AUTHOR: SONIA ROY

Introduction

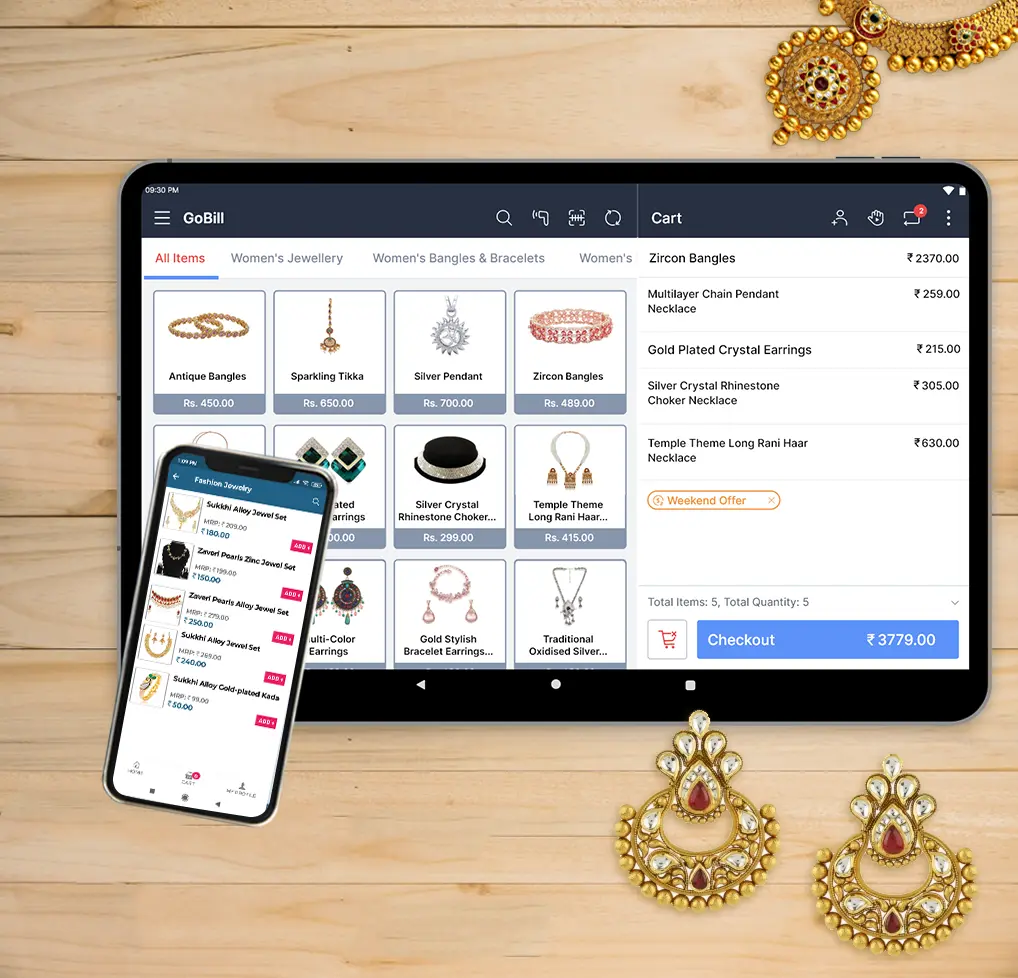

In today’s digital world, e-commerce[1] is more important than ever, and jewelry businesses are no exception. As a jewelry retailer, having a smooth, secure, and reliable payment process is essential to ensuring both customer satisfaction and business success. Payment processor integration for jewelry websites[2] is a crucial aspect of modern e-commerce, enabling you to manage transactions efficiently while providing a seamless shopping experience[3] for your customers. This guide will walk you through the importance, benefits, and steps involved in integrating a payment processor into your jewelry website.

What is Payment Processor Integration for Jewelry Websites?

Payment processor integration for jewelry websites refers to the process of embedding a secure and reliable system into your website to handle customer payments[4]. This allows customers to purchase jewelry directly from your site using various payment methods, such as credit cards, debit cards, digital wallets, or bank transfers. Integration means your jewelry store can safely and efficiently process online payments[5], preventing fraud and offering a seamless checkout experience.

Integrating a payment processor into your jewelry website ensures that your business stays compliant with security standards, especially in industries like jewelry, which often deal with high-value transactions.

Why is Payment Processor Integration Essential for Jewelry Websites?

1. Secure Transactions

One of the most significant reasons for integrating a payment processor is the security it provides. Jewelry transactions often involve substantial amounts of money, making them attractive targets for fraud. A reliable payment processor offers encryption and other advanced security features, ensuring that your customers’ sensitive payment details are kept safe.

2. Multiple Payment Options

Payment processor integration allows you to offer your customers a variety of payment methods, which is key to increasing conversion rates. Jewelry buyers, especially in high-end markets, may prefer using their preferred credit card or digital wallet for payment. With payment processor integration for jewelry websites, you can cater to all preferences, making the purchasing process convenient for your customers.

