AUTHOR : JAYOKI

DATE : 01/01/2024

Introduction

In a market driven by consumer preferences, and businesses are constantly seeking innovative ways to retain customers. Membership discounts have emerged as a powerful tool, fostering a sense of exclusivity among customers To effectively implement and manage these discounts, businesses must leverage advanced payment processors specifically to their needs.

Understanding Membership Discounts

Membership discounts involve offering special pricing or exclusive deals to customers who subscribe to a particular membership program. These programs are designed to reward loyalty and encourage repeat Processor for Membership business. Understanding the dynamics of membership discounts is crucial for businesses looking to maximize their impact.

The Need for an Efficient Payment Processor

While the concept of membership discounts is enticing, the efficient management of transactions is equally crucial. A reliable payment processor plays a pivotal role in ensuring seamless transactions, security, and an overall positive customer experience. Without an efficient payment processing system, businesses may face challenges in delivering the promised discounts to their members.

Benefits of Using Payment Processors

Streamlining Transactions

An efficient payment processor streamlines transactions, reducing the likelihood of payment delays or errors. This ensures that customers receive their membership discounts promptly, Discounts in India enhancing their satisfaction and trust in the business.

Ensuring Security

Security is paramount in payment transactions,[1] especially when dealing with sensitive customer information. A robust payment processor employs advanced encryption and security measures, safeguarding both the business and its customers from potential threats.

Providing Multiple Payment Options

Diversity in payment method guide[2] options is essential to cater to a broad customer base. A payment processor that supports various payment methods ensures that businesses can accommodate the preferences of their members, making the membership program more accessible and attractive.

Popular Payment Processors in India

India’s diverse market has led to the emergence of multipel payment gateway[3] processors, each offering unique features. Some of the prominent ones catering to membership discounts include [List of Payment Processors].

Choosing the Right Payment Processor

Selecting the appropriate payment processor[4] requires careful consideration of various factors. Businesses must evaluate transaction fees, integration capabilities, customer support, and compatibility with their membership platform before making a decision.

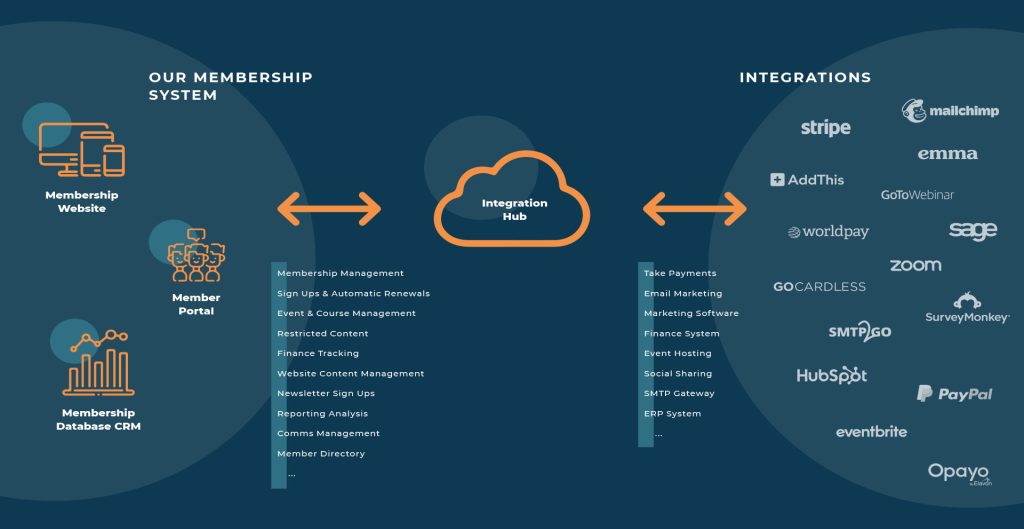

Integration with Membership Platforms

Seamless integration with membership platforms[5] is crucial for the effective implementation of discounts. Businesses should opt for payment processors that offer easy integration, minimizing disruptions to the customer experience.

Case Studies

Examining real-life case studies provides valuable insights into the successful implementation of payment processors for membership discounts in India. [Case Study 1], [Case Study 2], and [Case Study 3] highlight the positive impact of choosing the right payment processing solution.

Challenges and Solutions

While payment processors offer numerous benefits, businesses may encounter challenges during implementation. Payment Processor for Membership Common issues include technical glitches, user resistance, and security concerns. Solutions involve thorough training, transparent communication, and continuous monitoring to address potential issues promptly.

Future Trends in Payment Processing for Membership Discounts

The payment processing landscape is continually evolving, with emerging technologies shaping the future. Trends such as blockchain-based transactions, biometric authentication, and AI-driven fraud detection are expected to play a significant role in enhancing the efficiency and security of membership discount transactions.

Tips for Businesses Implementing Payment Processors

For businesses embarking on the journey of implementing payment processors for membership discounts, here are some practical tips:

- Conduct thorough research on available payment processors.

- Prioritize security features and compliance with industry standards.

- Seek customer feedback for continuous improvement.

- Regularly update payment processing systems to adopt new technologies.

- Train staff to handle potential issues and provide excellent customer support.

User Reviews

Feedback from businesses and users who have implemented payment processors for membership discounts provides valuable insights into the practical aspects of these systems. Positive experiences and constructive criticism help businesses make informed decisions.

Comparison of Processing Fees

Analyzing the processing fees of different payment processors is essential for businesses aiming to optimize their cost-effectiveness. Comparing fees, along with considering the features offered, ensures businesses choose a payment processor that aligns with their budget and requirements.

Regulatory Compliance

Adhering to regulatory standards and compliance is non-negotiable in the world of payment processing. Businesses must ensure that their chosen payment processor complies with all relevant regulations to avoid legal complications and protect both the business and its customers

Conclusion

In conclusion, the successful implementation of membership discounts in India hinges on choosing the right payment processor. Businesses must carefully assess their options, considering factors such as security, integration capabilities, and future trends. By prioritizing customer satisfaction and staying abreast of industry developments, businesses can unlock the full potential of membership discounts through efficient payment processing.

FAQs

- Is it necessary for businesses to offer membership discounts?

- Membership discounts are not mandatory, but they can significantly enhance customer loyalty and retention.

- How do payment processors contribute to the success of membership discount programs?

- Payment processors ensure seamless transactions, secure payments, and diverse payment options, contributing to a positive customer experience.

- What challenges might businesses face when implementing payment processors for membership discounts?

- Challenges may include technical glitches, user resistance, and security concerns, which can be addressed through proper training and communication.

- Are there any upcoming technologies that might impact payment processing for membership discounts?

- Emerging technologies such as blockchain, biometrics, and AI are expected to shape the future of payment processing, enhancing efficiency and security.

- How can businesses stay updated on the latest trends and technologies in payment processing?

- Regularly researching industry publications, attending conferences, and engaging with payment processor providers can help businesses stay informed.