AUTHOR : SOFI PARK

DATE : 25/12/2023

Introduction

In simple terms, a Payment Provider Collection Agency is an entity that specializes in recovering unpaid dues on behalf of businesses. This includes outstanding payments, defaulted loans, and unresolved

financial obligations. As India witnesses a surge in digital transactions and the proliferation of diverse payment channels, the need for effective debt recovery mechanisms becomes paramount. Payment provider collection agencies bridge the gap between businesses and defaulting customers, ensuring a smooth flow of financial transactions.

The Role of Payment Providers

Facilitating Digital Transactions

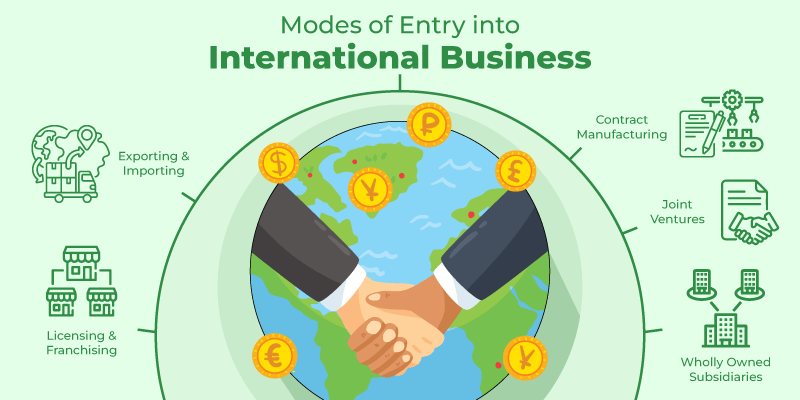

Payment providers act as the backbone of the digital payment ecosystem, enabling businesses to accept payments through various channels such as online transactions, mobile wallets, and electronic fund transfers.

Ensuring Secure and Seamless Payments

The role of payment providers extends beyond facilitating transactions. They are also responsible for implementing robust security measures to safeguard sensitive financial information, instilling trust among users. In a dynamic market, businesses often face challenges related to non-payment. Collection agencies step in to navigate the complexities of recovering unpaid dues, employing strategies that align with legal frameworks.

Navigating Legal Frameworks

Collection agencies[1] must operate within the bounds of the law. Understanding and navigating the legal landscape is crucial to ensure ethical and effective debt recovery.

Key Features of Payment Provider Collection Agencies

Integration with Various Payment Channels

An effective payment provider[2] collection agency seamlessly integrates with diverse payment channels, providing businesses with a comprehensive solution for recovering dues. Given the sensitivity of financial data, top-notch security measures are imperative. Introduction to collecting online payments agencies invest in cutting-edge technologies to safeguard the confidentiality of customer informatio

Customized Solutions for Businesses

Recognizing that each business has unique needs, payment provider collection agencies offer tailored solutions, considering factors such as industry type, customer base, and the nature of transactions. Businesses encounter challenges related to non-payment, ranging from delayed payments to outright defaults. Payment collection[3] agencies specialize in addressing these issues through strategic and ethical means

Strategies for Effective Debt Recovery

Successful debt recovery requires a combination of strategic planning, communication skills, and adherence to legal processes. Payment provider collection agencies employ proven strategies to recover dues while maintaining positive customer relationships.

Regulatory Landscape in India

Compliance Requirements for Collection Agencies

Payment provider collection agencies must adhere to stringent regulatory requirements set by the government. Debt collection[4] Compliance ensures fair and transparent practices in debt recovery. The Indian government actively participates in creating an environment that promotes fair practices in debt recovery. Various initiatives and regulatory updates aim to protect the interests of both businesses and consumers.

Advantages for Businesses

Improving Cash Flow

Successful Debt Collection[5] positively impacts a business’s cash flow, ensuring a steady stream of funds for operational expenses and growth initiatives. Payment provider collection agencies prioritize maintaining positive relationships with customers. Clear communication and ethical practices contribute to preserving customer goodwill.

Future Trends

Technological Advancements in Payment Collections

The future of payment provider collection agencies lies in embracing technological advancements such as AI and machine learning to enhance the efficiency of debt recovery processes. As the financial landscape evolves, regulatory frameworks governing payment provider collection agencies are likely to undergo changes. Staying informed about these changes is crucial for businesses.

Choosing the Right Payment Provider Collection Agency

Factors to Consider

Selecting the right payment provider collection agency requires careful consideration of factors such as reputation, track record, and the ability to tailor services to meet specific business needs. Clear and transparent payment terms from the outset contribute to minimizing the risk of non-payment issues.

Best Practices for Businesses

Proactive Measures to Prevent Unpaid Dues

Implementing proactive measures, such as regular communication with customers and timely reminders, can prevent non-payment issues from arising. Exploring real-world success stories highlights the positive impact payment provider collection agencies can have on businesses of various sizes and industries. Quantifying the impact on the bottom line showcases the tangible benefits businesses can derive from effective debt recovery strategies.

Conclusion

In conclusion, the symbiotic relationship between payment providers and collection agencies is integral to the financial ecosystem in India. With advancements in technology and a proactive regulatory environment, the future looks promising for payment provider collection agencies in India.

FAQs

1. How do Payment Provider Collection Agencies operate?

Payment provider collection agencies operate by partnering with businesses to recover unpaid dues through strategic and ethical means.

2. What steps can businesses take to prevent unpaid dues?

Businesses can implement clear payment terms, proactive communication, and timely reminders to prevent non-payment issues.

3. Are there any legal implications for non-payment in India?

Yes, there are legal implications for non-payment, and payment provider collection agencies operate within the legal framework to ensure fair debt recovery practices.

4. How do regulatory changes impact the operations of collection agencies?

Regulatory changes can influence the way collection agencies operate, and staying compliant is crucial for ethical debt recovery.

5. What are the key features businesses should look for in a payment provider collection agency?

Businesses should consider factors such as integration with various payment channels, robust data security measures, and a track record of customized solutions.