AUTHOR: SONIA ROY

Introduction

The jewelry industry has long been a target for fraudsters due to the high value of the goods and the potential for anonymous transactions[1]. As a jewelry business owner or an e-commerce platform selling luxury items, ensuring the security of your payments is critical to protecting your reputation, customer trust, and profits. That’s where payment processors[2] with fraud protection for jewelry come into play. These specialized systems are designed to minimize risks and safeguard both buyers and sellers in the jewelry sector.

In this article, we will explore the importance of fraud protection[3] in the jewelry industry and discuss the top payment processors that offer this essential feature. We’ll also answer frequently asked questions about securing online jewelry sales and reducing the likelihood of chargebacks, fraud, and payment-related issues.

Why Payment Processors with Fraud Protection Are Vital for Jewelry Businesses

Jewelry transactions[4] involve high-value products, making them attractive targets for fraudulent activity. Payment fraud can come in various forms, such as stolen credit cards, account takeovers, or chargeback fraud, where the customer disputes a legitimate purchase. Payment processors with fraud protection for jewelry[5] can prevent or minimize the financial and reputational damage caused by these incidents.

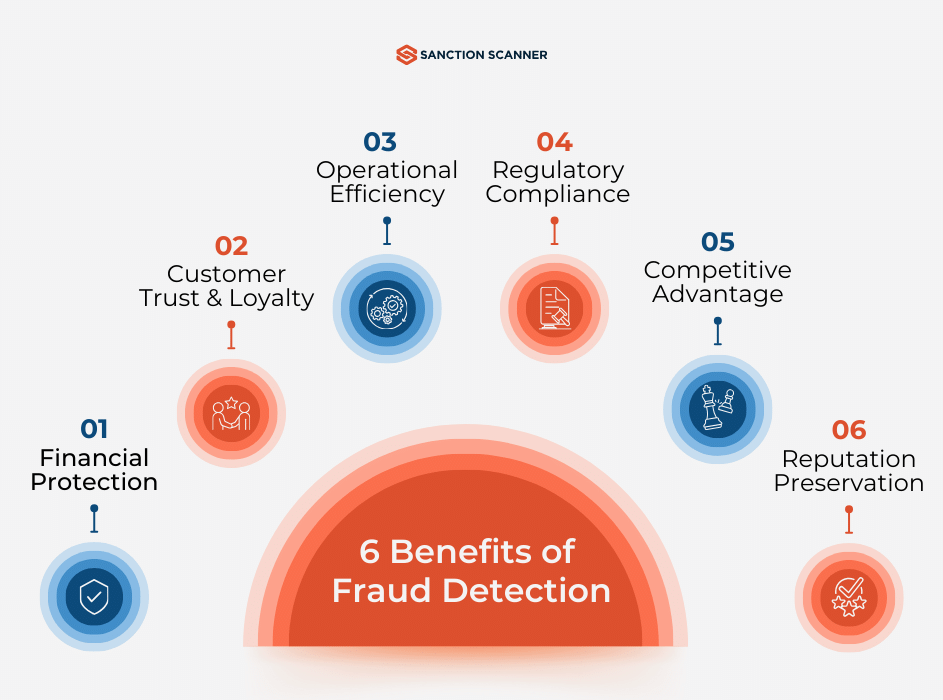

Fraud protection helps jewelry businesses in the following ways:

- Reduced Chargebacks: Chargebacks are a common problem in online sales, especially in the luxury goods sector. Fraud protection systems monitor transactions for suspicious activity, reducing the likelihood of chargebacks.

- Increased Customer Trust: Offering secure payment options can build trust with customers. Knowing their sensitive information is protected, customers are more likely to make purchases.

- Compliant with Industry Standards: Many payment processors ensure compliance with Payment Card Industry Data Security Standards (PCI DSS). This is crucial for keeping customer data safe and avoiding penalties for non-compliance.

- Prevention of Payment Fraud: By utilizing fraud protection tools like machine learning algorithms and real-time transaction monitoring, payment processors can detect and block fraudulent transactions before they affect your business.

Top Payment Processors with Fraud Protection for Jewelry Businesses

1. Stripe

Stripe is one of the most popular payment processors globally, offering robust fraud protection tools for jewelry businesses. Its machine learning algorithms, powered by Radar, detect and prevent fraudulent transactions in real time. Stripe also includes features like card authentication and device fingerprinting to enhance security.

- Fraud Protection Features: Stripe Radar uses machine learning to evaluate the risk level of each transaction and automatically blocks high-risk payments. The system also offers customizable rules for specific business needs, including jewelry sales.

- Advantages for Jewelry Businesses: Stripe’s seamless integration with e-commerce platforms, competitive fees, and built-in fraud protection make it an excellent choice for jewelry businesses of all sizes. Additionally, it supports recurring payments for subscription-based jewelry services.

2. PayPal

PayPal has long been a trusted name in the online payment industry, and it offers fraud protection for jewelry retailers. With over 300 million active users, PayPal provides a secure environment for jewelry transactions and includes advanced fraud detection tools that monitor purchases for suspicious activity.

