AUTHOR = DORA

DATE = 18/12/24

India has become a hub for international students, with universities[1] offering world-class education across a variety of disciplines[2]. However, the cost of education, both within the country and abroad, remains a significant challenge for many. Financial aid plays a pivotal role in making education[3] accessible to deserving students. In this context[4], payment provider college financial aid advisors are becoming increasingly crucial in India. They assist students in managing the complexities of financial aid, scholarships, and educational loans, ensuring that they have the necessary resources to pursue their academic dreams[5].

The Role of Financial Aid Advisors in India

Financial aid advisors are experts who help students and their families navigate the complex world of financial assistance. These professionals guide students in applying for scholarships, grants, and loans, ensuring they can make informed decisions about their finances. They also act as a bridge between students and financial institutions, helping them understand the terms of the aid and how it impacts their future.

How Payment Providers Facilitate Financial Aid in India

1. Simplified Payment Systems

Payment providers in India have revolutionized the way students pay for their tuition fees. These platforms allow students to make direct payments to educational institutions, including tuition, hostel fees, and examination costs. Payment providers offer multiple payment methods, including credit/debit cards, net banking, UPI, and wallets, making it easier for students and their families to pay their bills on time.

2. Educational Loans and Scholarships

Several payment providers have also partnered with financial institutions to offer educational loans at competitive interest rates. These partnerships ensure that students can access quick and hassle-free loan approvals, with flexible repayment options that suit their financial situation.

3. Financial Planning and Advisory Services

A key role of payment provider college financial aid advisors is to offer personalized financial planning and advisory services. They help students assess their financial needs, identify potential sources of aid, and create a roadmap for managing their finances throughout their education. This includes assistance in choosing the right loan products, understanding interest rates, and navigating the application process for scholarships.

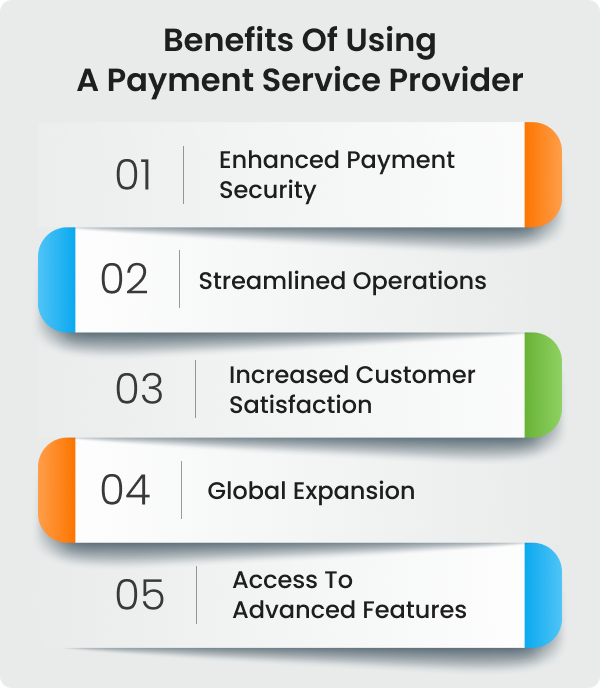

Key Benefits of Using Payment Providers for Financial Aid in India

1. Streamlined Process

One of the main advantages of working with payment providers is the streamlined nature of the financial aid process. Payment providers integrate with colleges, banks, and other financial institutions to offer students a comprehensive range of services under one roof. Students can apply for financial aid, secure loans, and make payments all through a single platform, simplifying what can often be a tedious process.

2. Transparency

Transparency is crucial when dealing with financial matters, especially in the context of educational expenses. Payment providers offer transparent fee structures, easy-to-understand loan terms, and clear guidelines for accessing financial aid.

3. Financial Literacy

Many payment providers offer financial literacy programs designed to educate students about managing their finances. These initiatives assist students in grasping the significance of financial planning, including budgeting, saving, and handling debt responsibly. In the long run, this financial literacy empowers students to make better decisions, both during and after their studies.

