AUTHOR : ISTELLA ISSO

DATE : 28/02/2024

Introduction

In today’s rapidly evolving digital landscape, the installation of payment processor programs plays a pivotal role in shaping the future of financial transactions. As India witnesses a surge in online activities and a transition towards a cashless economy, understanding and implementing robust payment processor programs have become essential for businesses. This article delves into the nuances of payment processor program installations in India, exploring their benefits, popular choices, installation steps, security measures, case studies, challenges, and future trends. Payment Processor Program Installations In India

Understanding Payment Processor Programs

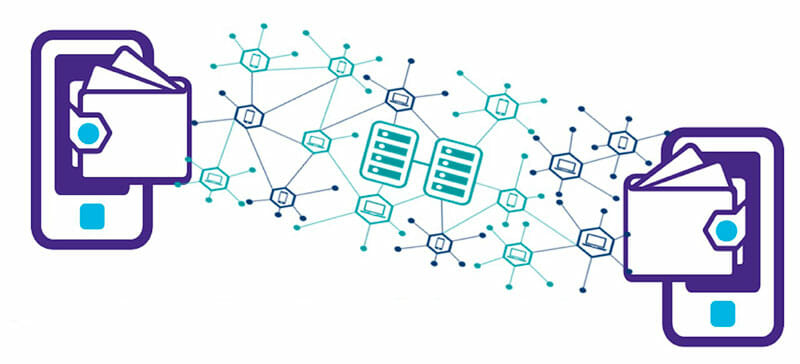

Payment processor programs are software applications that enable electronic transactions by transmitting payment information between the payer and the payee. They are designed to ensure the confidentiality and integrity of financial data, making them crucial in the age of digital commerce.

Benefits of Payment Processor Program Installations

Implementing payment processor programs in India offers numerous advantages for businesses and consumers alike. Payment Processor Program Installations In India

Enhanced Transaction Security

One of the primary benefits is the heightened security measures embedded in these programs, safeguarding sensitive information from potential threats.

Streamlined Payment Processes

These programs streamline payment processes, reducing complexities and providing a more efficient and convenient experience for users. By ensuring secure and seamless transactions, businesses can build trust with customers, leading to increased satisfaction and loyalty.

Popular Payment Processor Programs in India

Several payment processors[1] have gained popularity in the Indian market, each offering unique features and benefits. Leading the pack are programs like Paytm, Razorpay, and Instamojo, which have gained widespread adoption due to their reliability and user-friendly interfaces.

User-Friendly Interfaces and Integration Options

These programs boast user-friendly interfaces, making them accessible to businesses of all sizes. They also offer easy integration options with various platforms and applications[2].

Installation Steps for Payment Processor Programs

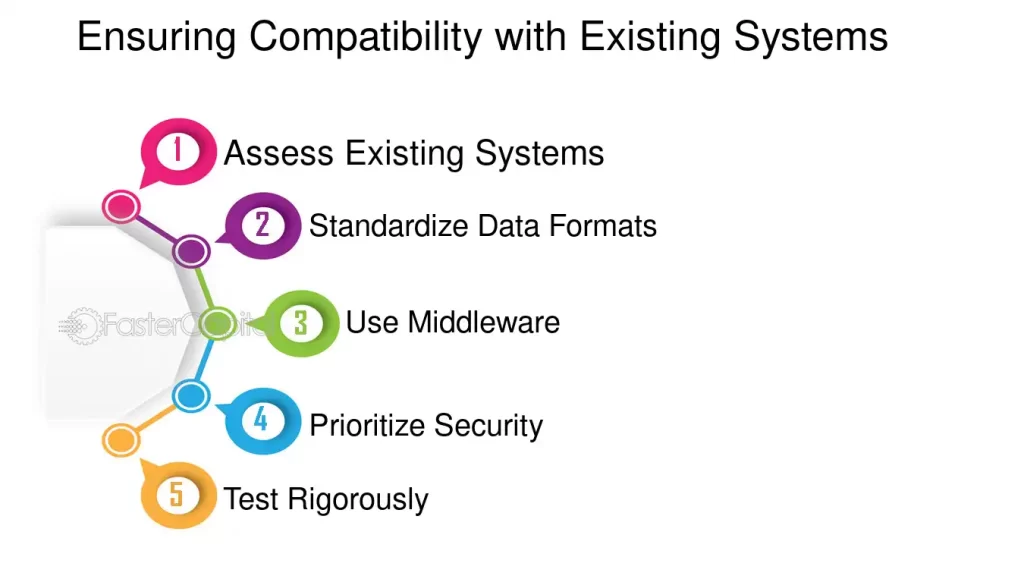

Implementing payment processor programs involves a systematic installation process[3], ensuring smooth integration with existing systems. The general installation process involves creating an account, configuring settings, and integrating the program into the business’s website or application.

Platform-Specific Guidelines

Different programs may have platform-specific guidelines, necessitating businesses to follow specific steps based on their chosen payment processor. Addressing common installation issues[4] promptly is crucial. This includes resolving compatibility issues, updating software, and ensuring a stable internet connection.

