AUTHOR: ROSE KELLY

DATE: 23/02/2023

Introduction to Payment Processor Relationship Marketing

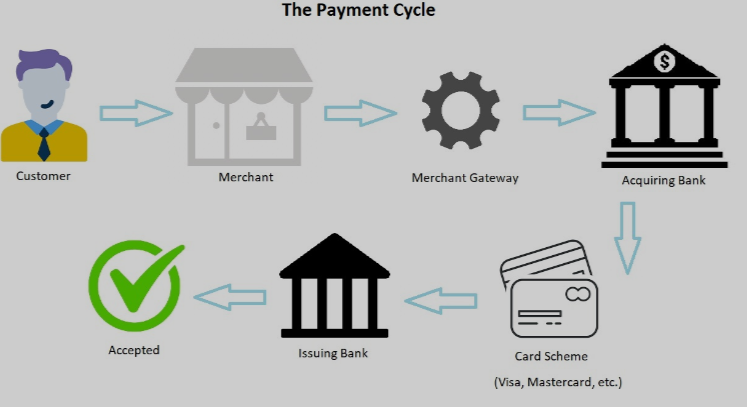

In the fast-paced digital world of commerce, the relationship between payment processors and merchants holds significant importance. Payment processor relationship marketing in India has become a crucial aspect of business strategy, facilitating seamless transactions and fostering long-term connections with customers.

Understanding Relationship Marketing

Definition of Relationship Marketing

Relationship marketing revolves around nurturing enduring relationships with customers, focusing on customer satisfaction and loyalty rather than one-time transactions. Payment processor Relationship Marketing in India It emphasizes understanding customers’ needs and preferences to deliver personalized experiences.

Importance in the Payment Processing Industry

In the realm of payment processing, where competition is fierce, relationship marketing plays a pivotal role in retaining merchants and attracting new ones. Building strong relationships fosters trust and loyalty, leading to increased revenue and market share.

The Rise of Payment Processors in India

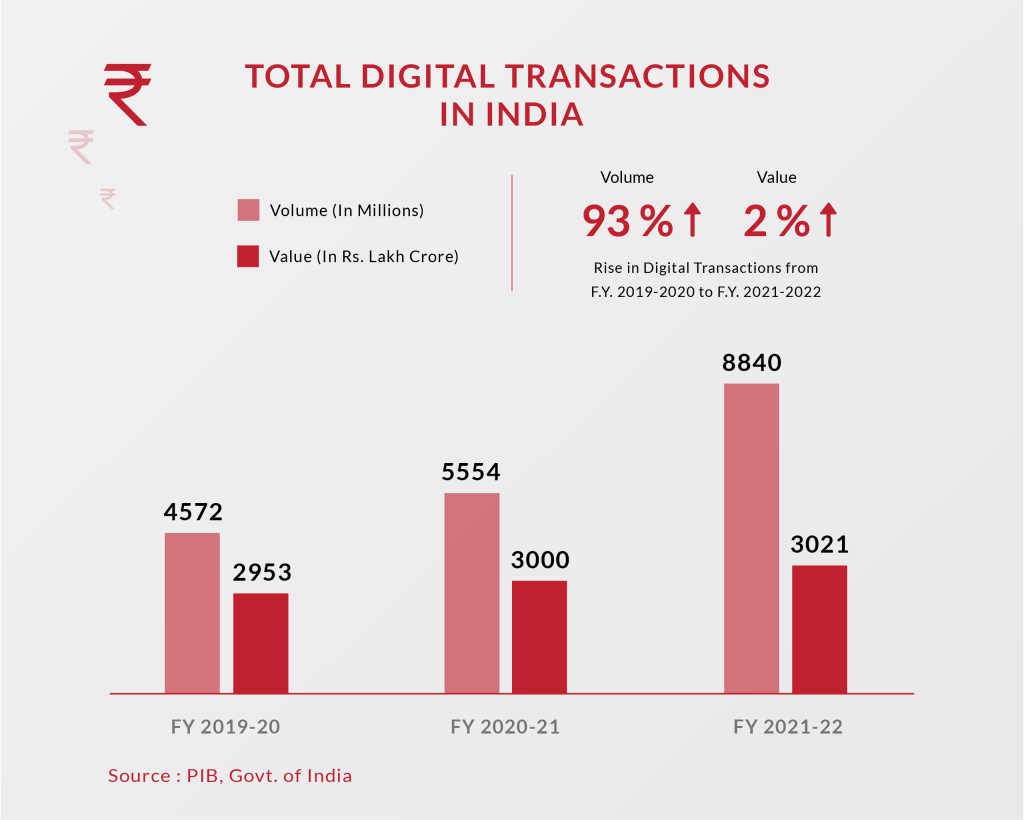

India has witnessed a remarkable surge in e-commerce activities and digital payment adoption in recent years. The proliferation of smartphones and internet connectivity has fueled this growth, making India a lucrative market for payment processors.

