AUTHOR: LUCKY MARTINS

DATE: 30/12/2024

E-Commerce

As the jewelry e-commerce market[1] grows, offering recurring billing options can be an innovative way to increase customer retention[2], boost sales, and create a steady revenue stream. Payment processors with recurring billing capabilities provide jewelry businesses with the tools to offer subscription services[3], installment payments, or membership-based pricing, all of which can be valuable for businesses selling high-end jewelry or luxury items.

In this guide, we’ll explore the concept of recurring billing, why it’s beneficial for jewelry e-commerce[4], and the best payment processors [5]that offer recurring billing solutions.

What is recurring billing?

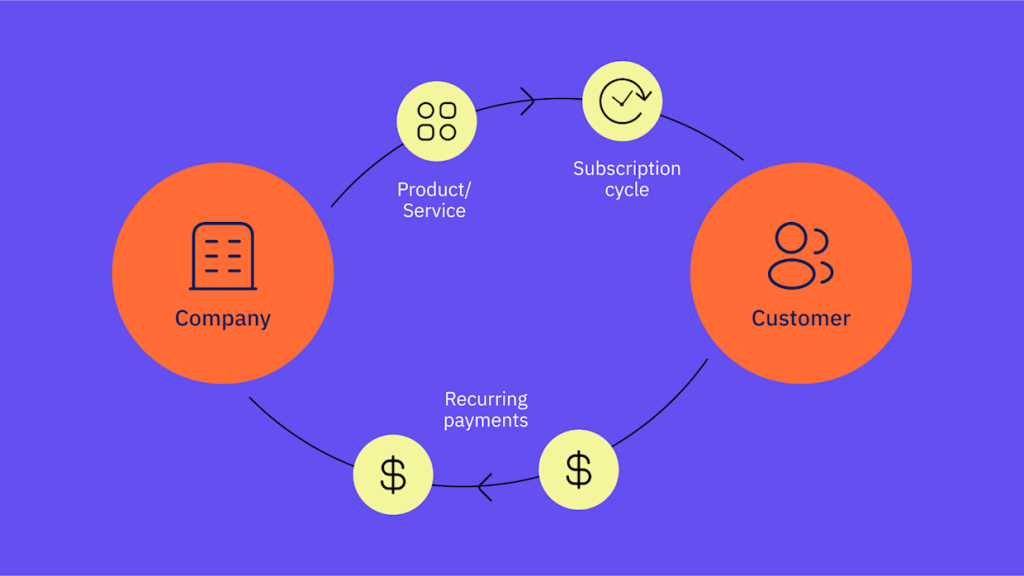

Recurring billing is a payment model that allows businesses to automatically charge customers on a regular basis for products or services.

Why is recurring billing important for jewelry e-commerce?

Recurring billing provides numerous advantages for jewelry e-commerce stores, especially those dealing with high-value items. Here’s why you should consider integrating recurring billing into your payment processing strategy:

1. Increased Customer Retention

- By offering subscription models or payment plans, customers are more likely to return, which helps build long-term relationships. Jewelry businesses can also provide customers with access to exclusive collections, making them feel valued and more committed to the brand.

2. Steady Revenue Stream

- Recurring billing provides predictable income, making financial forecasting easier and more reliable. Instead of waiting for large, sporadic payments, jewelry businesses can enjoy regular payments that help with cash flow management.

3. Increased Accessibility

- High-ticket jewelry can be a significant financial burden for some customers. By offering installment payment options, you make jewelry more accessible to a broader audience, potentially increasing your customer base.

4. Subscription-Based Models

- Offering a jewelry subscription box (for example, delivering a new piece of jewelry every month) can create a unique and ongoing relationship with customers. This model not only encourages repeat purchases but also allows you to introduce customers to new pieces they might not have considered otherwise.

5. Customization and Flexibility

- Payment processors that offer recurring billing allow businesses to customize their subscription and installment plans to meet specific customer needs. You can adjust the billing cycle, offer flexible pricing, or tailor discounts to improve customer loyalty.

Top Payment Processors for Jewelry E-Commerce with Recurring Billing

1. Stripe

Overview:

Stripe is a popular and developer-friendly payment processor known for its flexibility and scalability. It provides businesses with robust tools for subscription management, making it an ideal choice for jewelry stores that wish to offer recurring billing. Stripe’s recurring billing features allow businesses to create custom subscription plans and manage payments with ease.

Key Features:

- Flexible Recurring Billing: Stripe’s recurring billing service is highly customizable, allowing you to define your billing cycles, pricing models, and even offer trial periods.

- Global Payments: Stripe supports over 135 currencies, making it a great option for jewelry businesses that sell internationally.

- Easy Integration: Stripe integrates with popular e-commerce platforms like Shopify, WooCommerce, and BigCommerce, which simplifies the process for businesses looking to add recurring billing.

- Automated Invoicing and Receipts: Stripe automatically sends invoices and payment receipts, making it easier for jewelry businesses to manage transactions.

Best For:

Stripe is perfect for businesses that need customization and flexibility, especially if you’re operating at scale.

Key Features:

- Subscription Plans: PayPal allows businesses to create subscription-based billing plans, where customers can pay in installments or set up recurring payments.

