AUTHOR : RIVA BLACKLEY

DATE : 28/02/2024

Introduction to Payment Processors

In the digital age, payment processors have revolutionized the way businesses conduct transactions online. These tools facilitate secure and seamless payments, enhancing the overall customer experience. In India, the demand for efficient payment processing solutions has surged with the rapid growth of e-commerce and digital transactions. Payment Processor Online Software Tools in India.

The Need for Online Software Tools in India

With the increasing shift towards digital payments, businesses in India require robust online software tools to manage transactions efficiently. These tools offer a range of features designed to streamline payment processes, including invoicing, recurring billing, and real-time analytics. Payment Processor Online Software Tools in India.

What is a Payment Processor?

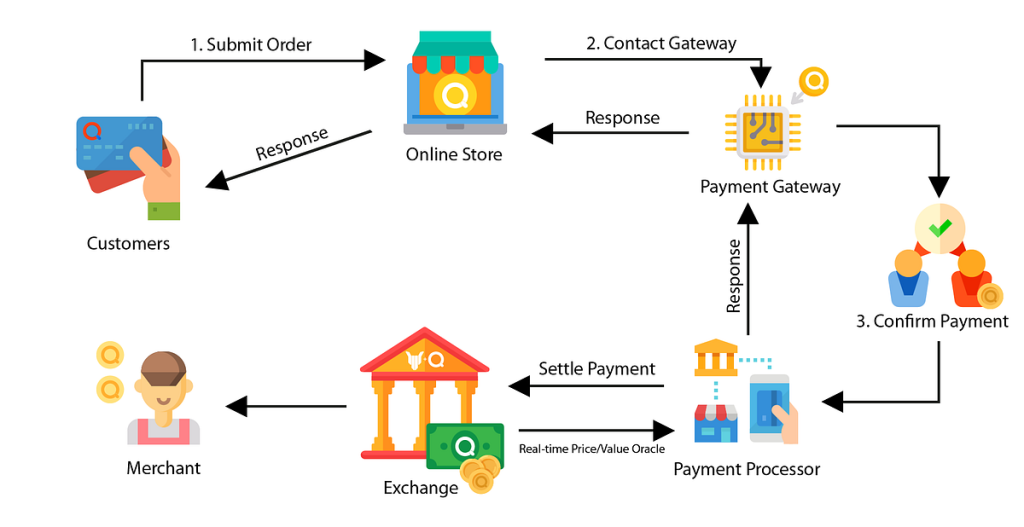

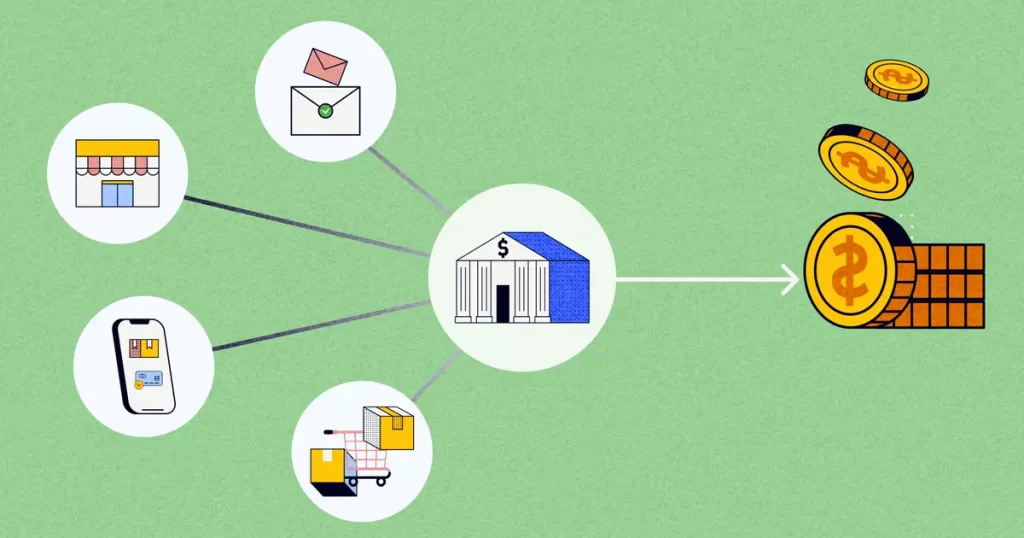

Payment processors are software solutions that enable businesses to accept payments online. They act as intermediaries between the customer, the business, and the financial institutions involved in the transaction. These tools ensure that the payment process is secure, seamless, and efficient.