Growth of E-commerce

The booming e-commerce sector has led to a surge in online transactions, necessitating efficient payment processing system[1] solutions. Payment processors enable merchants to accept various payment methods, catering to the diverse needs of online shoppers.

Digital Payment Trends

With the Indian government’s push towards a cashless economy and the rise of digital wallets and UPI payments, payment processors have become indispensable for businesses of all sizes. They provide secure and convenient payment solutions, driving the digital transformation economy of India’s[2]

Challenges Faced by Payment Processors

Despite the immense payment opportunities[3] processors encounter several challenges in the Indian market.

Competition

The payment processing landscape in India is highly competitive, with both domestic and international players vying for market share. To stay ahead, payment processing solution[4] must differentiate themselves through innovative solutions and superior customer service.

Security Concerns

As digital transactions increase, so do security threats such as fraud and data breaches. Payment processors must invest in robust security measures to protect sensitive financial information and build trust among merchants and consumers.

Regulatory Hurdles

The regulatory environment in India can be complex and subject to frequent changes, posing challenges for payment processors. Compliance with regulations such as RBI guidelines and data protection laws is essential to operate smoothly in the Indian market.

Implementing Relationship Marketing Strategies

To overcome these challenges and thrive in the Indian market, payment processors must adopt effective relationship marketing strategies.

Building Trust and Credibility

Trust is the cornerstone of successful relationships. Payment processing partnerships[5] should prioritize transparency, reliability, and integrity to earn the trust of merchants and consumers alike.

Personalized Customer Experiences

Understanding customers’ preferences and behavior allows payment processors to tailor their services to meet individual needs. Personalization enhances customer satisfaction and fosters loyalty, driving long-term growth.

Loyalty Programs

Rewarding loyal customers with exclusive benefits and incentives strengthens their emotional connection to the brand. Loyalty programs encourage repeat business and can serve as a powerful marketing tool for payment processors.

Customer Support and Communication Channels

Accessible customer support and effective communication channels are essential for resolving issues promptly and building rapport with merchants. Payment processors should offer multiple support options, including live chat, email, and phone support, to cater to diverse preferences.

Case Studies of Successful Relationship Marketing in India

Paytm

Paytm, India’s leading digital payments platform, has built a robust ecosystem of services catering to diverse customer needs. Through its loyalty program, Paytm Rewards, it incentivizes users to make transactions and engage with the platform regularly.

Razorpay

Razorpay, a popular payment gateway provider, focuses on delivering a seamless payment experience for businesses. Its personalized approach to customer service and innovative product offerings have helped it gain traction among merchants.

Future Trends and Innovations

Looking ahead, payment processors in India are poised to embrace emerging technologies and trends to stay ahead of the curve.

AI and Machine Learning

AI and machine learning algorithms can enhance fraud detection, improve payment security, and personalize user experiences. Payment processors are increasingly leveraging these technologies to drive innovation and efficiency.

Blockchain Technology

Blockchain technology holds promise for revolutionizing payment processing by enabling secure, transparent, and decentralized transactions. Payment processors are exploring blockchain-based solutions to enhance security and streamline cross-border payments.

Conclusion

In conclusion, payment processor relationship marketing in India is essential for driving business growth and fostering customer loyalty. By understanding customers’ needs, embracing innovation, and prioritizing trust and transparency, payment processors can navigate the challenges and capitalize on the vast opportunities in India’s dynamic market.

FAQs

- What role do payment processors play in relationship marketing? Payment processors facilitate seamless transactions and help businesses build strong relationships with customers through personalized experiences and loyalty programs.

- How can payment processors address security concerns in the Indian market? Payment processors can invest in advanced security measures, such as encryption and fraud detection algorithms, to safeguard sensitive financial information and build trust among users.

- What are some key strategies for implementing relationship marketing in the payment processing industry? Strategies such as building trust, personalizing customer experiences, implementing loyalty programs, and offering exceptional customer support are crucial for successful relationship marketing in the payment processing industry.

- How do emerging technologies like AI and blockchain impact payment processor relationship marketing? Emerging technologies like AI and blockchain enable payment processors to enhance security, streamline transactions, and deliver personalized experiences, thereby strengthening their relationships with merchants and consumers.

- What are some examples of successful relationship marketing initiatives by payment processors in India? Paytm’s loyalty program and Razorpay’s personalized customer service are notable examples of successful relationship marketing initiatives by payment processors in India.