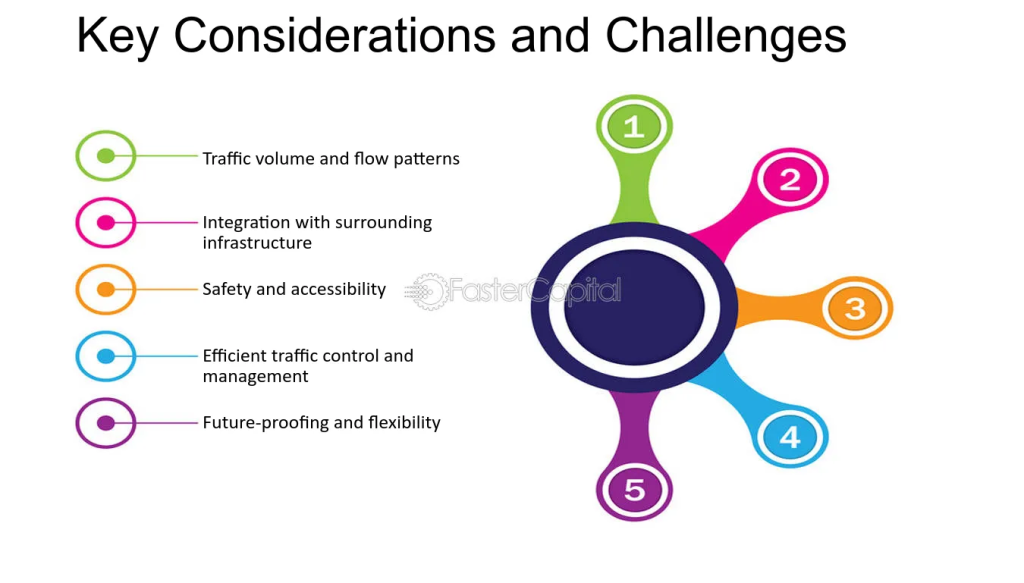

Challenges and Considerations

1. Limited Awareness

Despite the growing role of payment providers, many students in India are still unaware of the full range of financial aid options available to them. Financial aid advisors must make an effort to educate students about the services provided by payment platforms and how to best utilize them.

2. Eligibility Criteria

Scholarships and loans often come with strict eligibility criteria, which can be a barrier for some students. Payment providers help by identifying scholarships and loans that align with a student’s academic achievements and financial circumstances.

3. Interest Rates and Loan Terms

When applying for educational loans, students should carefully review the interest rates and repayment terms. Though payment providers often work with trusted financial institutions, students should compare loan options and ensure they understand how the loan will impact them post-graduation.

Conclusion

In conclusion, payment provider college financial aid advisors are playing a critical role in transforming the financial aid landscape for students in India. By simplifying the payment process, offering educational loans, and providing expert financial advice, they help students access the resources they need to pursue higher education. While challenges such as awareness and eligibility remain, the growing presence of payment providers is certainly a step in the right direction towards making education more affordable and accessible for all.

FAQs:

1. What is the role of a financial aid advisor in India?

A financial aid advisor in India assists students and their families in navigating the complex landscape of financial aid for education. They help identify scholarships, grants, and loan opportunities, guide students through the application process, and provide advice on budgeting and financial planning.

2. How do payment providers assist in college financial aid in India?

Payment providers assist students by offering a range of services including simplified payment options for tuition and other college expenses, educational loans, and scholarship search platforms.

3. What types of financial aid can payment providers help students access?

Payment providers in India help students access several types of financial aid, including:

- Scholarships: Payment platforms aggregate information about various scholarships from universities, government programs, and private institutions.

- Educational Loans: Through partnerships with banks and financial institutions, payment providers facilitate the application process for student loans, offering competitive interest rates and flexible repayment options.

4. How do payment providers simplify the payment process for students?

Payment providers simplify the payment process by offering various payment methods such as credit/debit cards, net banking, UPI, and digital wallets, making it convenient for students to pay tuition and other fees. Many platforms also offer the option to pay in installments, which can ease the financial burden on students and their families.

5. Are payment provider financial aid advisory services free?

The availability and cost of financial aid advisory services can vary depending on the payment provider and the specific services being offered. Some payment providers offer basic advisory services for free, while others may charge a fee for more comprehensive guidance or personalized financial planning.

GET IN TOUCH ____