explore real-world case studies. Businesses that have successfully implemented streamlined payment[5] processes share their experiences, highlighting the tangible benefits for customer satisfaction and overall sales.

Security Measures in Payment Processing

Security is non-negotiable when it comes to financial transactions. We delve into the security measures employed by payment processors to Discounts in India safeguard sensitive data, offering businesses and consumers peace of mind in their transactions.

Choosing the Right Payment Processor for Your Business

Selecting the right payment processor[2] involves a strategic decision-making process. Factors such as business size, transaction volume, and specific requirements play a pivotal role. We provide a step-by-step guide on how businesses can integrate a payment processor seamlessly.

User Reviews and Feedback

The voice of the user is invaluable. We gather insights from businesses and individuals who have used various payment processors for group purchases, Payment Processor for Group Purchase shedding light on the user experience and potential pain points.

Future Trends in Payment Processing for Group Purchases

As technology evolves, so does the landscape of payment processing. We explore emerging trends and innovations set to shape the future of group purchase payment processing in India, offering businesses a glimpse into what lies ahead.

Expert Recommendations

Industry experts weigh in on the discussion, providing valuable recommendations on choosing the best payment processor for group purchases. Their insights offer a holistic view, helping businesses make informed decisions.

Common Pitfalls to Avoid

Payment Discounts In the excitement of implementing a payment processor, businesses often fall prey to common pitfalls. We highlight these potential challenges and provide guidance on how to navigate them successfully.

Conclusion

In conclusion, the world of group purchase discounts in India is dynamic and exciting, but success hinges on choosing the right payment processor. A careful evaluation of features, user feedback, and future trends is essential to making an informed decision.

FAQs

- What makes group purchase discounts popular in India?

- Group purchases leverage collective buying power, allowing participants to enjoy significant discounts.

- How do payment processors enhance security in group transactions?

- Payment processors employ encryption and authentication measures to ensure secure transactions in group purchases.

- Can businesses customize payment processors for their specific needs?

- Yes, many payment processors offer customizable solutions based on business size and requirements.

- Are UPI-based processors suitable for large-scale group purchases?

- We explore the advantages and limitations of UPI-based processors for different scales of group transactions.

- What role do industry experts play in choosing a payment processor?

- Industry experts provide valuable insights and recommendations, guiding businesses to make informed decisions.