Author: NORA

DATE: 14-12-23

Introduction

In the dynamic landscape of financial transactions, payment processors have become the backbone of seamless and secure monetary exchanges As businesses strive to keep pace with technological advancements, the demand for efficient payment integration services in India is on the rise. This article delves into the evolution, significance, Payment Gateway Solutions challenges, and future prospects of payment and integration services in the Indian market

Evolution of Payment Processors

To understand the current state of payment integration Payment processor Payment Integration Services In India, E-commerce Payment Integration a glance at their evolution is essential. From traditional methods to the digital era, they have undergone a significant transformation. Online Payment Solutions Technological advancements, including the internet and mobile technology, have played a pivotal role in shaping the landscape of financial transactions.

Significance of Payment Integration Services

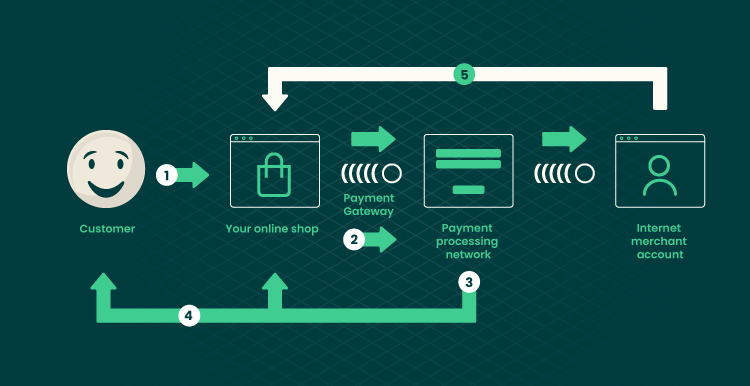

The seamless flow of transactions[1] is not just a convenience but a necessity for businesses in the modern era Payment gateway[2]services offer a bridge between consumers and businesses, ensuring a smooth and efficient exchange of funds. This not only enhances the overall user experience but also contributes to the growth of businesses Digital Payment Services[3] by fostering trust and reliability.

Key Features of Payment Integration Services in India

In a diverse market Payment API Integration[4] like India, payment integration services come with a set of distinctive features. Security remains a paramount concern, with robust measures in place to protect sensitive information. Multi-currency support caters to businesses dealing with international transactions[5] while seamless integration with popular platforms ensures accessibility for a wide range of users.

Top Payment Processors in India

An overview of the leading Integration integration services In India, it is crucial for businesses looking to choose the right service. Comparative analysis of their offerings, including transaction fees, processing speed, and customer support, aids in making an informed decision. The competition among these processors ultimately benefits businesses and consumers alike.

Challenges and Solutions

Despite the advantages, businesses often face challenges in the integration of payment services. These may include technical glitches, security concerns, and regulatory compliance. However, innovative solutions, such as advanced encryption methods and collaboration with regulatory bodies, are paving the way for smoother integration.

The regulatory landscape in India

The regulatory environment plays a significant role in shaping the operations of payment processors. Adherence to guidelines and compliance requirements is not just a legal obligation but also a means to build trust among users. Understanding the impact of regulations is crucial for businesses to navigate the complex landscape of financial transactions.

Trends Shaping Payment Integration

The future of payment integration is intertwined with emerging trends. The rise of mobile payments and integration with technologies like blockchain and AI are reshaping the way transactions occur. Businesses that embrace these trends are likely to stay ahead in the competitive market.

Case Studies

Real-world examples provide valuable insights into the impact of payment integration on businesses. Success stories highlight the benefits of seamless transactions, increased customer satisfaction, and improved operational efficiency. Lessons learned from these cases serve as a guide for businesses contemplating payment integration.

How to Choose the Right Payment Integration Service

Selecting the appropriate payment integration service is a critical decision for businesses. Factors such as security, compatibility with business operations, and transaction costs should be carefully considered. Tips for seamless integration can help businesses make the most of these services.

Future Prospects

The future of payment processors in India holds exciting possibilities. Anticipated advancements in technology, coupled with changing consumer preferences, are likely to shape the landscape. Businesses that stay abreast of these changes and adapt accordingly will be well-positioned for success.

Benefits for Small Businesses

Payment integration services are not exclusive to large enterprises. Small and medium-sized businesses can also reap the benefits of tailored solutions that are both affordable and scalable. Embracing payment integration levels the playing field, allowing businesses of all sizes to compete effectively.

Customer Testimonials

The real impact of payment integration is best reflected in the experiences of businesses and users. Customer testimonials provide a genuine perspective on the advantages of adopting these services. Positive feedback serves as a testament to the effectiveness and reliability of payment integration.

Security Measures in Payment Integration

Security is a paramount concern in financial transactions. This section explores the importance of secure transactions and outlines strategies to ensure data protection. Businesses and consumers alike must be aware of the measures in place to safeguard their financial information.

Conclusion

In conclusion, payment processors and their integration services play a pivotal role in the modern financial landscape of India. From ensuring secure transactions to fostering business growth, the benefits are manifold. Businesses that embrace these services and stay attuned to emerging trends will undoubtedly thrive in the ever-evolving world of financial transactions.

FAQs

- Q: Are payment integration services only for large businesses?

- A: No, payment integration services are designed to cater to businesses of all sizes, including small and medium enterprises.

- Q: How can businesses ensure the security of transactions during payment integration?

- Implementing advanced encryption methods and staying updated on security measures are crucial for ensuring the security of transactions.

- Q: What are the key factors to consider when choosing a payment integration service?

- A: Factors such as security, compatibility with business operations, and transaction costs should be carefully considered when choosing a payment integration service.

- Q: How do emerging technologies like blockchain and AI impact payment integration services?

- Emerging technologies enhance the efficiency and capabilities of payment integration services, offering innovative solutions and improved user experiences.

- Q: How often should businesses update their payment integration systems? Regular updates are recommended to ensure security, compatibility, and access to the latest features in payment integration services.