AUTHOR : BELLA

DATE : MARCH 1, 2024

Streamlining Financial Transactions

In today’s digital age, where online transactions are becoming increasingly prevalent, having a reliable payment processor and web-based software is crucial for businesses in India. These software solutions facilitate secure and efficient financial transactions, catering to the diverse needs of businesses operating in the Indian market.

Why Payment Processor Web-Based Software is Essential in India

India is experiencing rapid digitization, with more businesses and consumers embracing online transactions. Payment processor web-based software plays a vital role in facilitating these transactions by providing a seamless and secure platform for processing payments.

Top Features of Payment Processor Web-Based Software

Secure Transactions

One of the primary features of payment processor web-based software is its ability to ensure secure transactions. These software solutions employ advanced encryption techniques to safeguard sensitive financial information, protecting both businesses and their customers from potential cyber threats.

User-Friendly Interface

Another essential feature is a user-friendly interface that makes it easy for businesses to manage their transactions efficiently. Intuitive dashboards and streamlined processes enhance the user experience, allowing businesses to navigate the software with ease.

Integration Capabilities

Payment processor web-based software often comes with integration capabilities, allowing seamless integration with other business systems such as accounting software or e-commerce platforms.

Transaction Reporting

Comprehensive transaction reporting features enable businesses to gain insights into their financial activities. Detailed reports and analytics help businesses make informed decisions and optimize their financial strategies.

Popular Payment Processor Web-Based Software in India

Several payment processor web-based software solutions are widely used in India, catering to the diverse needs of businesses. Some popular options include Razorpay, PayU, Instamojo, and Paytm.

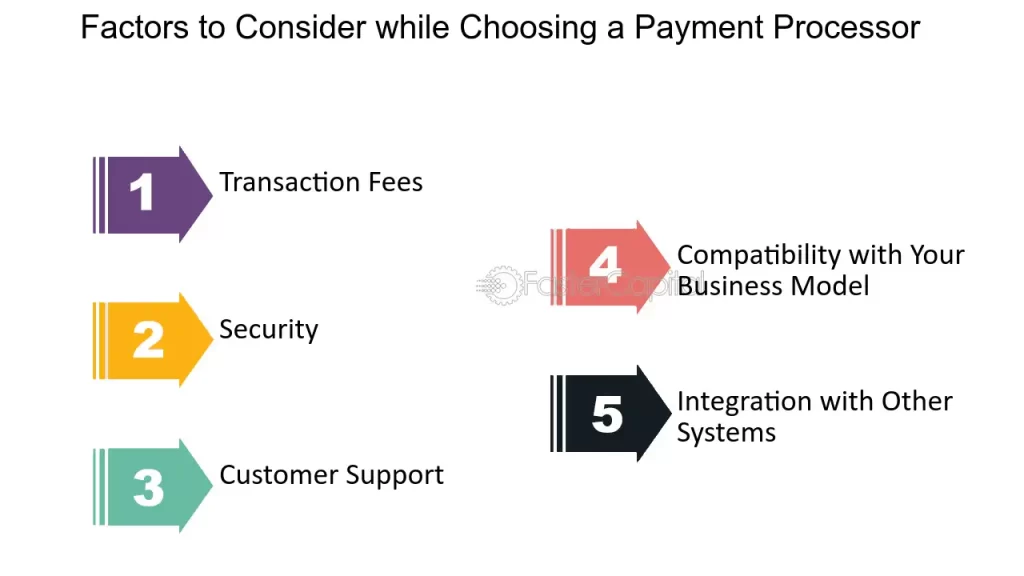

Factors to Consider When Choosing Payment Processor Web-Based Software

When selecting payment processor web-based software for their business, companies need to consider several factors to ensure they choose the right solution for their needs.

Security Measures

Security should be a top priority when choosing payment processor web-based software. Look for solutions that offer robust security features such as encryption, tokenization, and fraud detection capabilities.

Pricing

Consider the pricing structure of the software, including setup fees, transaction fees, and any additional costs. Choose a solution that offers transparent pricing and aligns with your budget.

Scalability

Opt for web-based payment processor software that can scale with your business as it grows. Scalable solutions can accommodate increasing transaction volumes and adapt to changing business needs.

Customer Support

Choose a provider that offers responsive customer support and comprehensive assistance to ensure a smooth user experience.

How Payment Processor Web-Based Software Benefits Businesses

Efficiency in Transactions

Payment processor web-based software streamlines financial transactions, reducing manual errors and processing times. This efficiency translates into improved productivity and operational efficiency for businesses.

Global Reach

With the ability to process payments from customers worldwide, payment processor web-based software expands the reach of businesses, enabling them to tap into new markets and grow their customer base.

Reduced Costs

By automating payment processes and eliminating the need for manual intervention, web-based payment processor software helps businesses reduce operational costs and increase profitability.

Challenges Faced with Payment Processor Web-Based Software in India

Despite their benefits, payment processor web-based software also presents some challenges for businesses in India.

Security Concerns

Security remains a significant concern, with the risk of data breaches and cyber attacks posing a threat to businesses and their customers.

Compliance Issues

Navigating regulatory compliance requirements can be complex, particularly in a dynamic regulatory environment like India. Businesses need to ensure they adhere to all relevant regulations to avoid penalties and fines.

Technical Glitches

Technical glitches and system downtime can disrupt operations and impact the user experience. Businesses should have contingency plans in place to mitigate the impact of such issues.

Future Trends of Payment Processor Web-Based Software in India

Looking ahead, the future of payment processor web-based software in India is promising. Advancements in technology, such as blockchain and artificial intelligence, are expected to enhance security and efficiency further. Moreover, increased adoption of mobile payments and digital wallets will drive the demand for innovative payment solutions.

Conclusion

In conclusion, payment processor web-based software plays a pivotal role in facilitating financial transactions for businesses in India. With their myriad benefits, including secure transactions, scalability, and efficiency, these software solutions are indispensable for navigating the digital landscape. However, businesses must carefully evaluate their options and address challenges such as security concerns and compliance issues to maximize the benefits of payment processor web-based software.

FAQs

- What is payment processor web-based software?

Payment processor web-based software facilitates secure and efficient financial transactions for businesses operating online. - How do I choose the right payment processor and web-based software for my business?

Consider factors such as security measures, pricing, scalability, and customer support when selecting payment processor web-based software. - What are some popular payment processor web-based software options in India?

Popular options include Razorpay, PayU, Instamojo, and Paytm. - What challenges do businesses face with payment processor web-based software in India? Challenges include security concerns, compliance issues, and technical glitches.

- What are the future trends of payment processor web-based software in India?

Future trends include advancements in technology, such as blockchain and AI, and increased adoption of mobile payments and digital wallets.