- Fraud Protection Features: PayPal’s advanced fraud protection includes risk management tools, 24/7 transaction monitoring, and seller protection programs that cover eligible items. It also offers features like identity verification and a dispute resolution process.

- Advantages for Jewelry Businesses: PayPal is widely recognized, and many customers feel comfortable using it for online purchases. Jewelry businesses can integrate PayPal easily into their websites and benefit from its comprehensive fraud protection.

3. Square

Square offers a full suite of payment processing solutions with built-in fraud prevention tools, making it ideal for both brick-and-mortar and online jewelry businesses. The company provides a comprehensive fraud detection system that monitors every transaction to identify patterns associated with fraudulent behavior.

- Fraud Protection Features: Square’s fraud protection includes encryption, tokenization, and real-time fraud monitoring. Additionally, Square offers chargeback protection to help businesses recover lost funds.

- Advantages for Jewelry Businesses: Square’s transparent pricing structure and simple integration make it ideal for jewelry businesses looking for an easy-to-use payment processor with fraud protection. The company also offers a range of tools for inventory management, sales tracking, and customer insights.

4. Authorize.Net

Authorize.Net is another popular payment processor with built-in fraud detection tools designed to protect jewelry businesses. It offers advanced fraud detection capabilities, including automated transaction screening, IP address blocking, and customizable filters to detect and prevent fraudulent activity.

- Fraud Protection Features: Authorize.Net provides a suite of fraud detection tools, including the Advanced Fraud Detection Suite (AFDS), which uses customizable filters and rules to block suspicious transactions. It also offers 3D Secure and tokenization to secure cardholder information.

- Advantages for Jewelry Businesses: Authorize.Net is ideal for jewelry businesses because it offers a wide range of payment options, including credit card payments, e-checks, and digital wallets. The fraud protection tools ensure that transactions are secure, reducing the risk of fraud and chargebacks.

5. Worldpay

Worldpay is a global leader in payment processing, providing fraud protection solutions tailored to the needs of jewelry businesses. With a focus on reducing payment fraud, Worldpay uses machine learning and artificial intelligence to detect unusual purchasing behavior.

- Fraud Protection Features: Worldpay uses advanced fraud prevention tools that include real-time transaction monitoring, risk scoring, and customizable fraud filters. The platform also offers 3D Secure authentication for added protection.

- Advantages for Jewelry Businesses: Worldpay supports a variety of payment methods and currencies, making it an excellent choice for international jewelry sales. The platform’s advanced fraud protection tools ensure that your transactions are secure, reducing the risk of fraudulent chargebacks.

How Payment Processors with Fraud Protection Benefit Jewelry Sales

In the jewelry industry, sales often involve high-value items and frequent international transactions. This makes fraud prevention a key aspect of your business’s success. Here’s how payment processors with fraud protection can positively impact your jewelry business:

- Reduced Losses: By preventing fraudulent transactions, jewelry businesses can avoid the financial losses that come with chargebacks and payment fraud.

- Enhanced Customer Experience: A secure payment process reassures customers, improving the likelihood of repeat business and positive reviews.

- Scalability: As your jewelry business grows, the risk of fraud increases. Using a payment processor with fraud protection ensures your payment system can scale while maintaining security.

- Compliance: These payment processors help you meet compliance standards, ensuring that your business adheres to industry regulations, which is essential for long-term success.

Conclusion

Payment processors with fraud protection for jewelry are indispensable tools for protecting your business from the growing threat of fraud. Whether you’re a small boutique or a large e-commerce platform, the right payment processor can help secure transactions, prevent chargebacks, and ensure customer trust. By carefully selecting a payment processor with robust fraud protection, you can focus on growing your jewelry business with peace of mind, knowing that your payments are secure and your customers are protected.

FAQs

1. What is fraud protection in payment processing?

Fraud protection in payment processing refers to tools and systems that help identify and prevent fraudulent transactions. This includes transaction monitoring, identity verification, and fraud detection algorithms that protect both the merchant and the customer from fraud.

2. Do payment processors with fraud protection offer chargeback prevention?

Yes, most payment processors with fraud protection offer chargeback prevention tools. These tools monitor transactions in real time and use algorithms to detect suspicious activity that could lead to chargebacks.

3. Why is fraud protection important for jewelry businesses?

Jewelry businesses are high-value targets for fraudsters. Payment processors with fraud protection help jewelry retailers secure transactions, reduce chargebacks, and protect both customer data and the business’s reputation.

4. Are there any payment processors with fraud protection for international jewelry sales?

Yes, many payment processors, including PayPal, Worldpay, and Stripe, offer fraud protection tools that are suitable for international transactions. These tools monitor transactions across borders and ensure the security of payments from global customers.

5. Can fraud protection systems reduce false positives?

Yes, advanced fraud protection systems use machine learning and sophisticated algorithms to reduce the likelihood of false positives—legitimate transactions being flagged as fraudulent. This improves the user experience and minimizes the disruption to legitimate sales.