AUTHOR : RIVA BLACKLEY

DATE : 12/12/2023

Introduction

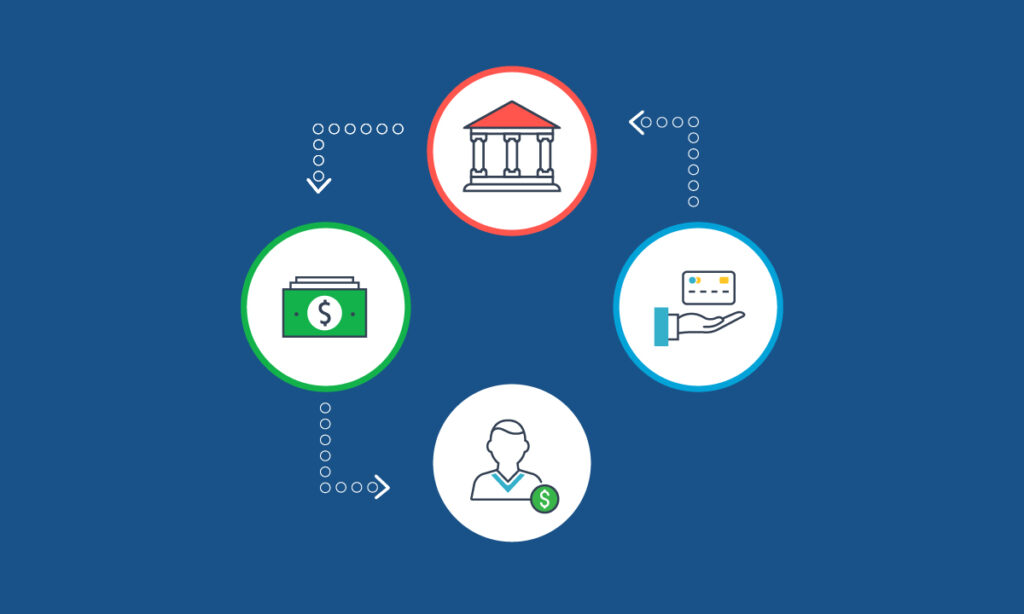

In a country where diversity is the norm, payment processors[1] play a crucial role in streamlining transactions, and their impact on liquor sales cannot be overstated. As India witnesses a digital revolution[2], the liquor industry[3] is adapting to modern payment solutions[4] for enhanced efficiency and customer satisfaction.

Payment Processor Landscape in India

India’s payment processing[5] industry has experienced a remarkable transformation in recent years. Giants like Paytm, Razorpay, and PhonePe have become household names, dominating the market share. Understanding this landscape sets the stage for comprehending the nuances of liquor sales transactions.

Challenges in Liquor Sales

Navigating the liquor sales landscape in India comes with its share of challenges. Regulatory hurdles, cash handling issues, and the need for secure payment solutions are among the prominent obstacles that retailers face. Payment processors provide a tailored solution to address these challenges head-on.

Emergence of Specialized Payment Processors

Acknowledging the unique demands of the liquor sales sector, specialized payment processors have emerged. These companies offer tailored solutions that cater specifically to the intricacies of selling alcoholic beverages, ensuring seamless transactions and compliance with regulations.

Benefits of Using Payment Processors in Liquor Sales

The adoption of payment processors in liquor sales brings forth a myriad of benefits. From heightened efficiency and improved customer experience to compliance with stringent regulations, the advantages are significant for both retailers and consumers.

Security Measures in Payment Processing

Ensuring the security of transactions is paramount in the liquor sales industry. Payment processors implement robust encryption and fraud prevention strategies, safeguarding both the financial interests of businesses and the sensitive information of consumers.

Integration of Digital Wallets

Digital wallet[1]s have become an integral part of the payment processing landscape. Their growing popularity among consumers presents a unique opportunity for liquor retailers to enhance convenience and offer additional advantages, fostering customer loyalty.

Consumer Adoption and Behavior

As India witnesses a shift towards digital payments, understanding consumer behavior becomes crucial. Factors influencing the choice of payment methods in the context of liquor sales provide valuable insights for retailers seeking to optimize their transaction processes.

Case Studies

Real-world [2]case studies exemplify the positive impact of implementing payment processors in liquor sales. Stories of successful integration not only highlight the efficiency gains for businesses but also showcase the tangible impact on revenue and customer satisfaction.

Future Trends in Payment Processing for Liquor Sales

Looking ahead, the future of payment processing in liquor sales is poised for exciting developments. Technological advancements, coupled with changing consumer expectations, are expected to shape the landscape over the next decade.

Choosing the Right Payment Processor

Selecting the right payment processor[3] is a crucial decision for liquor[4] retailers. This section provides insights into the factors to consider, offering a comparison of leading options to help businesses make informed choices.

Tips for Liquor Retailers

Maximizing the benefits of payment[5] processors requires strategic planning. This section offers practical tips for liquor retailers, ensuring a seamless integration that enhances the overall shopping experience for customers.

Regulatory Compliance

Navigating the legal landscape is imperative for liquor retailers. This section outlines best practices for ensuring regulatory compliance, helping businesses avoid pitfalls and legal complications.

Social Impacts of Digital Payments

Beyond the transactional realm, digital payments have broader societal implications. This section explores changing attitudes towards digital transactions and the role of payment processors in contributing to cultural shifts.

Conclusion

In conclusion, the synergy between payment processors and liquor sales in India is reshaping the retail landscape. From addressing challenges to providing a secure and efficient payment ecosystem, the role of payment processors is pivotal. As technology continues to advance, liquor retailers must embrace these changes to stay competitive and meet the evolving expectations of consumers.

FAQs

- What are the key challenges faced by liquor retailers in India regarding payment processing?

- Regulatory hurdles, cash handling issues, and the need for secure payment solutions are prominent challenges.

- How do payment processors contribute to the security of transactions in liquor sales?

- Payment processors implement robust encryption and fraud prevention strategies to ensure secure transactions.

- What role do digital wallets play in the liquor sales industry?

- Digital wallets have gained popularity, offering convenience and additional advantages for both retailers and consumers.

- How can liquor retailers maximize the benefits of payment processors?

- Retailers can maximize benefits by strategically choosing the right payment processor and following best practices.

- What are the future trends in payment processing for liquor sales in India?

- Technological advancements and changing consumer expectations are expected to shape the future landscape of payment processing in liquor sales.