AUTHOR : SOOK

DATE : 14/12/2023

Introduction

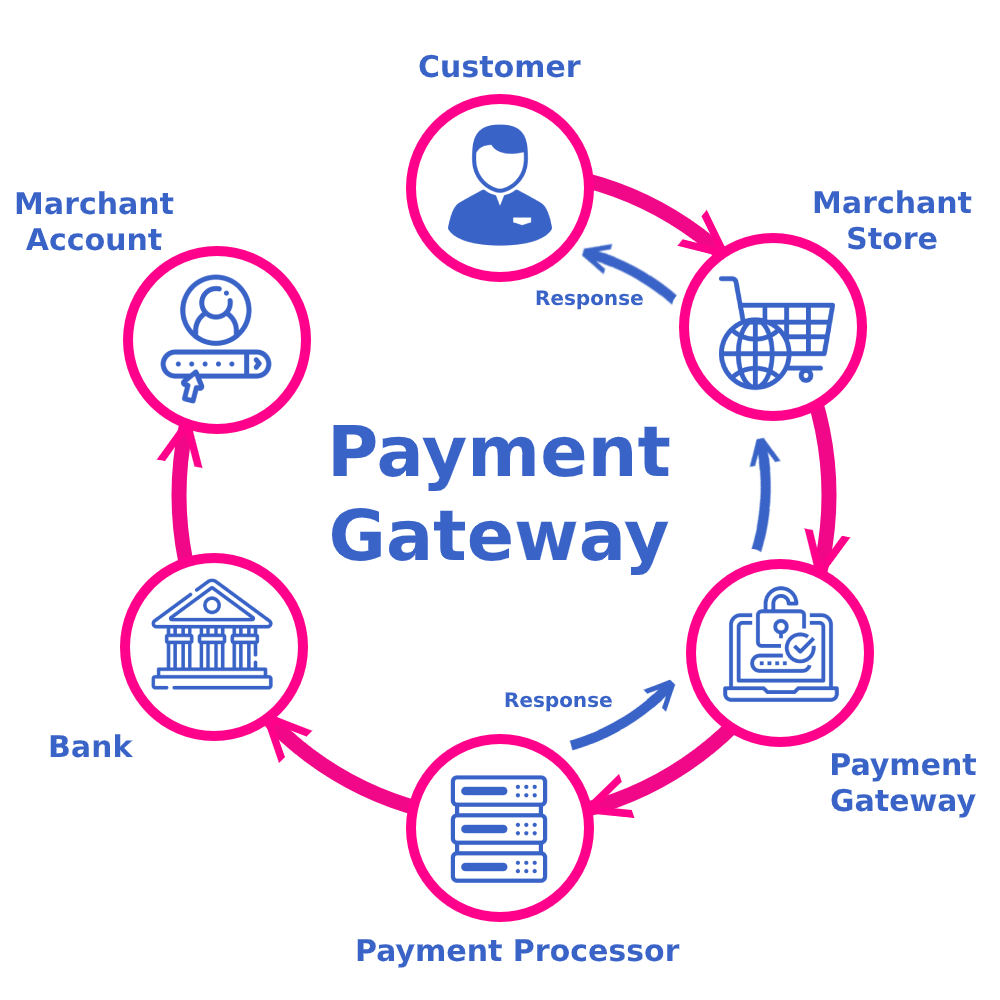

Understanding Payment Gateway Services

Payment processors act as intermediaries between a merchant and a financial institution, transactions by payment data. In India, these entities play a vital role in processing various forms of payments, including credit/debit cards, net banking, UPI, and digital wallets. A payment gateway is a technological that enables secure online transactions by authorizing payment between the buyer and the seller. In India, with the burgeoning e-commerce sector, payment gateways have become indispensable for facilitating swift and secure transactions.

Importance of Payment Gateways in India

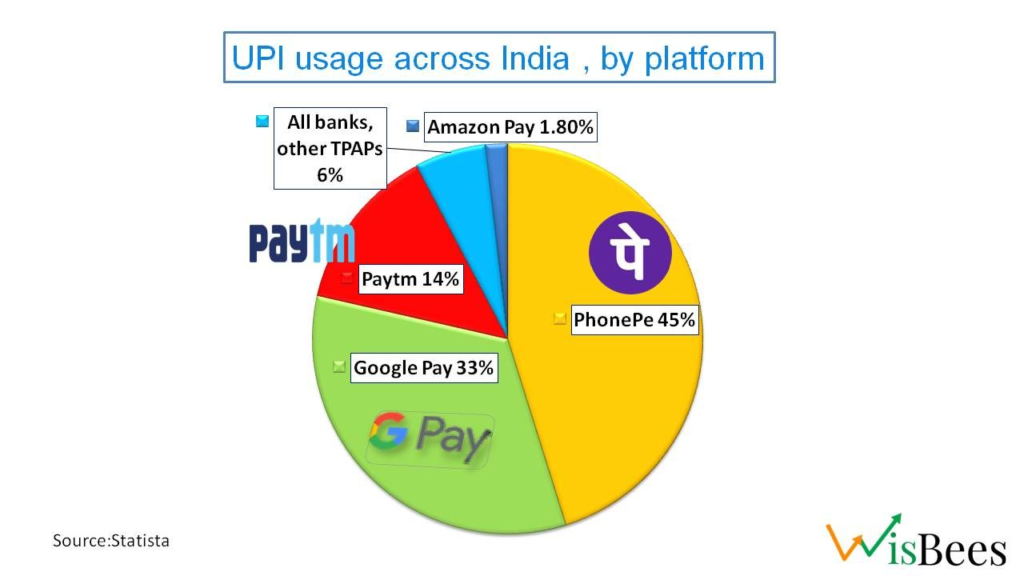

Key Players in the Indian Payment Processing Industry

The exponential growth of online businesses and digital transactions in India has elevated the significance of payment gateways. These services ensure reliability, encryption, authentication, and trust among consumers and businesses. in India’s competitive market, several prominent payment processors offer a spectrum of services. Comparing these players can assist merchants in selecting the most payment gateway for their business needs.