- Global Reach: PayPal supports payments in over 200 countries and 25 currencies, which is beneficial for jewelry businesses looking to attract international customers.

- Security: PayPal uses advanced encryption and fraud protection measures, ensuring secure transactions for jewelry businesses and their customers.

Best For:

PayPal is ideal for businesses looking for a simple, reliable, and globally accepted recurring billing solution.

3. Square

Overview:

Square is a highly user-friendly payment processor that provides both in-person and online payment solutions. It offers subscription billing capabilities that are perfect for jewelry businesses looking to simplify their recurring payment system. Square’s recurring billing system is easy to set up, with no monthly fees for businesses that use it.

Key Features:

- Subscription Billing: Square allows businesses to create subscription models for products and services, including jewelry sales and memberships.

- Recurring Payments: Customers can set up automatic payments for subscriptions, allowing them to receive jewelry on a regular basis without needing to manually input payment details.

- Integrated POS System: Square’s POS system works seamlessly with its online platform, making it easy to manage both physical and online sales in one place.

- Low Fees: Square offers competitive pricing with a transparent fee structure, which can be a great advantage for small to medium-sized jewelry businesses.

Best For:

Square is best for jewelry businesses that need a simple, cost-effective, and easy-to-integrate solution for recurring billing.

4. Authorize.Net

Overview:

It’s ideal for jewelry e-commerce stores that require extensive customization and support for high-value transactions.

Key Features:

- Advanced Recurring Billing: Authorize.Net allows businesses to set up complex subscription models with different billing cycles, pricing, and discounts.

- Flexible Payment Methods: The platform supports various payment methods, including credit cards, debit cards, and digital wallets.

- Customer Management: Authorize.Net provides tools for managing customer data, which can be helpful for businesses offering personalized jewelry subscription services.

- Fraud Protection: The platform offers built-in fraud detection tools to ensure secure transactions for high-value jewelry items.

Best For:

Authorize.Net is ideal for businesses that require a customizable and secure solution for managing recurring payments, particularly those with higher ticket prices.

5. Braintree

Overview:

Jewelry stores can use Braintree’s recurring billing feature to manage installment payments or subscriptions.

Key Features:

- Customizable Recurring Billing: Braintree allows businesses to define flexible payment schedules and offer unique subscription plans.

- Multi-currency Support: Braintree supports payments in multiple currencies, making it perfect for jewelry stores that sell to international customers.

- Integration with Platforms: Braintree integrates with a wide range of e-commerce platforms like Shopify, Magento, and WooCommerce.

- Advanced Fraud Protection: Braintree offers advanced tools to protect against fraudulent transactions.

Best For:

Braintree is ideal for businesses looking for flexible, secure, and international recurring billing solutions.

Conclusion

Incorporating recurring billing into your jewelry e-commerce store can offer a range of benefits, including improved cash flow, customer loyalty, and greater accessibility to your products. By selecting the right payment processor, you can easily manage subscription models, installment payments, and membership plans, helping you grow your business while offering your customers a seamless shopping experience.

FAQ:

1. What is recurring billing?

Recurring billing is a payment model where customers are charged automatically at regular intervals (e.g., monthly, quarterly) for products or services. It’s often used for subscription-based services or installment payments.

2. How do I set up recurring billing for my jewelry store?

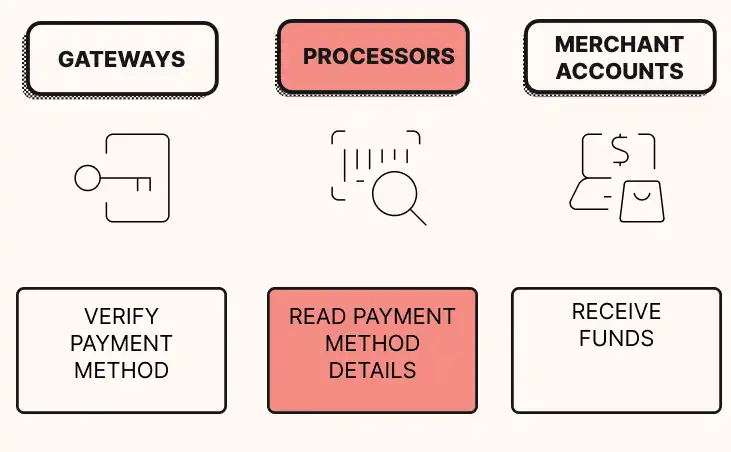

To set up recurring billing, you need to choose a payment processor that offers subscription or installment payment features. Most processors, like Stripe and PayPal, have user-friendly dashboards where you can create and manage recurring billing plans.

3. What are the benefits of recurring billing for a jewelry store?

Recurring billing can increase customer retention, provide a steady revenue stream, and make high-ticket jewelry more accessible to customers by allowing installment payments.

4. Are there any fees associated with recurring billing?

Yes, most payment processors charge transaction fees for recurring payments, as well as setup or monthly fees depending on the service. It’s important to compare pricing before selecting a processor.

5. Can recurring billing be used for both physical and digital jewelry products?

Yes, recurring billing can be used for both physical jewelry products (e.g., subscription boxes, installment payments) and digital jewelry products (e.g., digital designs, online consultations).