3. Faster Checkout

An efficient and quick checkout process is essential for minimizing cart abandonment. By integrating a payment processor into your jewelry website, you streamline the entire transaction, enabling customers to pay with minimal hassle. This increases the chances of a completed sale and enhances the overall customer experience.

4. Automated Payment Tracking

Payment processor integration can help you track your transactions automatically, saving you time and reducing errors. You no longer need to manually update your records after each sale. The system automatically updates your inventory and records payments, making it easier to manage your business.

5. Global Reach

Payment processor integration for jewelry websites ensures that you can accept payments from customers worldwide. Jewelry businesses often attract international buyers, and offering global payment methods helps expand your customer base. Whether a customer is in the US, Europe, or Asia, a reliable payment processor makes cross-border transactions hassle-free.

Key Features to Look for in a Payment Processor for Jewelry Websites

1. Security and Compliance

The most critical aspect of any payment processor is security. Look for payment processors that are PCI-DSS compliant to guarantee secure and protected transactions. This ensures that your website follows the necessary guidelines to protect customer data. A reliable payment processor safeguards against fraud and data breaches, protecting your business’s reputation.

2. Easy Integration

The payment processor should be easy to integrate into your jewelry website. Whether you’re using a website builder like Shopify or a custom-built e-commerce platform, the integration should be smooth and quick. Many modern payment processors offer pre-built plugins and APIs that make the integration process much easier.

3. Support for Multiple Payment Methods

Offering various payment options is crucial to catering to a wide audience. Look for payment processors that accept major credit cards, debit cards, digital wallets (like PayPal, Apple Pay, and Google Pay), and bank transfers. Offering a variety of payment methods boosts the likelihood of finalizing a sale successfully.

4. Transparent Fees

Ensure that the payment processor you choose has clear and transparent pricing. Certain payment processors impose a fee per transaction, whereas others require a monthly subscription charge. Make sure you understand the fees upfront so you can calculate the total cost of using the service.

5. Customer Support

Good customer support is essential, especially when you encounter issues with payments or transaction errors. Select a payment processor that provides dependable customer support, including 24/7 assistance, live chat, and email.

How to Integrate a Payment Processor into Your Jewelry Website: A Step-by-Step Guide

Step 1: Choose the Right Payment Processor

Start by researching payment processors that specialize in jewelry businesses. Popular choices for payment processing include PayPal, Stripe, Square, and Authorize.Net. Consider factors such as fees, security features, and integration options when selecting the processor.

Step 2: Register for an Account

After selecting a payment processor, the next step is to register for an account with them. You’ll need to provide business details, banking information, and other required documentation to verify your account.

Step 3: Integrate the Payment Gateway

Most payment processors offer easy-to-use plugins or APIs that allow you to integrate their system into your website. If you’re using a platform like Shopify or WooCommerce, this step will be easier since these platforms provide built-in integration options. For custom websites, you may need to work with a developer to ensure the integration is done correctly.

Step 4: Test the System

Prior to launching, it’s essential to test the payment processor integration to confirm everything functions smoothly. Test the payment process with different payment methods and ensure that customers are receiving confirmation emails and the system is updating your inventory.

Step 5: Go Live

After successful testing, you can officially start accepting payments through your jewelry website. Be sure to monitor the transactions regularly to ensure that everything is running smoothly.

Best Payment Processors for Jewelry Websites

- Stripe: Known for its easy integration and competitive fees, Stripe is a popular choice for jewelry websites.

- PayPal: With worldwide recognition and trusted security, PayPal offers a range of payment solutions.

- Square: Ideal for both online and physical jewelry stores, Square provides easy integration and low transaction fees.

- Authorize.Net: A great choice for larger jewelry businesses, Authorize.Net offers advanced features like fraud prevention tools.

Conclusion

Integrating a payment processor into your jewelry website is an essential step for any modern e-commerce jewelry business. It not only enhances customer trust by offering secure transactions but also simplifies the payment process for you. By selecting the right payment processor, you can expand your reach, ensure a smooth checkout experience, and maintain the highest standards of security. Whether you’re just starting or scaling your jewelry business, payment processor integration is a crucial investment for long-term success.

FAQs

1. What is payment processor integration for jewelry websites?

Payment processor integration for jewelry websites involves embedding a secure system into your site to handle customer payments and transactions.

2. How does payment processor integration benefit my jewelry business?

It provides secure, fast, and convenient payment methods, helping reduce cart abandonment and improving the overall customer experience.

3. What security features should I look for in a payment processor?

Look for features like encryption, fraud protection, and PCI-DSS compliance to ensure your customers’ payment details are secure.

4. Can I accept international payments with a payment processor?

Yes, most modern payment processors support international payments, allowing you to expand your customer base globally.

5. What are the costs associated with payment processor integration?

Costs vary depending on the processor you choose. Some charge per transaction, while others may have monthly fees. Always review pricing carefully before committing.