AUTHOR : MISTYY TAK

DATE : 01/03/2024

Introduction

In India, the financial landscape is rapidly evolving, and payment providers play a pivotal role in facilitating transactions between businesses and consumers. However, with the growing complexity and risk associated with payment processing, the need for robust assessment and grading software is paramount.

Why is payment provider assessment and grading software important?

In the digital era, businesses rely heavily on payment providers to handle transactions. However, not all payment providers are created equal. Some may offer better security features, while others may have lower transaction fees. Payment provider assessment and grading software help businesses evaluate the various payment providers and choose the one that best meets their needs.

Impact on Businesses

For businesses, choosing the right payment provider is crucial. A reliable and secure payment provider can help improve customer satisfaction, reduce transaction fees, and increase sales. On the other hand, a poor choice of payment provider can lead to security breaches, customer complaints, and loss of revenue.

Importance of Assessment and Grading Software

The performance of payment providers can vary significantly based on factors such as transaction speed, reliability, and security. As a result, businesses need a way to assess and grade the performance of these providers in order to make informed decisions

Payment Provider Assessment and Grading Software in India

In India, several assessment and grading[1] software solutions have emerged to meet the needs of businesses and consumers. These platforms analyze various metrics, such as transaction success rates, fraud detection, and customer support quality, to provide comprehensive assessments of payment[2] providers.

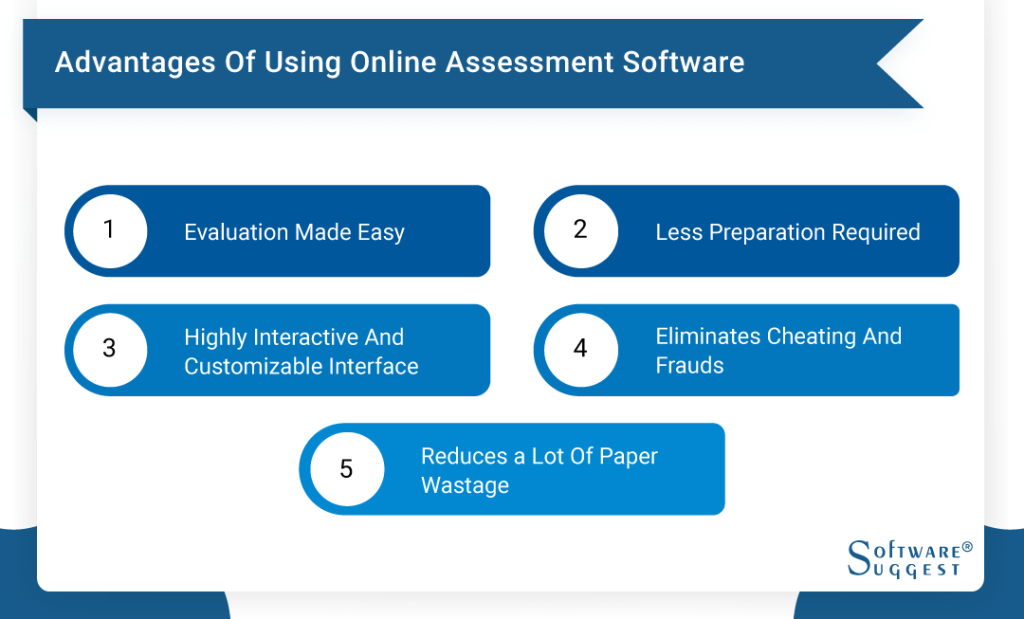

Advantages of Using Assessment and Grading Software

One of the primary benefits of using assessment and grader software is the ability to compare and evaluate payment providers[3] objectively. This can help businesses identify the most reliable and cost-effective options for their needs.

Payment Provider Assessment and Grading Software in India

As technology continues to evolve, so do the methods we use to evaluate and assess various systems. In India, one particular area where this evolution is evident is in payment provider assessment and grading software. This article will explore the importance of software[4], its impact on businesses, the features to consider, and how to select the right payment provider assessment and ggradesoftware for your needs.

How to Select the Right Payment Provider Assessment and Grading Software

To select the right payment provider assessment and grading software for your business, consider the following steps:

Research: Research different software solutions[5] and compare their features and pricing.

Trial: Take advantage of free trials or demos to test the software before committing.

Consultation: Seek advice from industry experts or other businesses that have used the software.

Feedback: Consider customer reviews and feedback on the software.

Customization: Look for software that can be customized to meet your specific needs.

Challenges Faced by Payment Providers

Despite the advantages of assessment and grading software, payment providers in India face several challenges. These include compliance with regulations, integration with existing systems, and ensuring the security of transactions.

The Future of Payment Provider Assessment and Grading Software

As the payment industry continues to evolve, assessment and grading software will play an increasingly important role. Advances in artificial intelligence and machine learning will enable more sophisticated analysis of payment provider performance.

Conclusion

In conclusion, payment providers are a critical part of the financial ecosystem in India. By using assessment and grading software, businesses can make informed decisions and ensure that their payment processing needs are met efficiently and securely.

FAQs

1. What is payment provider assessment and grading software? Payment provider assessment and grading software are tools that help businesses evaluate and choose the best payment providers for their needs.

2. How does payment provider assessment and grading software work? These software solutions analyze various aspects of payment providers, such as security, reliability, and cost, and provide businesses with a comprehensive assessment.

3. How can payment provider assessment and grading software benefit my business? By helping you choose the right payment provider, this software can improve customer satisfaction, reduce transaction fees, and increase sales.

4. What are some popular payment provider assessment and grading software solutions? Some popular payment provider assessment and grading software solutions include Brightfield Payment Assurance, Payment Provider Analyzer, and Checkbook.io.

5. How can I get access to payment provider assessment and grading software? You can get access to payment provider assessment and grading software by visiting the official website of the software provider and following the instructions to sign up.