AUTHOR : BELLA

DATE : FEBRUARY 29, 2024

Introduction to Payment Processor Software

In today’s digital era, payment processor software plays a pivotal role in facilitating secure and efficient transactions for businesses across various industries. Whether you’re a small startup or a large enterprise, having the right payment processor software is essential to streamline your financial operations and enhance customer satisfaction.

Key Features of Payment Processor Software

Payment processor software comes with a myriad of features designed to meet the diverse needs of businesses. These include:

- Secure transactions: ensuring the safety of sensitive financial data through encryption and fraud detection mechanisms.

- Multiple payment options: accepting payments via credit/debit cards, net banking, UPI, wallet, and other popular modes.

- Integration capabilities: seamlessly integrating with e-commerce platforms, POS systems, and accounting software.

- Reporting and analytics: providing insights into sales trends, transaction volumes, and customer behavior.

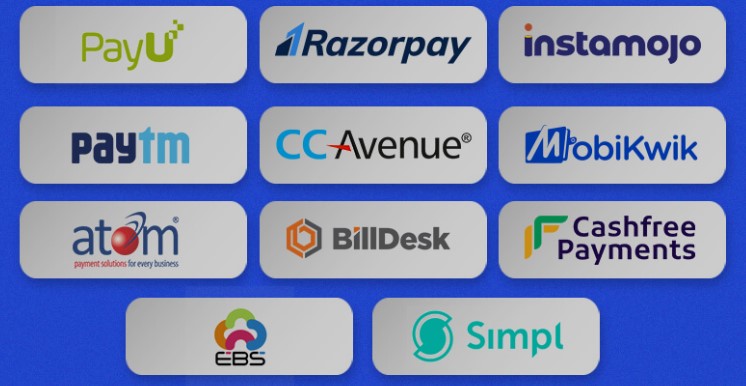

Popular Payment Processor Software Solutions in India

India boasts a vibrant fintech ecosystem, with several homegrown payment processor software solutions catering to the needs of businesses. Some of the prominent ones include:

- PayU: Known for its robust security features and user-friendly interface, PayU offers a comprehensive suite of payment solutions for online businesses.

- Razorpay: With its simple integration process and competitive pricing, Razorpay has emerged as a popular choice among startups and SMEs.

- Instamojo: Ideal for small businesses and freelancers, Instamojo enables hassle-free payments via links, QR codes, and payment pages.

- CCAvenue: One of the oldest players in the market, CCAvenue offers a wide range of payment options and customizable solutions for businesses of all sizes.

Comparison of Payment Processor Software Solutions

When choosing a payment processor software solution, it’s essential to consider factors such as pricing, features, and customer support. While some providers may offer lower transaction fees, others might excel in terms of integration capabilities or customer service.

Selecting the appropriate payment processor software involves several considerations.

Selecting the right payment processor software for your business requires careful consideration of several factors. These include:

- Assessing business needs: identify your specific requirements of transaction[1] volume, payment methods, and integration with existing systems.

- Compatibility with existing systems: ensuring seamless integration with your website, POS system, or accounting software.

- Scalability: Choosing a solution that can accommodate your business’s growth and evolving needs.

- Security measures: prioritizing providers that offer robust security features to safeguard against fraud and data breaches.

Steps to Implement Payment Processor Software

Once you’ve selected a payment processor software solution, the implementation process typically involves the following steps:

- Integration process: working with your chosen provider to integrate the software with your website or POS system.

- Testing phase: conducting thorough testing to ensure the software functions[2] correctly and processes transactions securely.

- Training for staff: Providing training to your staff members on how to use the software effectively and handle customer inquiries.

- Go-live phase: launching the software and monitoring its performance closely to identify any issues or areas for improvement.