Case Studies

Examining successful case studies of businesses in India that have embraced payment[5] processor programs highlights the positive impact on revenue and customer experience.

Successful Implementations in Indian Businesses

Businesses like XYZ Retail and ABC Tech have witnessed remarkable growth in revenue and customer satisfaction after implementing payment processor programs. The integration of these programs has not only streamlined payment processes but has also led to an increase in sales and customer trust.

Security Measures in Payment Processor Programs

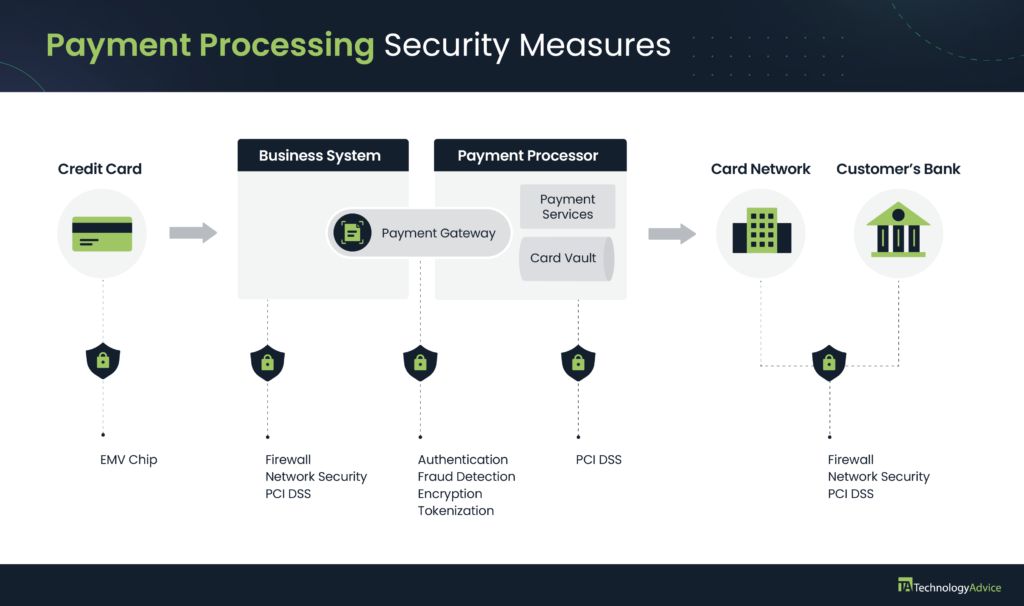

Security is paramount in payment processor programs, and businesses must prioritize measures to protect sensitive data. Implementing robust data encryption ensures that customer information remains confidential and secure during transactions. Adhering to industry standards and regulations is crucial for businesses to maintain the trust of customers and regulatory bodies.

Regular Updates and Patches

Frequent updates and patches are essential to address emerging security threats, keeping the payment processor programs resilient against potential vulnerabilities.

Challenges and Solutions

While the benefits of payment processor programs are evident, businesses may encounter challenges during the installation and integration process.

Addressing Common Challenges in Installations

Common challenges include compatibility issues with existing systems, technical glitches, and user resistance. These can be addressed through proper planning and communication.

Strategies to Overcome Integration Issues

Businesses can adopt strategies like thorough testing, employee training, and seeking support from the payment processor’s customer service to overcome integration challenges.

Ensuring Compatibility with Existing Systems

Ensuring compatibility with existing systems requires businesses to conduct thorough assessments and choose payment processor programs that seamlessly integrate with their infrastructure. As technology continues to evolve, the future of payment processing in India holds exciting possibilities.

Technological Advancements

Advancements in technologies like artificial intelligence and blockchain are likely to enhance the capabilities of payment processor programs, providing even more secure and efficient transactions.

Evolving Customer Expectations

Customers are expected to demand faster, more convenient, and secure payment options, driving further innovations in the payment processing landscape. The integration of payment processor programs with emerging technologies like blockchain may open new avenues for transparency and decentralization in financial transactions.

Conclusion

In conclusion, the installation of payment processor programs is not just a technological upgrade for businesses; it is a strategic move towards embracing the future of digital payments in India. Businesses that invest in secure and efficient payment processing solutions position themselves for success in an increasingly competitive and dynamic market.

FAQs

- Are payment processor programs suitable for all types of businesses?

- Yes, payment processor programs cater to businesses of various sizes and industries.

- How can businesses ensure the security of customer data during transactions?

- Implementing robust data encryption and regularly updating security measures are key to ensuring customer data security.

- What factors should businesses consider when choosing a payment processor program?

- Factors such as user-friendliness, integration options, security features, and customer support should be considered.

- Can businesses switch payment processor programs once installed?

- While it’s possible, it’s advisable to carefully plan and execute the transition to minimize disruptions.

- What role do payment processor programs play in the growth of e-commerce in India?

- Payment processor programs facilitate secure and efficient transactions, contributing significantly to the growth of e-commerce in India.