Comparison of Major Payment Processors

Popular Payment Gateway Services in India

From entities to emerging fintech , a diverse array of payment processors operates in India, each with unique features, pricing models, and service offerings. Services like Paytm, Razorpay, CCAvenue, and others have gained significant , offering customizable solutions, robust security features, and seamless integrations Payment processor Payment Gateway Services In India

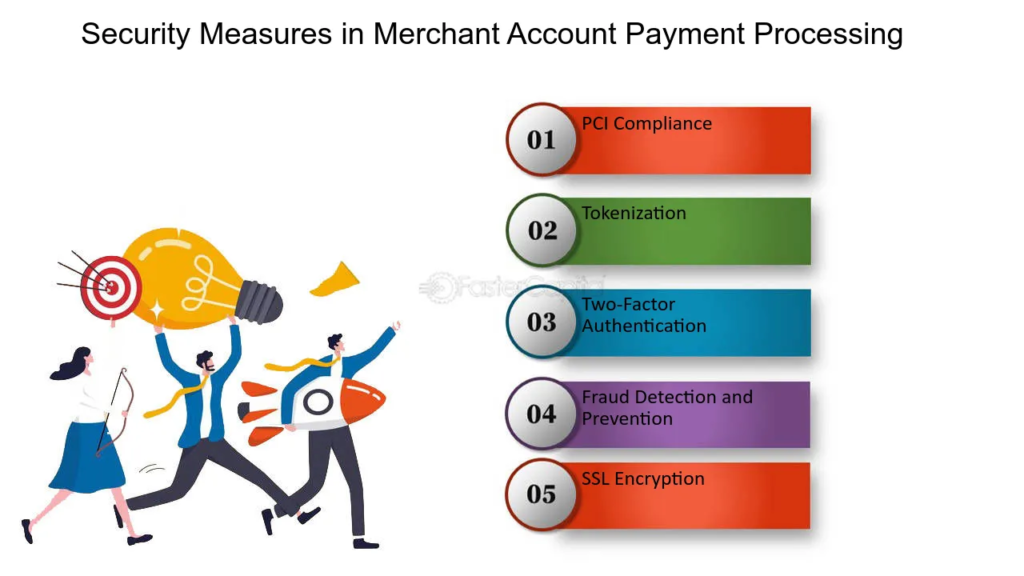

Security Measures in Payment Processing

Ensuring the security of online transactions is paramount. Payment system[1] gateways employ encryption protocols, tokenization, and stringent fraud prevention mechanisms to safeguard sensitive financial information.

Integration of Payment Gateways

E-commerce Platforms and Integration

For e-commerce businesses integrate a payment gateway[2] seamlessly into their platforms is crucial for enhancing customer experience and ensuring hassle-free transactions. With the surge in mobile-based transactions, payment gateways have their services to cater to the mobile-first approach, simplifying payments on handheld devices.

Regulatory Framework for Payment Gateways in India

RBI Guidelines and Regulations

The Reserve Bank of India (RBI) mandates guidelines and regulations that payment processors[3] must adhere to, ensuring compliance, security, and transparency in transactions. Stringent guidelines encompassing data localization, customer authentication, and risk management strategies govern the functioning of payment gateways in India.

Compliance and Licensing Requirements

Challenges Faced by Payment Processors in India

Entities operating in the Payment Platform[4] domain need to obtain specific licenses and adhere to regulatory compliance, contributing to a secure and trustworthy financial ecosystem. The ever-evolving technological landscape and competitive market pose challenges for payment processors. Adapting to new technologies, meeting customer demands, and staying ahead of the competition are ongoing hurdles.

Technological Challenges

Constant innovations necessitate payment processors to stay updated with the latest technologies, such as AI, blockchain, and biometrics, to enhance their services. Amidst the burgeoning competition, establishing a unique value proposition and ensuring cost-effectiveness are continuous challenges faced by payment processors.

Future Trends in Payment Gateway Services

Predictions for the Future of Payment Processing

As technology advances, the landscape of payment processing is poised for transformation. Anticipated advancements like contactless payments, voice commerce, and authentication methods are set to revolutionize payment gateways[5]. The integration of IoT, AI-driven fraud , and the expansion of cryptocurrency as a mode of payment are predicted to shape the future of payment processing in India.

Conclusion

In India’s rapidly evolving digital economy, payment processors and gateway services are pivotal for driving seamless and secure transactions. Adhering to regulatory frameworks, technological , and evolving consumer needs will be instrumental in shaping the future of payment processing in the country.

FAQs

- How do payment gateways ensure security during transactions?

- What are the key factors to consider while selecting a payment processor for a business?

- How does RBI regulate payment gateway services in India?

- What are the emerging trends in payment processing technology?

- Can cryptocurrencies become a mainstream mode of payment through payment gateways in India?