AUTHOR :HAANA TINE

DATE :23/12/2023

Introduction

In a rapidly evolving financial landscape, the need for effective credit counseling in India has become more pronounced than ever. This article delves into the role of payment providers in facilitating credit counseling services, addressing the unique challenges and opportunities in the Indian context.

The Landscape of Cred it Counseling in India

Current Scenario

India, with its burgeoning middle class and increasing financial literacy, presents a ripe environment for credit counseling services. However, the current landscape is marked by fragmented services and a lack of widespread awareness.

Growing Demand

As the financial aspirations of individuals soar, there is a growing demand for Payment Provider credit counseling services. This section explores the reasons behind this surge and the potential benefits it can bring to individuals and the economy at large.

The Role of Payment Providers

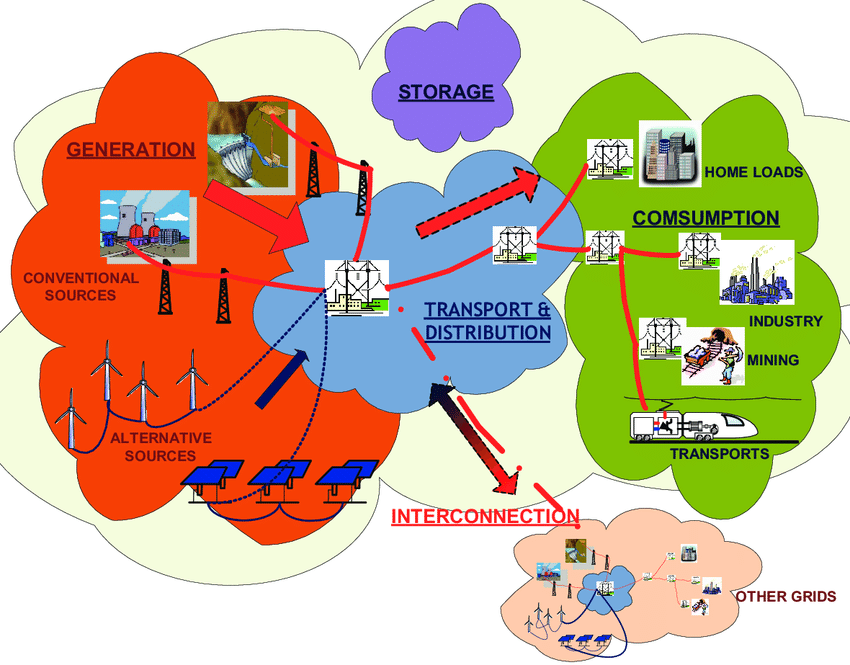

Facilitating Seamless Transactions

One of the pivotal roles of payment providers in credit counseling is the facilitation of seamless transactions. This involves creating a user-friendly platform for individuals seeking financial advice and assistance. Given the sensitive nature of financial transactions, the article discusses the security measures implemented by payment providers to ensure the safety of online payments in credit counseling scenarios.

Benefits of Credit Counseling through Payment Providers

Financial Education

Payment providers play a crucial role in disseminating financial education. Payment Provider Credit[1] Counseling in India This section explores how users can benefit from informative resources and tools, empowering them to make informed decisions.

Customized Solutions

Unlike one-size-fits-all approaches, credit counseling through Payment service provider[2] offers personalized solutions. This part of the article explores the advantages of tailored financial plans for individuals facing diverse financial challenges. An integral aspect of credit counseling is the formulation of debt management plans. The article elucidates how payment providers contribute to the creation and execution of effective debt management strategies.

Challenges and Solutions

Regulatory Challenges

Navigating the regulatory landscape can be challenging. Payment Provider[3] Credit Counseling in India This section examines the regulatory hurdles faced by credit counseling services and suggests potential solutions to create a more conducive environment.

Technological Solutions

Embracing technological advancements is essential for the growth of credit counseling services. The article discusses how innovative solutions can address challenges and enhance the overall Credit counseling[4] .

