AUTHOR: LUCKY MARTINS

DATE: 30/12/2024

The Ultimate Guide

In the flourishing world[1] of jewelry e-commerce, selecting the right payment processor is crucial for enhancing customer trust, ensuring secure transactions, and optimizing [2]the overall shopping experience. With an abundance of options available, it’s important to understand what factors to consider when choosing a payment processor tailored to your jewelry business[3]. This comprehensive guide will cover key considerations, popular payment processors[4], and address frequently asked questions.

Why Payment Processors Matter in Jewelry E-Commerce

Security and Trust

Jewelry purchases often involve significant financial transactions[5]. A trustworthy payment processor not only protects sensitive data but also enhances your brand’s reputation.

Customer Experience

A smooth and efficient checkout process is essential for minimizing cart abandonment. Payment processors that offer multiple payment options and quick transaction times can significantly improve the customer experience.

Cost-Effectiveness

Different payment processors have varying fee structures, which can impact your overall profitability. Understanding these costs is key to selecting a processor that fits your budget.

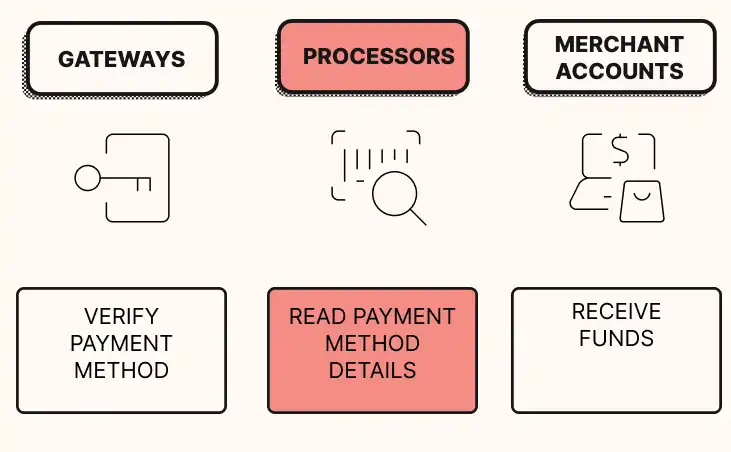

Key Features to Look for in a Payment Processor

When evaluating payment processors for your jewelry e-commerce business, consider the following features:

1. Security Measures

Look for processors that comply with PCI DSS (Payment Card Industry Data Security Standards). They should provide robust encryption and fraud detection tools to safeguard customer information.

2. Fee Structures

Different processors have varying fee models, including transaction fees, monthly fees, and chargeback fees. Choose a processor with transparent pricing that aligns with your business model.

3. Integration Capabilities

The payment processor should easily integrate with your existing e-commerce platform (such as Shopify, WooCommerce, or Magento) for seamless operation.

4. Payment Options

Offering a variety of payment methods—such as credit cards, digital wallets, and buy now, pay later options—can cater to diverse customer preferences and improve conversion rates.

5. Customer Support

Reliable customer service is essential for resolving any issues that may arise. Look for processors that offer 24/7 support through multiple channels.

Popular Payment Processors for Jewelry E-Commerce

1. PayPal

Overview: PayPal is one of the most widely recognized payment processors globally. It offers a user-friendly experience and is trusted by millions.

Pros:

- Extensive buyer protection policies.

- Supports international transactions.

- Easy integration with most e-commerce platforms.

Cons:

- Transaction fees can be high for lower-priced items.

- Risk of account holds if unusual activity is detected.

2. Stripe

Overview: Stripe is ideal for tech-savvy businesses looking for customizable solutions. It offers advanced features for developers.

Pros:

- Flexible API for tailored payment solutions.

- Supports multiple currencies and payment methods.

- Transparent pricing with no hidden fees.

Cons:

- It requires some technical knowledge for setup.

- Limited direct customer support compared to others.

3. Square

Overview: Square is popular among small to medium-sized businesses for its straightforward pricing and integrated point-of-sale solutions.

Pros:

- No monthly fees and clear transaction pricing.

- Easy-to-use dashboard with inventory management tools.

- Good for both online and in-person sales.

Cons:

- Limited international support.

- Higher fees for online transactions compared to in-person sales.

4. Authorize.Net

Overview: A subsidiary of Visa, Authorize.Net provides reliable payment processing services and has been in the industry for over 20 years.

Pros:

- Strong fraud protection features.

- Supports recurring billing options.

- Reliable customer service.

Cons:

- Monthly gateway fees can add up.

- The user interface may feel outdated to some users.

5. Adyen

Overview: Adyen is a global payment processor that offers a unified platform for managing payments in multiple currencies.

Pros:

- Wide range of supported payment methods.

- Advanced analytics and reporting tools.

- Strong security features.

Cons:

- Complex pricing structure that may confuse small businesses.

- Best suited for larger enterprises with significant transaction volumes.

How to Choose the Right Payment Processor

Assess Your Business Needs

Consider your transaction volume, customer demographics, and the types of products you sell. If you anticipate high-value transactions, prioritize security features and reliable support.

Compare Fee Structures

Analyze the fee structures of potential processors. Some may charge higher upfront fees but offer lower transaction costs, while others might have no monthly fees but higher transaction fees.

Evaluate Integration Capabilities

Ensure that the payment processor integrates seamlessly with your existing e-commerce platform. A complicated setup can lead to frustration and lost sales.

Look for Scalability

Choose a payment processor that can grow with your business. As your jewelry e-commerce store expands, you may need additional features or support.

Conclusion

Selecting the right payment processor is a critical decision for your jewelry e-commerce business. By understanding the unique needs of your business, evaluating different processors based on key features, and considering customer experience, you can make an informed choice. Whether you opt for PayPal, Stripe, Square, Authorize.Net, or Adyen, the right payment processor will enhance your customers’ shopping experience, build trust, and ultimately contribute to your business’s success.

FAQ:

1. What fees can I expect from payment processors?

Fees typically include transaction fees (a percentage of the sale), monthly fees, chargeback fees, and potentially setup fees. Always review the pricing details before committing.

2. Can I switch payment processors later?

Yes, most e-commerce platforms allow you to change payment processors. However, switching may involve some technical work and potential downtime.

3. How can I ensure the security of customer payments?

Select a payment processor that complies with PCI DSS and offers encryption and fraud detection. Displaying security badges on your site can also help build trust.

4. Is it necessary to offer multiple payment options?

Yes, providing various payment options can reduce cart abandonment and cater to different customer preferences, ultimately leading to higher conversion rates.

5. How long does it take to set up a payment processor?

Setup time can vary based on the complexity of your e-commerce platform and the chosen processor. Many can be set up within a few hours, while more complex integrations may take longer.