There are two main types of payment processors:

- Payment Gateways: These are responsible for securely transferring payment information from the customer to the merchant’s bank.

- Payment Aggregators: These platforms combine multiple payment gateways and provide businesses with a single point of access to various payment methods.

Why are payment processors important for businesses in India?

With India’s digital economy expanding rapidly, online transactions have become a cornerstone for many businesses. Payment processors make it possible for companies to accept payments quickly and securely from customers across the globe.

For businesses, the right payment processor can increase customer satisfaction by offering convenient payment options, reduce fraud risks, and streamline cash flow management. In a country as diverse as India, businesses can also benefit from processors that support multiple languages and currencies

Benefits of Using Payment Processors

Secure Transactions

Payment processors[1] employ advanced encryption techniques to safeguard sensitive financial information, ensuring that transactions remain secure and protected from cyber threats.

Convenience

By offering multiple payment options and seamless integration with e-commerce platforms, payment processors enhance the convenience of both businesses and customers, resulting in higher conversion rates and improved user satisfaction.

Popular Payment Processors in India

Several payment processors have gained prominence in the Indian market.

- Paytm: As one of the leading digital payment platforms[2] in India, Paytm offers a wide range of services, including mobile recharges, bill payments, and online shopping.

- PayPal: With its global presence and reputation for reliability, PayPal remains a preferred choice for businesses seeking international payment solutions and cross-border transactions.

Integration Options

Integration with e-commerce platforms and other third-party applications is crucial for seamless payment processing and automated order management.

How Payment Processors Work: The Technical Side

The payment processor securely transmits the data to the payment gateway[3], which verifies the details with the issuing bank. If the transaction is approved, the funds are transferred to the merchant’s account.

For businesses, integrating these payment processors is typically straightforward, with APIs provided for easy integration into websites or apps. Many processors also offer plugins for popular eCommerce platforms like WordPress, Shopify, and Magento.

Features to Look for in Payment Processing Software

When choosing a payment processor online tools in India [4]processor for your business, there are several key features to consider:

- Security Features: Ensure the processor complies with PCI-DSS standards and uses encryption to protect sensitive data.

- Multi-Currency Support: If your business is global, multi-currency support allows you to accept payments from customers worldwide.

- Mobile Compatibility: With mobile payments on the rise, make sure the processor is optimized for mobile use.

- Customer Support: 24/7 customer support and reporting tools are essential for troubleshooting issues and managing payments effectively[5].

Conclusion

In conclusion, payment processors play a crucial role in facilitating secure and efficient online transactions for businesses in India. When it comes to selecting Payment Processor Online Software Tools in India, businesses have a wealth of options designed to simplify transactions and improve efficiency. These tools offer seamless integration, security, and scalability, making them an essential part of any modern business. Whether you’re a small startup or a large enterprise, investing in the right payment processing solution can help you stay competitive, enhance customer experience, and streamline operations.

FAQS

- Is it feasible for me to employ more than one payment processor for conducting transactions within my business operations? Yes, many businesses use multiple payment processors to offer diverse payment options to their customers and mitigate risk.

- Are there any hidden fees associated with using payment processors? While most payment processors are transparent about their fee structures,.

- How long does it take to set up a payment processor for my business? The setup process varies depending on the payment processor and the complexity of integration required.

- Is it permissible to utilize multiple payment processors concurrently for my business needs? Implementing security measures such as SSL encryption and fraud detection algorithms.

- Can payment processors help me expand my business internationally? Yes, many payment processors offer features for accepting payments.