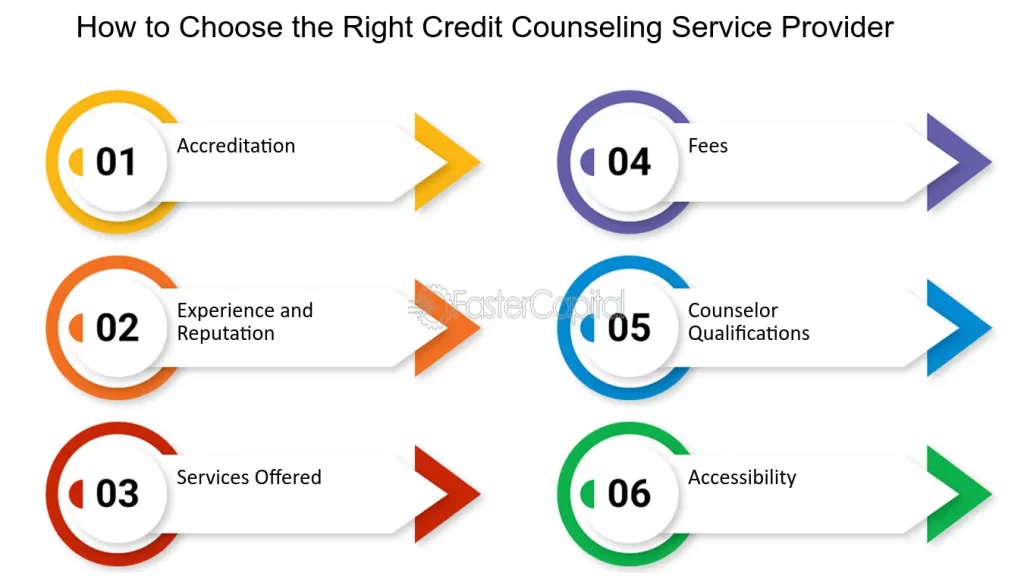

Choosing the Right Payment Provider for Credit Counseling

Factors to Consider

Selecting the right payment provider is crucial for the success of credit counseling efforts. The article outlines key factors individuals and organizations should consider when choosing a payment provider.

Real-world case studies provide insights into successful credit counseling scenarios facilitated by payment providers e-commerce[5] By examining these cases, readers can gain a deeper understanding of the practical applications of credit counseling.

Success Stories

This section highlights success stories of individuals who have benefited from credit counseling services provided by payment providers. These stories serve as inspiration for others considering credit counseling.

Examining lessons learned from various credit counseling cases helps in understanding best practices and potential pitfalls. This information equips individuals with knowledge to make informed decisions.

The Future of Credit Counseling in India

Technological Advancements

The article explores emerging technologies and their potential impact on the future of credit counseling. From artificial intelligence to blockchain, understanding these advancements is crucial for staying ahead in the financial counseling landscape.

Credit counseling is not an isolated service. This section discusses the integration of credit counseling services with the broader financial ecosystem fostering a holistic approach to financial well-being.

Conclusion

In conclusion, payment providers play a pivotal role in shaping the landscape of credit counseling in India. By fostering financial education, providing customized solutions, and addressing challenges, payment providers contribute significantly to the well-being of individuals and the economy.

FAQs

- How does credit counseling differ from traditional banking services?Credit counseling focuses on providing financial education, personalized solutions, and debt management plans, while traditional banking services primarily involve transactions and account management.

- Can credit counseling really help in managing debts?Yes, credit counseling can be highly effective in managing debts by offering tailored solutions, educational resources, and debt management plans.

- Are payment providers secure for credit counseling transactions?Payment providers implement robust security measures to ensure the safety of credit counseling transactions, making them a secure option for financial interactions.

- What role do regulations play in the credit counseling sector?Regulations play a crucial role in shaping the credit counseling sector, providing guidelines and standards to ensure ethical practices and consumer protection.

- How can individuals benefit from financial education through credit counseling?Financial education through credit counseling empowers individuals to make informed financial decisions, understand budgeting, and develop strategies for long-term financial success.