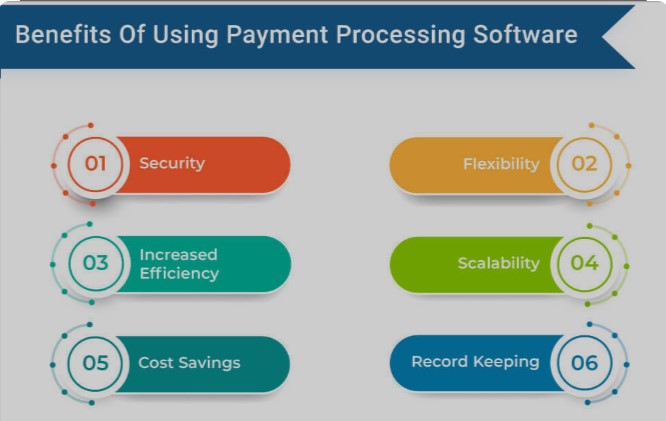

Benefits of Using Payment Processor Software in India

The adoption of payment processor software offers several benefits for businesses operating in India, including:

- Improved cash flow: accelerating the speed of transactions and reducing the time it takes to receive payments from customers.

- Enhanced customer experience: providing customers with a seamless and convenient payment experience[3] leads to higher satisfaction and repeat business.

- Streamlined operations: automating payment processes and reducing manual errors, thereby improving efficiency and productivity.

- Better security: Implementing advanced security measures to protect against fraud and ensure the integrity of financial transactions.

Challenges of Payment Processor Software Adoption

While payment processor software[4] offers numerous advantages, businesses may encounter certain challenges during the adoption process, including:

- Initial setup costs: Investing in hardware, software licenses, and integration services can be expensive, especially for small businesses with limited budgets.

- Technical issues: dealing with technical glitches, system downtime, or compatibility issues with existing infrastructure.

- Regulatory compliance: ensuring compliance with local regulations and data protection laws, which may vary depending on the industry and region.

Future Trends in Payment Processor Software

Looking ahead, several trends are expected to shape the evolution of payment processor software, including:

- Mobile payment solutions: The proliferation of smartphones and mobile wallets[5] is driving the demand for mobile-friendly payment options that offer convenience and accessibility.

- Blockchain technology: exploring the potential of blockchain-based payment solutions to enhance security, transparency, and efficiency in financial transactions.

- Artificial intelligence: Leveraging AI-powered algorithms for fraud detection, risk assessment, and personalized customer experiences.

Case Studies of Successful Implementation

Numerous businesses in India have successfully implemented payment processor software to streamline their operations and drive growth. Examples include:

- E-commerce businesses use payment processor software to offer secure and convenient payment options to online shoppers, leading to increased sales and customer satisfaction.

- Retail stores: Integrating payment processor software with POS systems to accept card payments and track sales data in real-time, enabling better inventory management and decision-making.

- Service providers are leveraging online invoicing and payment solutions to streamline billing processes and accelerate payment collections, resulting in improved cash flow and profitability.

Conclusion

In conclusion, payment processor software plays a crucial role in facilitating seamless and secure financial transactions for businesses in India. By choosing the right solution and effectively implementing it, businesses can enhance their operational efficiency, improve customer satisfaction, and stay competitive in today’s digital economy.

FAQs

- What is payment processor software?

Payment processor software is a technology solution that enables businesses to accept and process payments from customers via various channels, such as credit and debit cards, net banking, and digital wallets. - How do I choose the best payment processor software for my business?

When selecting a payment processor software solution, consider factors such as your business’s specific needs, compatibility with existing systems, scalability, and security features. - Can payment processor software handle international transactions?

Many payment processor software solutions support international transactions, allowing businesses to accept payments from customers worldwide in different currencies. - What security measures should I look for in payment processor software?

Look for payment processor software that offers robust security features, such as encryption, tokenization, and fraud detection algorithms, to protect against data breaches and unauthorized access. - How can payment processor software help improve the customer experience?

Payment processor software streamlines the payment process, making it faster, more convenient, and more secure for customers, thereby enhancing their overall experience with your business.