AUTHOR : SELENA GIL

DATE : 25/12/2023

Introduction

In the ever-evolving landscape of financial transactions, payment processors have become instrumental in shaping India’s economic trajectory. This article delves into the pivotal role played by payment processors in streamlining collections within the Indian market.

Payment processors, the facilitators of electronic transactions, have observe a significant evolution in India. Their importance in revolutionizing the payment ecosystem cannot be overstated

What is payment processing?

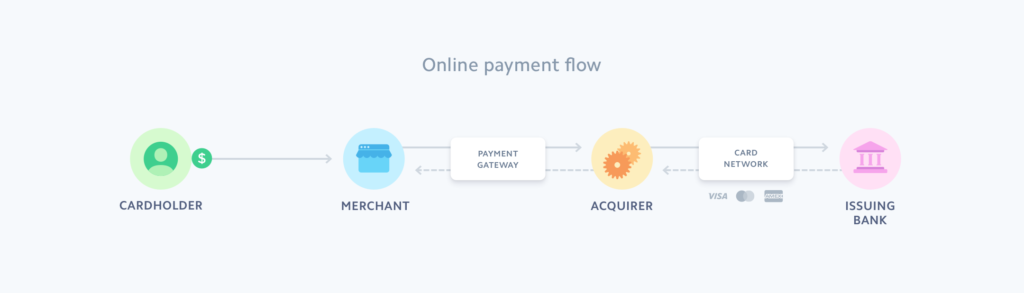

Payment processing involves the movement of funds from a payer to a recipient through various digital channels, encompassing multiple modes such as credit/debit cards, digital wallets, UPI Unified Payments Interface, and more. It serves as the backbone of financial transactions, facilitating seamless money transfer.

Importance of Efficient Payment Processing in Collections

In the domain of collections, where timely receipt of funds is crucial, efficient payment processing ensures the smooth functioning of financial operations. It becomes particularly critical in India, given its diverse landscape of payment methods and regulatory intricacies.

Challenges in Collections Process in India

India presents a mosaic of payment methods[1] and systems, making the collections process multifaceted and challenging. Moreover, the regulatory landscape adds complexity, requiring adept handling and compliance adherence.

Role of Payment Processors

Payment processors play a vital role in streamlining collections by leveraging technology to smoothen payment flows. They ensure compliance with regulations and Payment Processors Streamline Your Collections Processes[2] in India provide secure channels for financial transactions.

Key Features to Look for in Payment Processors

When seeking a Payment Processing Solutions[3], flexibility in handling various payment modes and seamless integration with existing systems are essential. The ability to adapt and cater to diverse transaction needs is paramount.

Popular Payment Processors in India

Advantages of Using a Reliable Payment Processor

Several companies offer payment processing solutions tailored for Indian collections. Understanding their profiles, offerings, and conducting a comparative analysis assists in making an informed choice.

Deploying a reliable payment processor enhances Collection effectiveness[4] expediting the receipt of funds while significantly improving the overall customer experience.

Best Practices for Implementing Payment Processors

Future Trends in Payment Processing for Collections

Implementing collecting online payments[5] necessitates effective training and onboarding procedures. Continuous monitoring and optimization further refine the collection process.

The future of payment processing in Indian Payment Processors Streamlining Collections in India collections foresees technological innovations catering to evolving consumer preferences. This could revolutionize transaction methods, ensuring more secure and user-friendly experiences.

Innovations in Technology

Technological advancements are at the forefront of Payments Data is Revolutionizing[5]. Contactless payments have gained significant traction, especially in a post-pandemic world, due to their convenience and hygiene factors. The use of near-field communication (NFC) and QR codes enables swift and secure transactions without physical contact.

Biometric Authentication

Biometric authentication methods, such as fingerprint and facial recognition, are being integrated into payment systems. These methods offer heightened security by using unique biological traits for user verification, enhancing the overall safety of transactions.

Blockchain Technology

Blockchain technology is gaining momentum for its potential in transforming payment processing. Its decentralized nature ensures secure and Payment Processors Streamlining Collections in India transparent transactions, reducing the risk of fraud and enhancing trust between parties involved in collections.

Enhanced Mobile Wallets

Mobile wallets are evolving to offer more than just payment functionality. They’re becoming comprehensive financial ecosystems, integrating services like bill payments, investments, and even insurance. These enhancements provide users with a one-stop solution for various financial needs.

Security and Compliance

Maintaining stringent security measures and compliance with regulations is imperative in financial transactions. A reputable payment processor prioritizes data security and compliance adherence, safeguarding sensitive information during transactions.

Integration Capabilities

The ability to seamlessly integrate with existing systems is a hallmark of a good payment processor. This integration streamlines operations, reducing the likelihood of disruptions in the collections process.

Analytics and Reporting

Advanced payment processors offer robust analytics and reporting tools. These insights empower businesses with valuable data on transaction trends, customer behavior, and financial performance, enabling informed decision-making.

Conclusion

In essence, the role of payment processors in the collections process in India cannot be overstated. Their efficiency, security measures, and ability to adapt to dynamic payment landscapes are pivotal for a streamlined financial ecosystem.

FAQs

- What are the primary challenges faced in payment processing for collections in India?

- How do payment processors contribute to enhancing customer experience in collections?

- Which factors should one consider when selecting a payment processor for collections?

- Are there emerging trends in payment processing that might revolutionize collections in India?

- What measures can companies take to ensure smooth implementation of payment processors for collections?